On Episode #185 of the PricePlow Podcast, Mike and Ben welcome Jonathan Baner (Senior R&D Director) and James Stone (Vice President of Global Marketing and Insights) from Glanbia Nutritionals to explore the fascinating world of protein extrusion technology and better-for-you snacking. This powerhouse team brings deep expertise in both the science and consumer insights driving the functional foods revolution, revealing how advanced extrusion processing is solving the longstanding challenge of creating high-protein snacks that actually taste good and deliver satisfying texture.

Jonathan Baner (Senior R&D Director) and James Stone (VP of Global Marketing & Insights) from Glanbia Nutritionals reveal how twin screw extrusion technology is revolutionizing protein fortification in snacks, pushing protein levels from 5-7% up to 85% while maintaining the crunch consumers crave on Episode #185 of the PricePlow Podcast.

From Ingredients to Extrusion Technology, Glanbia Nutritionals is Behind Better Snacking

The conversation dives into the mechanics of twin screw extrusion technology that transforms fine protein powders into everything from cheese puffs to protein cereals, the critical differences between dairy and plant-based proteins in processing, and the four distinct snacking behavior profiles that brands need to understand. From Jonathan's 25 years of extrusion expertise to James's insights on consumer trends showing that Americans consume sweet snacks 6.4 times per week, this episode unpacks how Glanbia is pushing protein fortification from the typical 5-7% found in traditional snacks up to an impressive 65-85% range without sacrificing the crunch and flavor consumers demand.

Beyond the technical breakthroughs, we explore real-world market dynamics including the tight supply situation for whey protein isolate, the evolution of clean label formulations, the seed oil debate, and how GLP-1 adoption is driving unprecedented protein demand. This episode showcases how ingredient innovation at the B2B level is transforming what's possible in functional snacking, with applications ranging from airport grab-and-go options to high-protein cereal that's eaten more as snacks than breakfast.

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

https://blog.priceplow.com/podcast/glanbia-nutritionals-healthy-snacking-185

Video: Glanbia Nutritionals - Extrusion Technology & Better-For-You Snacking

Podcast: Play in new window | Download (Duration: 1:23:06 — 80.1MB)

Detailed Show Notes: Engineering Better-For-You Snacks with Protein Extrusion

-

0:00 - Introduction to Glanbia's Functional Foods Team

Mike and Ben welcome Jonathan Baner and James Stone from Glanbia Nutritionals to discuss the ingredients and technologies making functional foods more nutritious without sacrificing taste or texture. Jonathan brings a food science background from the University of Illinois and 25 years of extrusion technology expertise, currently serving as Senior R&D Director at Glanbia's extrusion innovation center in Gridley, Illinois. His team handles all process and product innovation work that later scales to commercial production at the Mooresville, Indiana facility.

James contributes a unique perspective as VP of Global Marketing and Insights, with nearly three and a half years at Glanbia following a varied career that began at Kellogg Company working on cereals and healthy snacking. His early involvement in launching products like Raisin Bran Crunch (now a $2+ billion business) and his personal commitment to the ketogenic lifestyle for the past decade provide valuable consumer insights. As a certified keto educator and former natural bodybuilding competitor, James understands both the science and lived experience of functional nutrition.

The conversation immediately establishes that while many consumers know Glanbia through brands like Optimum Nutrition, Glanbia Nutritionals operates as the B2B ingredient powerhouse supplying the industry's most successful brands. This behind-the-scenes role has positioned them uniquely to develop cutting-edge extrusion technologies and protein solutions that are transforming what's possible in better-for-you snacking.

-

5:00 - The Snacking Landscape: Consumption Patterns and Consumer Demands

James opens with a striking statistic that frames the entire discussion: the average American consumer consumes a sweet snack 6.4 times per week. With seven days in a week, this means Americans are averaging nearly one sweet snack per day, highlighting the massive scale of the snacking market. However, the role of snacking has evolved dramatically over the past five to ten years, with consumers increasingly seeking functional benefits from their snack choices rather than empty calories.

The functionality consumers demand breaks down into two clear categories: ingredients they want to reduce and nutrients they want to increase. The number one ingredient consumers are looking to reduce is sugar, followed closely by overall carbohydrate content. On the additive side, protein tops the list of nutrients consumers want more of, with fiber and digestive health support coming in second. This dual mandate of reduction and fortification creates significant formulation challenges that traditional snack technologies struggle to address.

Moreover, when consumers look to increase protein intake, food and beverage remains the number one source by over 55%. However, one in three consumers are specifically using fortified foods to get more protein rather than relying solely on whole food sources or supplements. This represents a massive market for protein-fortified snacks, bars, and cereals that deliver meaningful nutrition in convenient, enjoyable formats.

-

8:00 - Understanding Extrusion Technology: From Play-Doh to Protein Puffs

Ben steers the conversation toward the core technology, and Jonathan demystifies extrusion by starting with a relatable analogy: the Play-Doh Fun Factory toy. At its core, extrusion simply means taking a material and forcing it through a shaping die to create a specific form. The process appears across multiple industries, from automotive plastic moldings to aluminum profiles, but food extrusion represents a specialized application with unique challenges and opportunities.

The food industry initially adopted extrusion in the feed sector, where simple single screw extruders combined molasses and feed ingredients to create easier-to-handle pellets. Modern food extrusion has evolved far beyond these origins, with Glanbia utilizing sophisticated twin screw extruders that provide precise control over mixing, cooking, and shaping. The twin screw design is critical when working with fine protein powders, which behave very differently from the starches that traditional snack extrusion was designed around.

The extrusion process begins with blending fine protein and starch powders into a homogeneous mixture that feeds into the extruder. Inside the extruder, rapid cooking and mixing occurs within seconds as water is added to create a dough. The magic happens at the die where the dough is shaped into rings, balls, or other formats. The compression created by the die restricts flow and generates steam under pressure inside the extruder. When this pressurized dough hits atmospheric pressure at the die exit, the steam flashes off and expands the dough into the familiar puffed texture consumers expect. Jonathan likens it to a balloon guy at a fair making those long balloon animals – the expansion followed by some collapse creates the final structure.

-

12:00 - The Protein Challenge: Why High-Protein Snacks Were Nearly Impossible

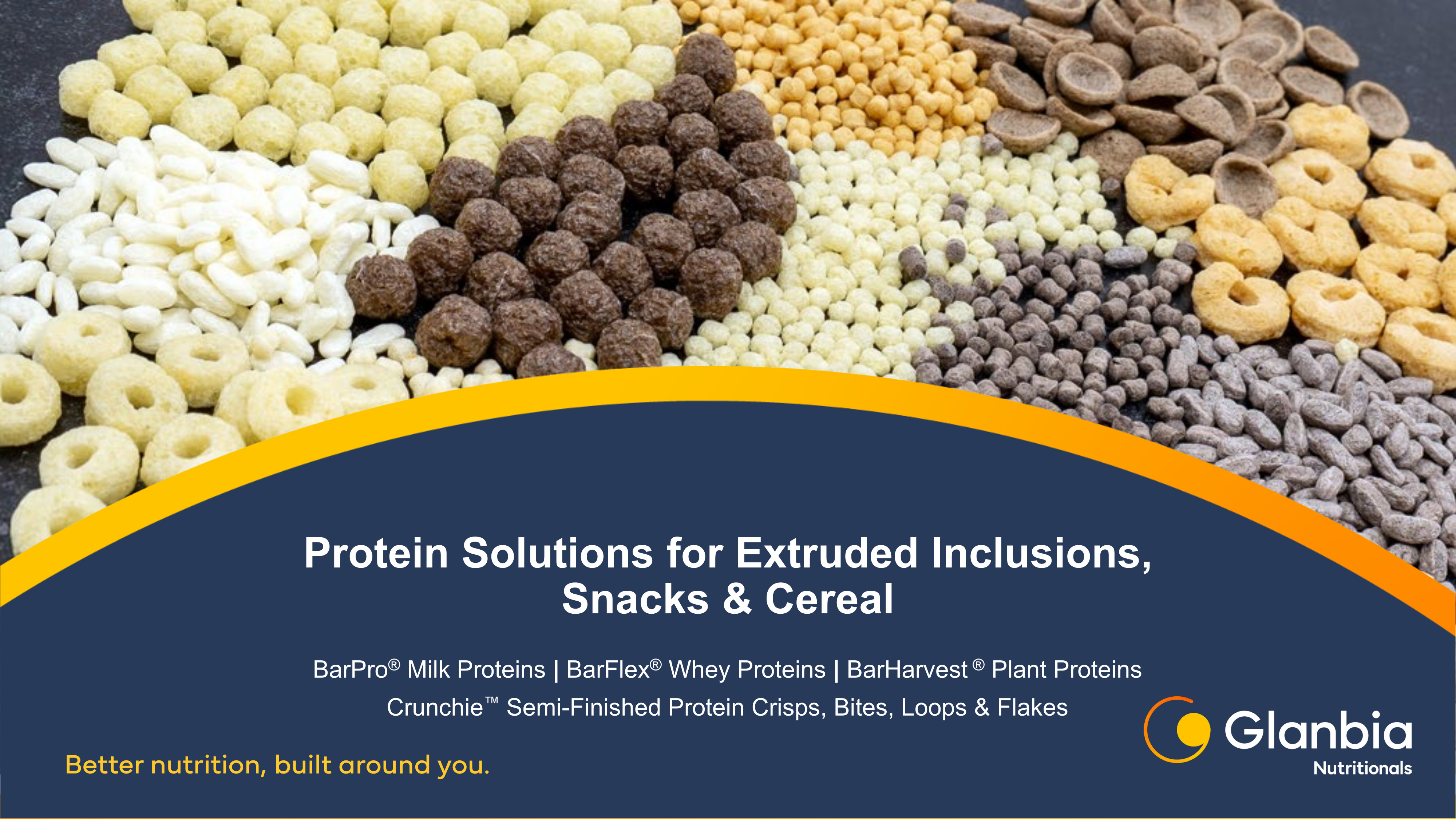

22% of consumers now replace meals with snacks. Glanbia Nutritionals' BarPro® proteins, Crunchie™ inclusions, and functional bioactives solve the texture and taste challenges that have plagued high-protein snacks for years.

Jonathan emphasizes that if someone had told him 25 years ago that they'd be creating crispy, crunchy snacks with high levels of protein and fiber, he would have said it was impossible. Both protein and fiber are traditionally enemies of expansion in extrusion processing. Standard starch-based snacks like cheese balls typically contain only 6-7% protein and deliver relatively empty calories. The breakthrough that Glanbia achieved pushes protein content up to the 65% range while maintaining a similar eating experience and format.

The technical challenge stems from how protein molecules behave under the high heat and pressure of extrusion. Proteins tend to denature and create "glue-like" substances that can seize up machinery or fail to expand properly. Starches, in contrast, expand predictably when forced through dies under pressure, which is why traditional snacks like Cheetos and Fritos rely heavily on corn or other carbohydrate bases. Getting protein to support expansion rather than collapse requires deep understanding of protein chemistry and structure.

Glanbia's competitive advantage comes from the marriage of protein chemistry expertise with extrusion processing knowledge. When the company acquired Packmore about four years ago, the combination of Glanbia's dairy protein innovation capabilities with Packmore's extrusion technology created something unique in the industry. This collaboration enabled them to develop protein modifications and processing conditions that allow for high protein content without sacrificing the delicate, crispy texture consumers expect from their favorite snacks.

The range of achievable protein levels provides formulation flexibility depending on target markets and price points. Some products don't include any carbohydrates and push into the 85%+ range of native protein, making them ideal for keto and very low-carb applications. Other formulations step back to the 50% range, incorporating some starch to balance expansion, texture, and cost.

-

17:00 - Texture Optimization and Business Model

This raises an important question about how texture changes with different protein levels, drawing a parallel to how whey protein isolates deliver different mouthfeel compared to concentrates in the beverage space. Jonathan confirms that texture can be precisely dialed in to match specific targets, even when working with high protein formulations. When brands come to collaborate with Glanbia, they often bring a competitive product or reference sample and say "this is our target" for texture and mouthfeel.

The team has successfully developed products where consumers can't necessarily tell that it's a non-starch based product from a texture standpoint. The expansion characteristics, crunch profile, and melt-in-your-mouth qualities can closely mimic traditional corn-based snacks even at much higher protein levels. The primary trade-off is flavor -- corn has a very recognizable flavor profile in the snack industry, while dairy proteins introduce a different (though clean) flavor baseline that requires different seasoning approaches.

Mike asks an important operational question about how the business model works for brands interested in creating protein-fortified snacks. Glanbia operates on multiple levels to serve different customer needs. They can sell optimized protein solutions directly to other extrusion manufacturers who want to develop products using their own processing capabilities. These ingredient solutions have been specifically engineered for extrusion, providing a plug-and-play option for manufacturers with existing equipment.

However, Jonathan emphasizes that Glanbia strongly prefers to innovate directly with customers at Glanbia Nutritionals' facilities. This co-development approach allows for much faster iteration and better results because texture attributes like "crispy" and "crunchy" mean different things to different people. Having customers on-site for development sessions enables real-time feedback and immediate adjustments that would take weeks through a mail-sample approach. Glanbia has full internal manufacturing capabilities to take products from ideation through commercial production, with coating systems that can apply either oil-based slurries (similar to cheese balls) or water-based slurries (more common in cereal products). They don't handle retail packaging but work with partners to get products into bottles, stand-up pouches, or chip bags.

-

21:15 - Functional Ingredients and Plant Protein Challenges

Mike raises an important question about incorporating functional ingredients into extruded snacks, particularly given the heat exposure during processing. The trend toward GLP-1 agonist support supplements represents just one example of premium functional ingredients that brands might want to include. Jonathan explains that the extrusion process does expose ingredients to significant heat and mechanical shear, which creates challenges for temperature-sensitive compounds. For most functional ingredients, especially expensive ones like specialty bioactives or caffeine (which has a rough flavor when not encapsulated), Glanbia recommends incorporating them into the topical coating rather than running them through the extruder itself.

Ben shifts the discussion to plant proteins, noting that while whey will likely always reign as the gold standard, plant proteins continue gaining interest for various reasons beyond just dietary restrictions. Pea protein is one of the most promising plant alternatives, though it's relatively new compared to ingredients like soy protein isolate, which has been refined over 30-40 years to optimize functionality. Pea proteins generally aren't isolated to the 90% protein level common with whey or milk proteins, and the protein structure behaves differently under extrusion conditions.

Flavor presents another significant hurdle with plant proteins. Glanbia's pea proteins offer improved flavor profiles compared to many competitors, but they still carry inherent "beany" notes or umami characteristics that work better with savory applications than sweet ones. Jonathan notes these natural flavor notes complement products like spicy cheese puffs, sriracha snacks, nacho flavors, and jalapeno seasonings quite well. However, creating sweet applications like vanilla or chocolate cereals becomes more challenging when fighting against the underlying plant protein flavor. Dairy proteins, in contrast, provide a clean palette that works equally well with sweet or savory profiles.

-

26:00 - The Plant-Based Meat Decline: Lessons for Functional Foods

Mike observes an interesting dichotomy in the plant-based space: while innovative plant-based snacks continue finding success, companies like Impossible Meats have struggled significantly trying to mimic traditional meat products. Three to five years ago, Jonathan's team did extensive work supporting plant-based meat launches using extrusion technology (the same process used to produce those products), but consumer adoption has tapered off dramatically as James predicted.

A diverse array of protein-enriched extruded pieces showcasing Glanbia's BarPro, BarFlex, BarHarvest, and Crunchie technologies designed to solve texture and taste challenges in snacking applications.

James provides crucial insights into why plant-based meat alternatives have largely failed while plant-based snacking shows more promise. The fundamental problem was positioning plant proteins as "fake meat" rather than allowing them to stand on their own merits. When plant-based burgers and meat alternatives launched, they emphasized how closely they mimicked real meat while simultaneously claiming superior health benefits. Consumers quickly recognized the paradox: products marketed as healthier alternatives often contained long lists of highly processed ingredients with names they couldn't pronounce.

The evolution now focuses on plant-based products standing independently as nutritionally valuable options rather than pretending to be something they're not. This means emphasizing complete protein profiles -- either from single plant sources that naturally provide all essential amino acids or from strategic combinations that together deliver complete nutrition. Consumers increasingly understand the importance of complete protein, making this a key differentiator in plant-based formulations.

Taste and texture improvements represent the second critical factor in plant-based success. Early plant-based products often delivered poor eating experiences that didn't justify repeat purchases. The focus now is on creating products that genuinely taste good and offer satisfying textures, particularly in savory flavor profiles where plant proteins perform best. The clean label aspect also matters: fewer ingredients that consumers recognize and understand rather than long lists of additives and modifiers.

-

29:30 - Flavor Innovation: Ethnic Profiles and Cheese Evolution

When Mike asks about flavor profiles the team wishes brands would explore more, both Jonathan and James express enthusiasm for expanding beyond mainstream options. Jonathan, as a self-described lover of ethnic flavors, sees tremendous opportunity in profiles that may be out of the mainstream American palate but offer complex, interesting taste experiences. Examples like peri peri, tikka masala, and other globally-inspired seasonings could differentiate brands in an increasingly crowded better-for-you snacking market.

While major snack producers tend to stick with proven, familiar flavors that appeal to the broadest audiences, smaller emerging brands have more flexibility to experiment with unique taste profiles. Flavor Producers (a division owned by Glanbia) actively tracks upcoming trends and works to develop innovative seasonings that can be applied to protein-fortified bases. This capability allows smaller brands to differentiate through distinctive flavor experiences while still leveraging proven protein fortification technology.

James builds on this by highlighting cheese as a category ripe for innovation. While consumers are extremely comfortable with foundational cheese flavors like nacho and cheddar, the diversity of cheese types offers numerous unexplored opportunities. Different Italian cheeses like Parmesan, Romano, or aged provolone provide distinct taste profiles. Latin American and Mexican cheeses bring different textural and flavor characteristics that could create novel snacking experiences.

Comprehensive overview of Glanbia's protein solutions spanning whey, milk, and plant-based options, each optimized for specific texture characteristics from short and dense to smooth and chewy applications.

The versatility of cheese flavors extends to "cheese plus" concepts where cheese serves as a foundational note enhanced with complementary ingredients. A cheese base can accept additions of sweetness, spice, or other flavor dimensions while maintaining the familiar comfort of cheese. This approach allows for innovation and differentiation while keeping consumers anchored in recognizable taste territory that drives repeat purchases. Mike confirms this works well, as nutritional yeast provides that characteristic savory, cheesy umami flavor in dairy-free applications, proving cheese-like experiences can come from unexpected ingredient sources.

-

33:30 - The Four Snacker Types: Texture Preferences and Product Formats

Mike brings up fascinating consumer research showing four distinct mouth behavior profiles for snackers:

- Crunchers,

- Chewers,

- Smushers, and

- Suckers.

This segmentation helps brands understand different consumer preferences and formulate products accordingly. Jonathan confirms that while the current discussion focuses primarily on crunchers (consumers who seek crispy, crunchy textures), Glanbia's technology platform extends well beyond just extruded puffs.

The cruncher segment dominates savory snacking and represents the sweet spot for extrusion technology. These consumers want audible, satisfying crunch and crispy textures that provide both tactile and acoustic feedback during eating. Extrusion excels at creating various shapes and formats that all deliver on this crunchy promise: crisps that resemble rice pieces, ball-shaped bites similar to cheese balls, loops, and flakes. Each shape offers slightly different eating experiences while maintaining that critical crunch factor.

When the conversation shifts to sweet snacking (products with chocolate, vanilla, caramel, or cookies and cream flavors), texture preferences change somewhat. Sweet applications can incorporate softer, more chewy elements and products with more melt-in-your-mouth characteristics. This aligns more with the "chewer" profile where consumers want something with give and a softer bite. Gummies and protein-fortified fruit leathers are other Glanbia product categories that target these alternative mouth behavior preferences, though Jonathan clarifies these would be handled by different groups within the company -- specifically their bar group that understands how to control moisture migration and maintain soft, pliable textures with protein fortification.

James notes that texture preference often correlates with whether a product is positioned as savory versus sweet. Savory snacks almost universally require some degree of crunch and textural experience, while sweet products have more flexibility to incorporate softer, chewier textures. This understanding helps brands make appropriate format decisions based on their flavor direction and target consumer segments.

-

37:30 - The Keto Perspective and Protein Cereal's Surprising Use Case

CREATEA Mighty Mango breaks new ground with stable creatine in RTD format plus Zynamite S mango leaf extract for mental energy. This natural, clean-label concept beverage showcases what's possible when industry leaders collaborate. Sample it at SupplySide Global 2025!

James shares insights from his ketogenic lifestyle experience that relate directly to snacking behavior. When people adopt low-carb or keto approaches, they often turn to nuts as their go-to snack because nuts are widely perceived as healthy and relatively low in carbohydrates. However, nuts present a trap for unwary dieters: the calories from fat add up quickly, and many nuts contain more carbohydrates than people realize.

Macadamia nuts represent one of the best options for keto dieters because they're extremely low in carbohydrates while providing healthy fats that support ketosis. A handful of macadamias delivers satisfying crunch and fat content that promotes satiety. However, other popular nuts like pistachios require much more portion control. Despite their nutritional benefits, it's easy to consume a handful of pistachios and quickly reach your glycemic load threshold due to their higher carbohydrate content compared to macadamias.

Mike adds that nuts often become the downfall of dieters who lack portion control. A proper serving of nuts is typically just 28 grams -- a small handful that disappears quickly and leaves people wanting more. The high caloric density combined with the ease of overconsumption makes nuts a risky choice for snackers who struggle with self-regulation. Protein-fortified alternatives can deliver similar crunch satisfaction with better macronutrient profiles and more volume per calorie. This is where high-protein, low-carbohydrate extruded snacks offer significant advantages.

James then reveals a fascinating consumer insight that transforms how the industry should think about protein cereal: almost 70% of protein cereal consumption occurs as snacking rather than traditional breakfast with milk. The shapes and formats of protein cereal make them naturally friendly for grab-and-go snacking: easy to pop in your mouth one at a time, no preparation required, satisfying crunch. Consumers also frequently mix protein cereal into Greek yogurt as a way to stack protein intake. A serving of high-protein cereal combined with a cup of Greek yogurt easily delivers 20-25 grams of protein in a format that feels less clinical than drinking a protein shake or eating a protein bar.

-

43:00 - Trail Mix Reinvention and Extrusion Versatility

Ben suggests incorporating extruded protein pieces into trail mixes as a way to boost overall protein content while maintaining familiar formats. Jonathan enthusiastically agrees, noting that Magic Spoon and Catalina Crunch have successfully launched snack mixes that combine various textures, including nuts, with protein-fortified extruded pieces. These products deliver impressive protein content while providing the textural variety that makes trail mix appealing.

The format innovation extends beyond just ingredient composition to packaging as well. Moving from traditional box formats to stand-up zipper pouches positions these products as portable snacks rather than breakfast cereals. A pouch fits easily in a backpack, gym bag, or car cup holder, reinforcing the on-the-go usage occasion. This seemingly simple packaging change actually helps shift consumer perception and usage patterns.

Ben observes that airports represent an ideal testing ground for protein-fortified snack concepts. When traveling and trying to maintain healthy eating habits, options are typically limited to jerky, protein drinks, and maybe yogurt if you find a grab-and-go section. Trail mixes exist but rarely leverage protein fortification, leaving a gap in the market for convenient, high-protein snacking options that don't require refrigeration and provide satisfying crunch. Ben jokes that his food expenses when traveling often exceed his accommodation costs because he prioritizes finding quality protein options.

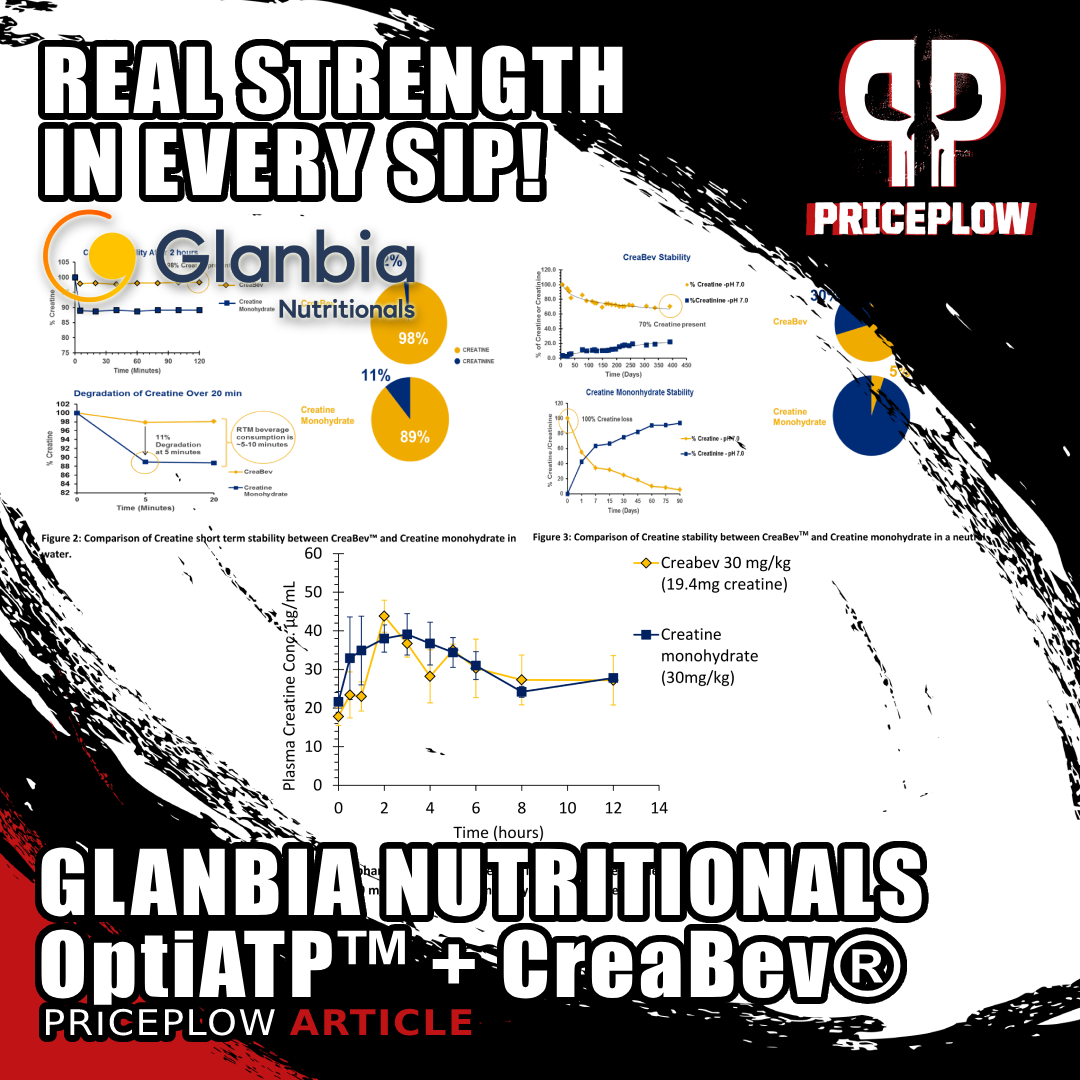

Finally! Creatine that stays stable in beverages thanks to Glanbia Nutritionals' CreaBev™ technology. Plus OptiATP® brings actual cellular energy to RTDs -- not just caffeine. Add in Collameta™ marine collagen tripeptides & TruCal® bone minerals = strength from every angle. Read about all four ingredients in Glanbia Nutritionals' Strength Platform

Jonathan explains that Glanbia's role extends beyond just producing extruded pieces to providing bulk proteins optimized for various manufacturing processes. Co-manufacturers and food companies can purchase these specialized proteins and incorporate them into their own production systems, whether that's extrusion, baking, or other processes. The proteins have been engineered to be heat durable and process-tolerant, solving technical challenges that generic proteins might present. These are "plug and play" ingredient solutions for manufacturers who have extrusion capabilities but lack the protein chemistry expertise to develop their own specialized proteins.

-

47:30 - Emulating Textures and Consumer Acceptance

Ben expresses amazement at the idea that extrusion technology could potentially emulate the texture of nuts, which would open up entirely new product possibilities. Jonathan confirms that extrusion offers tremendous versatility in texture manipulation. The same basic process can produce everything from very soft, airy Cheetos-style puffs to extremely hard, glassy Captain Crunch-type textures. Products like Pirate's Booty demonstrate that extrusion can even create dual textures within a single piece -- part crispy, part dissolving.

This textural range means that if a brand wants an ingredient that mimics the hard, dense bite of a nut while delivering high protein, the extrusion parameters can be adjusted to achieve that goal. Different screw speeds, temperature profiles, moisture levels, and die designs all influence the final texture. By carefully controlling these variables, extruded pieces can be engineered to match specific textural targets.

However, James raises an important caution drawn from the plant-based meat experience: there's a difference between technical capability and market acceptance. Just because you can create a perfect nut analog doesn't mean consumers will embrace it. When products try too hard to emulate natural foods like nuts or meat, consumers often reject them as "fake" or overly processed. The Impossible Burger phenomenon demonstrated that consumers are skeptical of foods trying to be something they're fundamentally not, especially when examining ingredient lists reveals extensive processing.

Mike often uses the term "Trojan horse" to describe the more successful approach: giving people a familiar, relatable food they already accept as processed, then adding protein to improve its nutritional profile. People don't feel deceived because they're not being sold a replacement for whole foods. Creating a "high-protein Chex Mix" with various extruded shapes works because consumers already accept Chex Mix as a manufactured product category. Nobody expects it to be minimally processed, so protein fortification and texture optimization feel like improvements rather than deceptions.

-

54:00 - Whey Protein Supply Constraints and GLP-1 Impact

Ben raises a critical industry issue: with protein fortification reaching fever pitch across categories from Starbucks to Burger King to Uncrustables, and with Glanbia being one of the world's largest whey protein producers, will supply constraints limit this growth? He notes hearing from Glanbia sales representatives that whey protein isolate (WPI) is sold out through 2026, raising legitimate questions about whether ingredient availability will bottleneck the functional foods revolution.

A ready-to-drink beverage with creatine that actually works. FitAid RX uses CreaBev® encapsulation tech to deliver 1g stable creatine monohydrate -- solving a problem that's stumped the industry for decades.

James confirms that whey protein isolate faces the tightest supply situation in the protein market. WPI is a byproduct of cheese manufacturing -- the whey that separates during cheese production gets further processed into protein isolates. Since cheese production capacity is relatively fixed in the short term, the amount of whey available for conversion into WPI is limited. Demand has grown faster than the industry's ability to expand cheese production and WPI processing capacity.

James expects WPI constraints to continue for at least the next year to eighteen months. However, other protein categories offer more flexibility. Milk protein concentrates, some plant proteins, and whey protein concentrate (WPC) have better availability. The good news for functional foods is that many applications can use proteins other than WPI: milk protein and WPC work well in extrusion and other manufacturing processes.

Looking forward, if the belief holds true that protein consumption will continue increasing across the population (with approximately 57-60% of consumers actively seeking more protein in their diets) supply pressures will intensify. Consumers want protein from diverse sources and formats: powders, drinks, natural whole foods, fortified snacks, and bars. This buffet of options spreads demand across different protein types, but the sheer volume of total demand creates pressure across all categories.

James identifies GLP-1 agonist medications as a potential catalyst for even greater protein demand. Currently, three major barriers limit GLP-1 adoption:

- Cost (the medications are expensive),

- Side effects (including significant gastrointestinal distress for many users and blindness for unlucky others), and

- Application method (most require injections).

If pharmaceutical companies can address these barriers through lower-cost options, improved formulations with fewer side effects, and oral delivery methods, adoption could accelerate dramatically. The nutritional implication centers on protein requirements -- when people use these medications for weight loss, maintaining muscle mass becomes critical, and protein is the number one macronutrient they need.

-

58:00 - Extrusion Process Details and Customer Collaboration

Mike asks about limitations in what Glanbia can produce or common requests they have to decline. Jonathan explains there's actually very little they struggle to accomplish in terms of what customers ask. The market capacity in twin screw extrusion is relatively tight compared to single screw systems traditionally used for snacks. As protein fortification increases, brands are discovering that single screw technology struggles with higher protein levels, which opens opportunities for Glanbia's twin screw capabilities.

The biggest push from customers is always for more protein -- how can we get higher levels while maintaining texture? The complexity increases as protein levels rise, with 90% protein representing the current maximum using the highest protein ingredients available. Introducing starch and other ingredients makes the process easier and reduces complexity at lower protein levels. Generally, there's very little Jonathan's team would immediately say no to, though success isn't always guaranteed... that's the nature of research and development.

For brands wanting comprehensive product development rather than just purchasing protein ingredients, Glanbia offers inclusive co-development services. The commitment is simple: come on-site, work with the team, and they'll help design the product with development costs covered. The opportunity assessment looks at ingredients as well as processing potential. Jonathan reiterates that historically, the back-and-forth of mailing samples was inefficient. Changes that could be made in two minutes with in-person feedback would take weeks through remote iteration.

The preferred collaborative approach brings customers to either the Twin Falls, Idaho site or the Gridley, Illinois site where resources are concentrated. These facilities can react quickly to feedback and targets, whether customers bring competitive samples to match or have specific texture, format, and protein level goals. The hands-on collaboration dramatically accelerates development timelines and ensures the final product truly meets the brand's vision. For finished goods, Glanbia can handle everything through bulk packaging but works with partners for retail packaging formats like bottles, stand-up pouches, or chip bags.

-

1:00:15 - Fortifying Fruit Snacks and Multi-Category Capabilities

Mike proposes an interesting use case: taking a fruit snack like the minimally processed "That's It" bars (which he saw at Expo West 2025 and later found at Costco) and protein-fortifying them. These products are essentially just mashed fruit with no other ingredients -- a fruit roll-up type format. How would Glanbia approach protein-fortifying something like this, especially given that fruit can be perishable?

Jonathan clarifies this wouldn't fall under his extrusion group but would be handled by their bar group, which understands protein chemistry as it relates to maintaining soft, pliable textures. The key challenges in protein-fortifying fruit products include controlling moisture migration (preventing the texture from hardening over time) and maintaining the characteristic soft, chewy mouthfeel consumers expect. The bar team has solutions for these challenges that allow meaningful protein fortification while preserving sensory attributes.

This highlights how Glanbia's capabilities extend across multiple product categories and formats. While extrusion excels for crunchy snacks and cereals, other divisions handle bars, gummies, and fruit leathers. The coating capabilities can also apply protein-fortified compound coatings to extruded bases, creating hybrid products. For instance, a chocolate coating on a crispy protein puff delivers both satisfying crunch and indulgent mouthfeel while boosting overall protein content. The challenge with topical applications is that coating ingredients often dilute protein percentages, so formulators must start with high-protein bases to maintain impressive finished product specs.

Mike asks about Glanbia's fee structure for this type of exploratory development work. Jonathan explains they take a dual approach: if there's an ingredient play for Glanbia (brands will purchase their proteins), development collaboration is often included. They also offer contract product development services where brands pay for the development work itself. The assessment considers the opportunity size and ingredient commitment, with many scenarios resulting in free ideation samples for committed partners.

-

1:03:00 - Fiber Fortification and Gastrointestinal Health

Mike shifts the discussion to fiber, noting that while protein has dominated the conversation, James mentioned fiber early on as another nutrient consumers want to increase. Jonathan explains that Glanbia can work with many different fibers, though formulators must understand that fibers behave differently depending on whether they're soluble or insoluble. Each type impacts the extrusion process and final product characteristics differently.

Rachel Schreck and Brent Petersen from Glanbia Nutritionals reveal the revolutionary Strength Platform featuring CreaBev®, OptiATP™, and beverage-stable innovations on Episode #174 of the PricePlow Podcast.

Insoluble fibers tend to reduce expansion and can create a more glassy, gritty texture or denser chew-down rather than the soft, puffy texture most consumers expect in snacks. Soluble fibers generally process more favorably in extrusion. One significant benefit of certain fibers is inherent sweetness: ingredients like inulin bring natural sweetness without adding sugar, which is extremely valuable given consumer demand to reduce sugar content. This allows for better-tasting products without compromising on the clean label positioning that consumers increasingly demand.

James broadens the fiber discussion to emphasize that consumers are really looking for comprehensive gastrointestinal support, with fiber being just one component. While fibers derived from tapioca starch, chicory root, or inulin serve important roles, brands must be careful about GI distress. Chicory root, for example, can cause significant digestive discomfort in some consumers despite its fiber benefits. The key is selecting fibers that provide benefits without negative side effects.

The holistic approach to GI health extends beyond fiber to include fermented foods like kefir and cottage cheese, which have surged in popularity for their probiotic benefits. Colostrum is another emerging ingredient in the gut health space, offering benefits for gut permeability and immune function. James notes that COVID permanently linked immune health and gut health in consumer consciousness: people now understand these systems work together rather than in isolation, driving interest in ingredients that support both simultaneously.

-

1:06:00 - Colostrum: Immune Support and Gut Health Innovation

Ben asks whether Glanbia works with colostrum, having noticed it trending in sports nutrition circles. James confirms that Glanbia acquired two of the world's most renowned colostrum companies several years ago, positioning them as a major supplier of this specialized dairy ingredient. Colostrum is the first milk produced by mammals after giving birth, loaded with immunoglobulins and growth factors that support newborn development. In supplement form, colostrum comes from cows after the calf has received what it needs.

For immune support, colostrum's high concentration of immunoglobulins (antibodies) provides defensive compounds that help strengthen the body's natural immune responses. The ingredient is rich in antioxidants and other bioactive compounds that support overall immune function. For gut health, the benefits extend to actually healing gut permeability issues. Leaky gut syndrome, where the intestinal barrier becomes compromised, allows bacteria and toxins to pass through that shouldn't, triggering immune responses and inflammation. Colostrum can help tighten and seal that gut barrier.

Ben observes an interesting evolution in how colostrum has been marketed over the past decade. Ten years ago, colostrum supplements emphasized growth factors and IGF-1 (insulin-like growth factor), attempting to position the ingredient almost as a natural anabolic agent for muscle building. This aggressive positioning tried to make colostrum sound like a growth hormone alternative, which probably contributed to skepticism and limited mainstream adoption.

The current positioning is much more reasonable and holistic, focusing on immune support, gut health, and overall wellness rather than making quasi-pharmaceutical muscle-building claims. James agrees this shift reflects broader industry maturation. When ingredients get marketed with exaggerated claims that sound too good to be true, consumers become skeptical. More modest, science-backed positioning around realistic benefits builds credibility and drives sustainable growth. The terminology matters too: describing products as "loaded with immunoglobulins" might sound impressive to educated consumers but concerning to others, whereas positioning around "antioxidants" and "immune system strength" resonates more broadly.

-

1:10:00 - Seed Oils Discussion and Oil Selection

Before dropping out with a power outage, Mike asks about oil trends and technologies, noting that seed oils face more criticism than ever. Jonathan explains that from a technical standpoint, Glanbia can work with virtually any oils in their formulations, whether plastic fats or liquid oils. However, consumer preferences are definitely shifting away from seed oils, driven by awareness of omega-6 fatty acid concerns and clean label demands.

Avocado oil represents the most prominent trending alternative, though it commands premium pricing that impacts product cost structures. High oleic sunflower oil remains common in formulations and offers better oxidative stability than standard sunflower oil, which is critical for shelf-stable snacks. Coconut oil appears occasionally and delivers a very indulgent, unique mouthfeel that works well in certain applications, but also comes at higher cost than traditional options. MCT oil appeals to keto consumers but can present stability challenges.

Oil stability is critical for shelf-stable snacks that might sit in warehouses or on store shelves for months before consumption. Oils prone to oxidation create rancidity problems that ruin products and damage brands. This technical requirement sometimes conflicts with consumer preferences for certain oil types. Formulators must balance consumer preferences with technical requirements and cost considerations -- there's always that price point question of where brands can introduce premium oils while maintaining competitive pricing.

Ben asks James, given his keto background, whether he sees genuine value proposition differences between oils beyond just name recognition and seed oil avoidance. James confirms there are real differences, especially for consumers pursuing clean label products. Someone specifically seeking a "clean label" will understand and care about oil quality differences. That consumer will notice whether a product uses avocado oil, olive oil, coconut oil, or high oleic sunflower versus generic vegetable oil blends. However, James notes that most consumers don't understand what "high oleic" means... without education from the brand about why they're using it and what advantages it offers, the term doesn't communicate value or justify premium pricing.

-

1:17:00 - Defining Clean Label and Ingredient Transparency

Ben raises a critical question about how to define clean label, noting there's no legal definition. The term means different things to different people, making it useful for marketing but challenging as a formulation guideline. Jonathan offers a practical definition: consumers look for recognizable ingredients: names they know and understand versus complex chemical terminology. If people can read an ingredient list and recognize what's there, that generally qualifies as "clean label" in consumer perception.

In the US, some flexibility exists in how ingredients are labeled, with common names often permitted instead of technical chemical names. This creates more accessible ingredient lists that consumers can understand. Europe follows much stricter conventions with specific requirements for ingredient names and E-numbers (codes for additives), eliminating ambiguity but sometimes making labels appear more "chemical" despite using the exact same ingredients. Jonathan mentions methylcellulose as an example of an ingredient name that causes consumer concern despite being a benign food additive -- the technical name sounds like something created in a laboratory, triggering skepticism.

James adds that while no single definition exists, Glanbia approaches clean label through two lenses: ingredient familiarity (do people recognize and understand what's listed?) and list simplicity (is it short and straightforward?). The goal is creating formulas with four to seven recognizable ingredients rather than long lists of complex compounds. This approach builds consumer trust and comfort without requiring technical knowledge of food science.

James provides a specific example of how Glanbia helps brands achieve cleaner labels through ingredient innovation. In baking applications, their flax ingredients can replace multiple other components including fillers and emulsifiers. This allows brands to transform a product from having a non-clean label (many unfamiliar ingredients, long list) to a clean label (familiar ingredients, short list) while maintaining or improving functionality. A single multifunctional ingredient that replaces three or four separate additives simplifies the ingredient declaration while potentially reducing costs and processing complexity.

Ben appreciates this framing because it distinguishes between "clean" (open to interpretation) and "transparent" (more objective). Transparency means consumers can read and understand what's in a product and where it comes from. Ben's "parent test" provides a useful benchmark: if he gave a product to his parents and they read the ingredient panel, would they understand what's there? For most consumers without food science backgrounds, long chemical names create concern regardless of safety.

-

1:21:00 - SupplySide Global 2025, Better-For-You Snacking Data, and Final Thoughts

James shares compelling data about how better-for-you positioning changes consumption patterns. For standard sweet snacks, only 10% of consumers consume these at least four times per week. However, when the same sweet snack formats offer better-for-you characteristics (higher protein, lower sugar, functional ingredients), that frequency jumps to 31% of consumers eating them at least four times weekly. This three-fold increase in consumption frequency demonstrates the power of permissible indulgence. When consumers know they're eating something with functional benefits, they give themselves permission to snack more often.

Mike asks about Glanbia's plans for SupplySide Global at the end of October 2025. James confirms Glanbia will exhibit with two large booths: one for Glanbia Nutritionals showcasing their protein and functional ingredient platforms, and another for their Flavor Producers and FoodAround divisions. The theme for Q4 focuses on weight management and metabolic health, directly addressing the GLP-1 discussion. The team wants to help brands understand what happens when people pursue weight loss and how nutrition can support those journeys.

Beyond the booth presence, Glanbia is excited to partner with PricePlow and other industry collaborators on bringing visibility to CREATEA, a functional beverage collaboration focused on cognitive health. Ben notes they've just begun announcing this partnership and will have extensive content leading up to and following SupplySide. The collaboration brings together creatine and other cognitive support ingredients in innovative beverage formats, showcasing a different aspect of Glanbia's capabilities beyond extrusion.

Ben expresses genuine appreciation for the depth of information shared, noting he learned tremendously from the conversation. The extrusion technology discussion was particularly fascinating, from understanding the Play-Doh analogy through to realizing the textural versatility and potential applications. Mike agrees that the session delivered exceptional value, particularly the statistical insights James provided throughout... understanding that Americans snack 6.4 times weekly on sweets, that better-for-you products drive 3x higher consumption frequency, and that 70% of protein cereal consumption occurs as snacking rather than breakfast.

Jonathan thanks Mike and Ben for the opportunity to discuss their work, expressing appreciation for the platform to share both the science and practical applications of protein fortification. James echoes the gratitude and emphasizes excitement around continuing these conversations at SupplySide Global.

Where to Follow and Learn More

- James Stone: LinkedIn

- Jonathan Baner: LinkedIn

- Glanbia Nutritionals: PricePlow | LinkedIn

- Related Articles:

- Related Episodes:

Conclusion: Engineering the Future of Functional Snacking

This comprehensive discussion with Jonathan and James reveals how Glanbia Nutritionals is fundamentally transforming what's possible in better-for-you snacking through advanced extrusion technology and deep protein chemistry expertise. The ability to push protein content from the typical 5-7% in traditional snacks up to 65-85% while maintaining crispy, crunchy textures represents a breakthrough that opens entirely new product categories and market opportunities.

The real-world applications emerging across protein cereals, snack mixes, and fortified versions of familiar favorites demonstrate how scientific innovation at the ingredient level cascades into products that genuinely improve consumer nutrition. The transparency around challenges – from plant protein flavor profiles to WPI supply constraints to the careful positioning required for market acceptance – showcases the kind of honest partnership approach that drives sustainable innovation.

Looking forward, the convergence of increasing protein awareness, GLP-1 adoption driving medical recommendations for protein intake, and continued refinement of extrusion technology suggests the better-for-you snacking revolution is just beginning. The ability to deliver permissible indulgence – products that taste great while providing functional nutrition – will define successful brands in the coming decade.

Thank you to Jonathan and James for sharing their incredible expertise and for the innovation work that's making protein fortification possible across categories. Their combination of technical excellence and consumer understanding represents exactly the kind of science-driven ingredient development that creates real market opportunities while delivering meaningful benefits to consumers. See you at SupplySide Global!

Subscribe to the PricePlow Podcast for more conversations with industry innovators and ingredient experts who are shaping the future of nutrition!

Comments and Discussion (Powered by the PricePlow Forum)