Welcome back to Episode #199 of the PricePlow Podcast! Today we're diving deep into the science and innovation behind functional proteins with Brad Meyers, VP of Functional Proteins and Snacking at Glanbia Nutritionals. This conversation explores how the supplement and functional foods industry is evolving to meet growing consumer demands for higher protein, lower sugar products that actually taste good, all while navigating the rapid market transformation driven by GLP-1 medications and changing lifestyles.

Brad Meyers, VP of Functional Proteins and Snacking at Glanbia Nutritionals, breaks down the food science behind better-for-you protein products, from solving the protein bar hardness problem to designing the innovative OvenPro platform for high-protein baked goods on Episode #199 of the PricePlow Podcast.

Brad brings over 20 years of food ingredients experience to the table, including a fascinating background in sweeteners and natural ingredients before specializing in proteins. In this episode, we explore the food science fundamentals that make or break protein-fortified products, from understanding Maillard browning reactions to solving the infamous protein bar hardness problem.

We also get an inside look at Glanbia's extensive applications lab capabilities, including their OvenPro platform specifically designed for high-protein baked goods, and discuss innovative future product concepts that could reshape on-the-go protein consumption.

Subscribe to the PricePlow Podcast on your favorite platform, and sign up for Glanbia Nutritionals news alerts below before we dive in!

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

https://blog.priceplow.com/podcast/glanbia-nutritionals-functional-proteins-199

Video: Functional Protein Innovation with Brad Meyers from Glanbia Nutritionals

Podcast: Play in new window | Download (Duration: 1:06:20 — 56.2MB)

Detailed Show Notes: Brad Meyers Breaks Down the Science Behind Better-For-You Functional Foods

-

0:00 - Introduction and Brad's Background in Food Science

Ben welcomes Brad Meyers, VP of Functional Proteins and Snacking at Glanbia Nutritionals, to discuss the innovation behind functional protein ingredients. Brad shares his unique journey into food science, explaining how he accidentally discovered the field while applying to the University of Illinois at Champaign. Originally interested in biochemistry, Brad ended up in the agriculture school's food science program and immediately fell in love with the discipline. He explains that food science applies every scientific field -- physics, engineering, chemistry, biology, and microbiology -- specifically to how they work in food systems, creating a practical career path that doesn't require a PhD to do meaningful work.

This is the third podcast episode of 2025 with Glanbia Nutritionals, and part 2 of a 2-part series on functional proteins:

-

4:45 - Career Versatility and Food Science Opportunities

Brad emphasizes the diverse career paths available with a food science degree, noting that professionals can work in engineering at production facilities, R&D bench work, basic ingredient research, sales, or marketing. He's spent over 20 years in the food ingredients industry, focusing on specialty ingredients with unique functionality. Before specializing in proteins, Brad worked in natural ingredients and sweeteners, starting his career in a beverage lab reducing sugar through different sweetener combinations. This broad experience across ingredients and applications has shaped his approach to functional protein innovation at Glanbia, where he now oversees both business development and technical applications.

-

6:00 - Market Evolution: From Sports Nutrition to Lifestyle Nutrition

Brad provides critical context on how the protein market evolved heading into and coming out of the pandemic. He explains that GLP-1 medications act more like gasoline on an existing fire rather than being the root cause of protein's growth. The bigger trend started before the pandemic, with consumers shifting from hardcore sports nutrition to lifestyle nutrition -- weekend warriors and health-conscious consumers who aren't necessarily gym rats but want to make better choices. The pandemic temporarily disrupted high-protein categories like bars and ready-to-mix powders because people stopped commuting and traded down to cheaper granola bars. By mid-2023, these categories normalized back to pre-pandemic growth patterns, with high-protein segments driving the majority of growth.

-

8:00 - The GLP-1 Effect: Supercharging Consumer Interest in Protein

Following normalization in 2023, GLP-1 medications like Ozempic and Wegovy entered the mainstream, supercharging everything by creating an entirely new consumer segment interested in protein. Brad emphasizes that alongside GLP-1's impact, general health and wellness awareness has increased significantly. Critically, product technology has continued to improve dramatically -- these high-protein products simply taste better than they used to. For the mass market lifestyle consumer, taste really matters. While hardcore gym-goers might tolerate mediocre taste to hit their protein goals, everyday people making healthy choices need products that genuinely taste good, and the industry has finally reached that threshold through advances in both ingredient technology and manufacturing processes.

-

9:45 - Taste is King: Consumer Research Across Categories

Ben and Brad discuss how taste consistently ranks as the number one factor in consumer surveys, regardless of other claims like clean label, high protein, or low sugar. Brad shares insights from his sweetener days in the early-to-mid 2000s when stevia was emerging, noting that across every product category and ingredient he's worked with, taste always dominates consumer priorities by a wide margin. The only exception might be hardcore supplements, where consumers sometimes believe if it doesn't taste bad, "the medicine isn't working." But particularly in mainstream food and beverage, taste has always been king. Marketing dollars might get a consumer to try your product once, but it's taste that drives repeat purchases.

-

11:45 - From Theory to Practice: Why Sugar Does More Than Sweeten

22% of consumers now replace meals with snacks. Glanbia Nutritionals' BarPro® proteins, Crunchie™ inclusions, and functional bioactives solve the texture and taste challenges that have plagued high-protein snacks for years.

Brad begins explaining the complex role sugar plays beyond just sweetness, noting that modern flavoring technology makes it relatively straightforward to achieve good flavor. However, the real challenge lies in texture and mouthfeel -- critical components often overlooked. Sugar provides body, mouthfeel, browning reactions, and bulk in powder applications. When you replace sugar with high-intensity sweeteners like sucralose (600 times sweeter than sugar) or acesulfame K (200 times sweeter), you're pulling out 200 parts of one ingredient and adding only one part of another, creating a massive bulk deficit. This explains why diet sodas taste thin compared to regular sodas: different consumer sets have adapted to different textural expectations, but in applications like protein bars, achieving the right texture while reducing sugar becomes significantly more complex.

-

14:00 - Food Engineering Fundamentals: Mass Balance in Formulation

Brad introduces the critical concept of mass balance, explaining that in any food formula, you only have 100% to work with. If you're increasing protein from zero to 33%, then 33% of something else must come out. This fundamental principle applies to all fortification or reduction strategies. The conversation reveals a common consumer misconception: people want more protein but don't understand why their favorite baked goods can't simply contain 25 grams like their protein powder. The reality involves complex chemical and functional changes that occur when you add substantial protein to traditional food matrices.

-

15:15 - Food Chemistry 101: Browning Reactions and Protein Behavior

Ben asks Brad to explain the chemistry that happens when you add protein to foods, particularly baked goods. Brad breaks down two types of browning reactions: caramelization (heat-driven sugar browning) and the Maillard reaction (where reducing sugars combine with amino acids from protein). The Maillard reaction is particularly important because it develops flavor and color in baked goods... it's what makes bread crusts golden and delicious. However, this same reaction can be problematic in protein bars, causing unwanted browning over 12-14 months of shelf life when the bar turns from white to brown. Understanding and controlling these reactions is crucial for product developers working with high-protein formulations.

-

17:30 - Protein's Impact on Texture: The Moisture and Chewiness Challenge

Brad explains what happens functionally when you add significant protein to products. Protein changes texture dramatically, typically making products drier and chewier whether you're working with baked goods or bars. He draws a contrast between protein bars from 15-20 years ago (products you had to chew for 20 minutes that weren't pleasant experiences, just something you "muscled through" to get your protein) and modern protein bars that taste like candy bars and are genuinely delightful to eat. This transformation represents massive technological advancement in both ingredient science and manufacturing processes.

-

19:30 - The Protein Bar Hardness Problem: Choosing the Right Proteins

Jonathan Baner (Senior R&D Director) and James Stone (VP of Global Marketing & Insights) from Glanbia Nutritionals reveal how twin screw extrusion technology is revolutionizing protein fortification in snacks, pushing protein levels from 5-7% up to 85% while maintaining the crunch consumers crave on Episode #185 of the PricePlow Podcast.

One of the most common failure modes in high-protein bars is hardness over time. Brad explains that when you take a protein bar fresh off the production line, it's soft and great. But if you don't use the right proteins in the formulation, somewhere between six weeks and twelve months later, the bar becomes rock-hard. He's seen protein bars he couldn't cut with a steak knife. Importantly, this isn't necessarily about protein quality, but rather about using the right kind of protein for the application. The protein you want in a ready-to-mix tub is fundamentally different from the protein you'd want in a bar. The chemistry is different, the functionality is different, and even the processing requirements differ, meaning manufacturers might use the same equipment but run it differently for protein bars versus cereal bars.

-

22:45 - Consumer Demands: More Protein, Less Sugar, Better Taste

The conversation shifts to consumer expectations and market realities. Brad explains that increasing protein and reducing sugar typically go hand-in-hand in consumer demands, people want both simultaneously. Fiber emerges as an excellent tool for replacing sugar because it provides bulk and comes with genuine health benefits. Brad notes that American consumers particularly are not getting enough fiber in their diets. Ben observes that Glanbia's customers are generally pursuing the healthier route rather than just making things taste good at any cost: they're trying to eliminate ingredients consumers don't want while maintaining great taste. Brad confirms that Glanbia Nutritionals focuses entirely on providing better nutrition and healthful foods, working across proteins, vitamins, minerals, and even their own flavoring systems, all aimed at delivering better health outcomes.

-

27:45 - Protein as a Health Signal: Consumer Perception Research

Brad shares fascinating insights from Glanbia's primary consumer research: protein has become a signal to consumers that a product is healthy. This creates both opportunities and challenges. On one hand, adding protein to products automatically elevates consumer perception of healthfulness. On the other, there's a risk of "protein washing" where brands add token amounts just for the claim without meaningful nutritional benefit. When consumers see "high protein" on a label, they're more likely to purchase that product over alternatives, even before considering other factors. This consumer behavior drives demand for effective protein fortification solutions that deliver real nutritional value while maintaining the taste and texture consumers expect.

-

29:00 - Market Gaps: White Space for Innovation

Brad identifies significant white space in the current protein market based on occasions and need states that remain underserved. Many traditional protein products like bars and shakes don't fit all consumption occasions throughout the day. This insight drives Glanbia's development of specialized ingredient systems for different applications. Brad specifically mentions their focus on baked goods as a food form that can serve occasions and need states not being met by traditional protein products. The industry has opportunities to expand beyond the typical protein bar and powder formats into new territories where consumers would welcome protein but haven't yet found appealing options.

-

35:00 - OvenPro Platform: Purpose-Built Proteins for Baked Goods

Brad introduces OvenPro®, Glanbia's ingredient platform specifically developed for baked goods applications. The platform includes specialized variants: OvenPro Bread, OvenPro Bread Zero Net Carb, OvenPro Cake, and OvenPro Quick Bread. Each variant is designed to work optimally in different categories of baked goods -- breads versus muffins versus cakes versus cookies. Brad explains that different baking applications require different protein selections because of varying functional requirements. If a baker wants to create high-protein bread, Glanbia would recommend different proteins than for someone making high-protein cookies or muffins. The OvenPro platform represents years of R&D focused on solving the unique challenges of high-protein baking.

-

37:00 - Glanbia's Unique Approach: Deep Applications Expertise

Mike asks the million-dollar question for brands: when do you contact Glanbia versus going directly to a contract manufacturer? Brad explains what differentiates Glanbia Nutritionals -- they invest just as much in applications R&D as they do in developing novel proteins. Glanbia maintains a huge applications team with labs and pilot plants worldwide, doing extensive development work on behalf of customers ranging from startups to the world's biggest CPG companies. Customers come with a brief, Glanbia develops recipes in their labs, and they invite customers to work side-by-side with scientists on the bench. This collaborative approach dramatically accelerates development -- what might take 6-12 weeks through back-and-forth sampling can be completed in just two days when customers visit the lab, leaving with finished concepts ready for commercialization.

-

38:45 - The Development Ecosystem: Ingredients, Brands, and Co-Manufacturers

Brad clarifies Glanbia's role in the supply chain. While they're not a co-manufacturer themselves, they act as an ingredient house that can connect brands with appropriate contract manufacturers. Typically, the co-man places the ingredient order, so Glanbia already works with numerous co-manufacturers across different application areas. They can link brands they're developing formulas for to co-mans (contract manufacturers) matching their scale, needs, and product type. Some companies self-manufacture or already have preferred co-man partners, which works perfectly. Glanbia also trains co-manufacturers directly on protein applications, sometimes doing collaborative development with co-mans on behalf of the brands they serve. This comprehensive ecosystem approach means brands can enter the relationship at any point along the value chain.

-

40:45 - Beyond Protein: Full-Service Applications Support

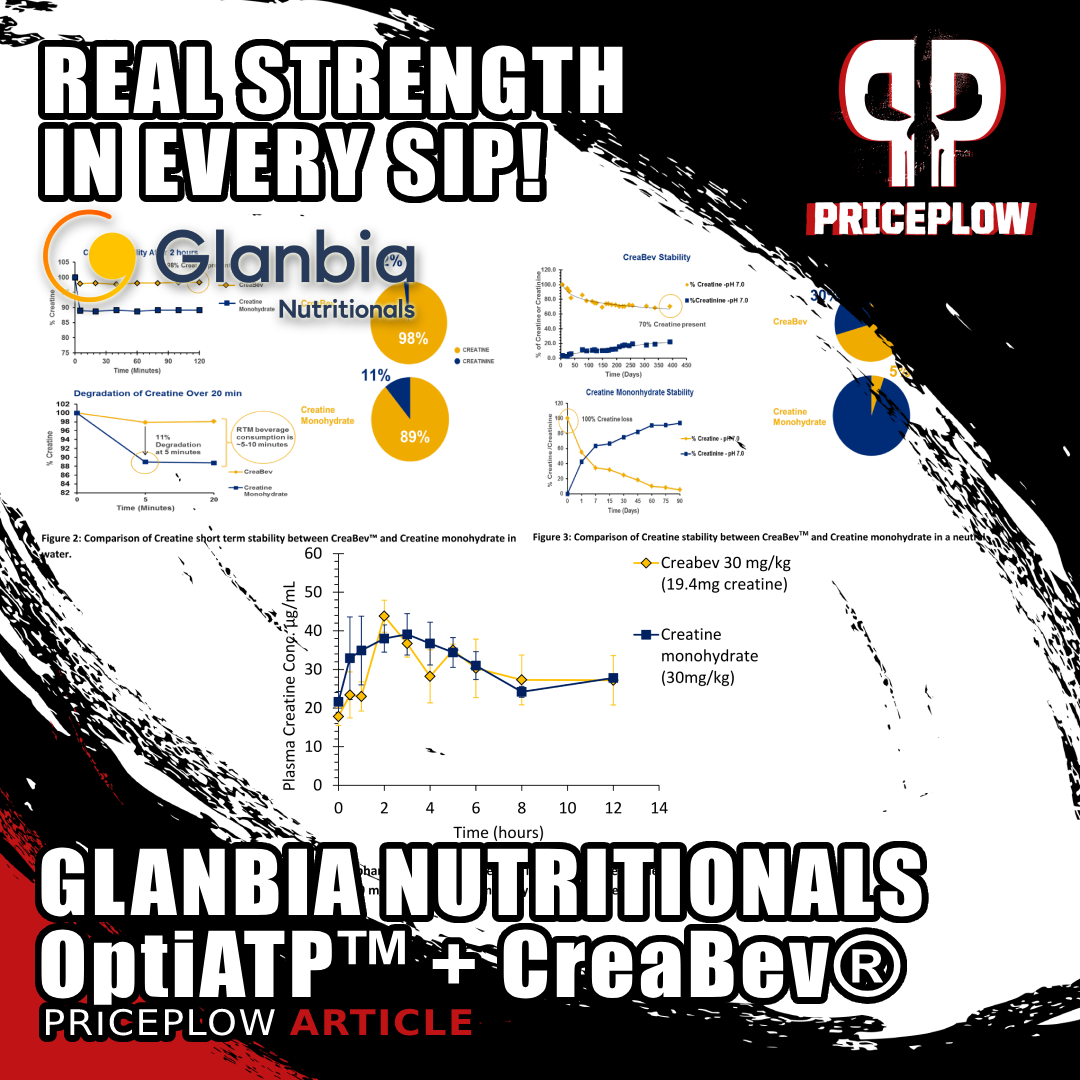

Finally! Creatine that stays stable in beverages thanks to Glanbia Nutritionals' CreaBev™ technology. Plus OptiATP® brings actual cellular energy to RTDs -- not just caffeine. Add in Collameta™ marine collagen tripeptides & TruCal® bone minerals = strength from every angle. Read about all four ingredients in Glanbia Nutritionals' Strength Platform

Brad reveals an interesting aspect of Glanbia's expertise: their applications team knows almost as much about fiber as they do about protein because they're using fiber alongside protein in virtually every application. This depth of knowledge extends across multiple ingredient categories because they're formulating complete products, not just selling single ingredients. Brands can come to Glanbia with just a concept or idea, and Glanbia can transform it into reality. This full-service capability particularly benefits branding companies -- those who know consumers, markets, and distribution but may lack expertise in protein science, formulation, and selecting the right proteins for specific applications. That's where Glanbia truly shines, bringing deep technical knowledge that complements brands' market expertise.

-

43:45 - Speed to Market: From Concept to Finished Product in 48 Hours

Ben expresses excitement about visiting Glanbia's applications labs to create something collaboratively. Brad emphasizes that speed to market is critical in today's environment. When development happens via prototyping and mailing samples back and forth, the process can take 6-12 weeks from concept to finished product. However, when customers come directly to Glanbia's labs, they can complete the entire development cycle in just two days, leaving with finished concepts. This dramatic reduction in development time allows brands to reach market significantly faster. Brad encourages this collaborative approach because it yields better outcomes -- when customers confirm that onsite collaboration is happening, that's when Glanbia knows they'll achieve great results.

-

45:45 - Protein Supply Realities: No Shortage on the Horizon

Mike asks about global protein supply and whether shortages might occur with surging demand from GLP-1 consumers and general market growth. Brad provides reassuring context: while specific years might see slight tightness in particular protein types, overall global protein supply remains robust. Dairy proteins are relatively abundant -- there's plenty of milk being produced globally. Plant proteins like pea and soy also have healthy, growing supply chains. Brad notes that the bigger challenge isn't protein availability but rather other ingredients commonly used in high-protein products. For example, allulose has experienced supply challenges, and prebiotics can sometimes be tight. The protein itself, whether dairy or plant-based, generally isn't the limiting factor in formulation or production.

-

47:45 - Dairy vs. Plant Proteins: Applying Expertise Across Sources

Brad addresses the perception that Glanbia primarily focuses on dairy proteins. While they're a major player in dairy, having one of the world's largest whey protein facilities in Idaho, they also work extensively with plant proteins like pea and wheat. The key insight is that Glanbia has taken their deep processing knowledge and proprietary expertise developed with dairy proteins and applied it to other protein sources. This allows them to deliver the same texture, functionality, and performance regardless of source. When Brad says he represents functional proteins at Glanbia, that spans a wide variety of protein sources, not just dairy. This diversified portfolio positions Glanbia to meet varying customer needs and preferences across the spectrum of protein types.

-

50:15 - OvenPro and Wheat: Flour Replacement vs. Fortification

Rachel Schreck and Brent Petersen from Glanbia Nutritionals reveal the revolutionary Strength Platform featuring CreaBev®, OptiATP™, and beverage-stable innovations on Episode #174 of the PricePlow Podcast.

Mike asks whether wheat protein can be used to replace wheat flour in baked goods. Brad clarifies that the OvenPro range includes different products for different purposes. One variant is designed as a drop-in, one-for-one flour replacement but with higher protein content -- the intention being to create higher protein, lower carb breads where manufacturers could replace one kilo of flour with one kilo of OvenPro. Other OvenPro ingredients are designed more for fortification rather than complete flour replacement. You'd still need to remove some flour due to mass balance principles, but these variants work alongside flour rather than completely replacing it. The entire OvenPro range offers different ingredients with different purposes depending on target specifications and end-use applications.

-

51:30 - Future Product Concepts: The Frozen Protein Pouch Idea

Mike asks Brad if there are products he wishes existed in the market. Brad shares a creative concept from his trips to Japan: he saw squeeze pouches filled with ice cream in frozen coolers, similar to applesauce pouches for toddlers. His idea is a frozen squeeze pouch containing 20 grams of whey protein in a high-protein ice cream format. Coming out of the gym hot and grabbing this cold, protein-rich pouch would be both refreshing and functional. Brad acknowledges this requires both product innovation and packaging innovation. The conversation becomes practical as Mike reveals they know manufacturers who could produce such pouches, leading to discussion of a potential 2026 collaboration for trade shows. This illustrates how product innovation often emerges from identifying unmet consumer needs at specific occasions.

-

53:45 - Technical Requirements for Pouch Manufacturing

Brad walks through what would be required to develop the frozen protein pouch concept. First, understanding the manufacturer's viscosity requirements and how product will pump through their systems. Second, knowing their temperature processes because proteins denature (change shape and unravel) at higher temperatures, and once denatured, they can't be "renatured." Different proteins have different temperature sensitivities -- milk proteins versus whey proteins respond differently. Third, considering freeze-thaw conditions and viscosity in the frozen pouch to ensure it remains squeezable. Fourth, establishing the design brief around protein content, acceptable sugar levels, which ingredients are in or out of scope (sugar alcohols, fiber, artificial sweeteners, natural sweeteners like stevia or monk fruit). The development would require deep collaboration with the manufacturer around processing conditions while maintaining the nutritional profile.

-

56:45 - GLP-1 Consumer Segmentation: Not a Monolithic Group

The discussion returns to GLP-1 medications and consumer segmentation. Brad explains that GLP-1 users shouldn't be viewed as a single homogeneous group. Drawing on data from James Stone's team, Brad notes that some GLP-1 consumers are prescribed the medication by doctors due to diabetes or serious obesity, while others might be using it more for cosmetic weight loss with only 10-15 pounds to lose. These different segments have vastly different needs, goals, and product requirements. Brad predicts the market will increasingly recognize these distinct cohorts and develop tailored products for each segment. Understanding that GLP-1 users span a spectrum from medical necessity to lifestyle choice should inform how brands approach product development and positioning.

-

1:00:15 - Market Size and Growth Projections for GLP-1

Brad shares that the data on existing GLP-1 consumers is staggering -- already millions of users in the United States alone. The projected growth rates are equally impressive, suggesting dramatic expansion in the coming years. He mentions that pharmaceutical companies are working on ingestible pill forms rather than injections, which could be a game-changer. Many potential users are hesitant about self-injection, so once pill forms become available at lower costs, adoption could accelerate dramatically. Ben echoes this sentiment from his panel discussions, noting that injectable administration is a significant hurdle for many consumers, and oral GLP-1 medications could fundamentally transform the weight management supplement market by making pharmaceutical options more accessible and appealing than traditional dietary supplements.

-

1:03:45 - Real-Time Data from Clinical Trials: A New Phenomenon

Ben observes the fascinating real-time release of data about these drugs through online communities. Clinical trial participants are posting about their experiences on platforms like Reddit, sharing insights before official study publication. He mentions recent studies on newer GLP-3 variants where trial participants are discussing benefits online during the trial itself. This represents a new frontier in how pharmaceutical development intersects with consumer awareness. Brad agrees this live evolution is compelling, noting it's heavily tied to protein consumption since GLP-1 users are consistently told they need to consume more protein alongside medication. This creates an enormous opportunity for the functional protein industry.

-

1:04:45 - Closing: Where to Learn More and Connect

Ben wraps up by asking where people can find more information. Brad directs listeners to Glanbia.com for comprehensive company information and resources. He encourages following Glanbia Nutritionals on LinkedIn, where they're very active with educational webinars, primary research, and technical data. Companies looking to launch new products or fortify existing ones with protein should reach out through the website or LinkedIn -- Glanbia welcomes collaboration with anyone looking for expertise in selecting the right proteins and applications. Mike thanks Brad for the insightful conversation and hints at taking potential collaboration ideas offline for 2026, referencing their successful beverage project earlier in the year. The episode concludes with mutual appreciation and excitement for future opportunities.

Where to Follow Brad Meyers and Glanbia Nutritionals

- Brad Meyers on LinkedIn: https://www.linkedin.com/in/brad-meyers-1191ba11/

- Glanbia Nutritionals website: https://www.glanbia.com

- Glanbia Nutritionals on LinkedIn: https://www.linkedin.com/company/glanbianutritionals/

- Glanbia Nutritionals on Instagram: https://www.instagram.com/glanbianutritionals/

- Subscribe for Glanbia Nutritionals News on PricePlow: https://www.priceplow.com/glanbia-nutritionals

You can also see our previous podcasts and our article, "Glanbia Nutritionals' Better-for-You Snack Setup: BarPro, Crunchies, and Functional Bioactives Transform Protein Snacking":

- Glanbia Nutritionals Strength Platform: CreaBev®, OptiATP™, and the Future of Beverage Innovation | Episode #174

- Making Better For You Snacks Better with Glanbia Nutritionals: Jonathan Baner & James Stone | Episode #185

Brad Meyers provided incredible insights into the science and strategy behind functional protein innovation. From understanding Maillard reactions to solving shelf-life challenges to creating entirely new product formats, this episode reveals how ingredient companies like Glanbia are partnering with brands to meet the evolving demands of health-conscious consumers. The future of functional foods looks delicious!

Thank you to Perfect Shaker for sponsoring Episode #199 of the PricePlow Podcast! Check out their incredible shaker cups at PricePlow.com/perfect-shaker or PerfectShaker.com.

Subscribe to the PricePlow Podcast on any platform, sign up for Glanbia Nutritionals news on PricePlow, and leave us a great review on Apple Podcasts and Spotify!

Comments and Discussion (Powered by the PricePlow Forum)