https://blog.priceplow.com/podcast/mike-mccandless-106

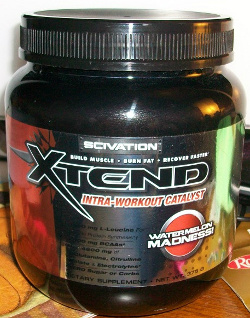

If you've been around the supplement industry the past decade or two, you've undoubtedly heard of Mike McCandless, the founder of Scivation and creator of the legendary Xtend BCAA formula that upended the entire sports nutrition industry.

Mike McCandless: A Master of Supplement Business Transactions

Mike McCandless is the founder of Scivation, who created Xtend and sold the business to Nutrabolt in 2017, amongst other business transactions. He joins the PricePlow Podcast to explain how to sell a supplement brand, and what his next steps might be.

The last time we publicly spoke was when Scivation was sold to NutraBolt in early 2017, but that wasn't Mike's first -- nor last -- business transaction. Before Scivation took off, he started in retail and Internet retail, running and selling 1Fast400 and Bulk Nutrition. After Scivation, he also started and sold KetoLogic and FBomb, and also finally parted ways with his PrimaForce single-ingredient brand that was a longtime PricePlow favorite.

Mike's been listening to the PricePlow Podcast, and, well, he's got a lot to say. As is often the case with him. So we brought him on to tell his story, give his opinions, and see what he might do next.

With no more non-competes in the industry, Mike's possibly itching to get involved in the next big thing, but at the "old" age of 44, he's not interested in another startup. He is, however, interested in helping good people turn their supplement businesses into transactable entities that can be sold.

Prepare yourself for a podcast of the ages. There is a 0% chance you'll listen to this and not learn or laugh.

Podcast: Play in new window | Download (Duration: 2:01:01 — 123.2MB)

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

Detailed Show Notes with Mike McCandless

Note: In these show notes, Mike McCandless will just be called Mike. For references to PricePlow's Mike, we'll note him as "Mike R".

-

0:00 - Introductions

Mike R introduces Mike McCandless as a "Modern Day Renaissance Man", briefly mentioning that he not only founded Scivation (which he sold to Nutrabolt), but also Bulk Nutrition, 1Fast400, and a couple of keto product companies.

The backstory is that we recently finally decided to delete the 1Fast400 brand from our system (its products had been long gone), so we sent an email to Mike about it, saying farewell. This turned into a conversation about a potential podcast, and it finally came through!

Mike's been in the space for over 20 years, as a consumer, selling at a brick & mortar store, internet retail, and then of course building brands.

-

2:00 - Mike's origin story and synopsis of sales

Like many others, Mike started at GNC. This was around 1999, in peak "Body for Life" heyday, referencing back to the big Bill Phillips book.[1] Mike was sold stuff that he later found that wasn't a good deal.

As a sales rep during college, Mike was making great money at a corporate GNC store. Using that money, he began to save up for his own store. Mike also worked at a franchise GNC, which is a whole different beast (and he may have alluded to franchising itself being more powerful than anyone realizes).

He then started a retail store (this would be around 2000-2002), was just hoping to have enough money for a standard American family experience. In 2002 Mike also began some websites (1Fast400 and BulkNutrition) and those took off as well, selling in 2006. During that, he started Scivation in 2004, selling that in 2017. After that he started a couple of keto brands (Ketologic and FBomb), which were also sold recently. Finally, he sold PrimaForce in 2022.

Mike's never taken a business class - it's all been real-world experience.

Because of this, "It's weird - I don't feel old, but I'm an old man in the industry". Mike R retorts that "Timing the market isn't as important as time *in* the market."

-

4:45 - What is 1Fast400?! Flashback to the Bodybuilding.com Forums

In the early Internet days, you'd have to get your Internet name. Mike didn't even know Bodybuilding.com existed (see Episode #099 with Ryan DeLuca, which intersects with this story) until a customer came in talking about it. There was infinite information there, early Internet days.

Mike's a slim-framed guy, so he's not going to go in as "22InchBicepMike", but Mike did run the 400 meter sprint in high school and college, so he named himself 1Fast400 (you can still read his old posts there on that account[2]).

Looking at what was going on in the Bodybuilding.com forums, he realized there was an opportunity to sell things that Bodybuilding.com wouldn't - eg. the early days of prohormones.

"Like any business, there's always a ground swelling of super hardcore customers that are early to market on a lot of stuff, so I focused on getting those products and then offering them in a web store."

"And so if it was not for Bodybuilding.com, I would never have existed." -- We then flash back to Episode #099.

Mike mentions that today's influencers on social media is just a different version of forum reps. Mike's surprised he got away with as much as he did, promoting his stuff on someone else's forums.

1Fast400 had a very unique name that actually worked when typing it into web browsers. He then created his own bulk powders brand inside of that, Bulk Nutrition, which eventually became its own website.

-

8:00 - Prohormones and Ephedra: The OG Industry Seed Funding in the 2000s

Mike R asks for confirmation on his theory that, since this industry was not going to get any venture capital funding, that prohormones were the original seed funding for companies to later clean up their act. Mike agrees - there was a short window that eventually was going to blow up.

Yep, Rick Collins is still at it in DC. Image with Nutrabolt's Diana Morgan at the 2023 NPA Fly-In Day (See Episode #100)

Mike flashes to the time when he joined a group with our friend Rick Collins, where they lobbied for more time to sell prohormones. They needed a sell-off period so they could sell them before the ban took place. This was successful -- Mike bought everyone's inventory with 10 days to go, and turned it around for a quick profit, and when the ban came, he sold the rest overseas. "Wild times man, wild times."

This was all legal (although we could debate prohormone DSHEA legality). The same thing happened to ephedra. Mike borrowed as much money as he could from his parents to stock up on the OG Lipo-6, then flip it.

The guys get into a discussion on the legality, and Mike notes that everyone knew it was going to end at some point. His suggestion is to know the answer to the question, "What is your defensible position>?" This is because laws are written in a gray area to allow for some strong enforcement if needed.

Mike talks about how enforcement is not level across the industry. He references a person who was on the front page of USA Today for breaking countless laws, yet never did any time (referring back to our article titled The Cahill Craze Scandal: How to Stop One Man's Destruction of an Industry), while others may spend tons of time in prison.

-

15:00 - The hidden lesson from Bulk Nutrition

Getting back to Mike's story, Mike R brings us back to Bulk Nutrition, trying to understand if selling bulk powders was that big of a market in the 2000s. It turns out that there was a huge lesson in this:

A lot of times companies companies believe they know what the consumer wants and why they want it, and I think it's the most arrogant thing that you can ever think -- because you have to test a lot to see what the consumers really want, and adjust accordingly.

What he didn't realize is that he was selling huge orders to folks buying single ingredients like ALCAR (acetyl L-carnitine) for their animals - especially horses. And these are large animals needing large doses.

By making tons of money here, he could win on price in other products he was reselling.

-

16:45 - Question: Why not continue down this path to success?

Mike R asks why not stick with what works in terms of single-ingredients, since he was doing so well with the animal market? How did he get away from that?

Mike's business growth at this point was getting to the point where something needed overhaul - he had 4,000 unique SKUs all in his head. He was efficient with cash flow, and he was very close to Europa Sports, which made him quite nimble.

At this point we also get a quick snippet on PrimaForce, which was nothing more than taking the ingredients he already had an whitelabeling them.

-

18:25 - Answer: A counterfeit lawsuit takes down Mike's retailers

But to answer the above question, Mike got sued for counterfeit goods that he had acquired from a distributor in Canada. It was MRI NO2.

With Mike's luck, he was the only person in the US who had bought from that distributor. His facilities got raided, it went to depositions, and he only sold $1700 worth of product, totally meaningless for a business projected to make 8-figures that year.

Ryan Deluca, founder and 17-year CEO of Bodybuilding.com joins the PricePlow Podcast for Episode #099 to talk about the genesis and sale of Bodybuilding.com and his new venture, Black Box VR, which brings virtual reality to physical fitness

Mike's not a counterfeiter, and is actually well-known for testing far more product than the average operator, but because of this, he was liable for up to $3 million. Canada didn't have strict laws on counterfeiting at the time, and Mike was the one holding the bag of legal fees.

This cleaned Mike out, he almost lost everything over something he didn't do, and that was terrifying to him.

So after this, Mike is introduced to Russ DeLuca (Ryan's dad) in 2006, and publicly states that he'd be willing to sell his properties. By the time he was home from his trip, there were offers to buy his online retail businesses. He quickly made a deal and got out, in order to focus on Scivation.

-

21:00 - Scivation and Branched-Chain Amino Acids

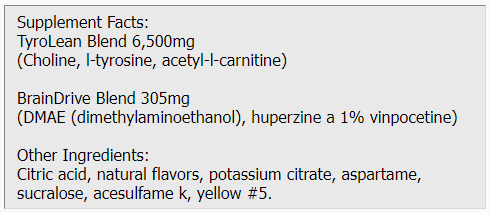

Back then, branched-chain amino acids (BCAAs) were in a weird place. They didn't dissolve in water and didn't taste good, so you had to take enormous tablets, which most didn't want to do. Mike saw opportunity in it, but he first saw opportunity in a product called NeuroStim, which was his first anchor SKU for Scivation:

The common sense idea, in general, is to make greater profit on his own store by selling his own product there instead of someone else's. But next, he could also sell it to his competitors. In the long term, that's a better business model than Internet retail.

-

22:30 - The Start of Scivation Xtend

At the time, Mike was dating a fitness competitor, and made her a daily gallon jug of what would eventually become the Xtend formula. He had her drink that and keep everything else the same. She came in leaner, with more muscle, and 3 pounds heavier than previous contests, so he knew he had something here.

The issue was the white flaky powder and the bitterness, and a lot of that issue was actually caused by the blending process. They innovated the product to allow their product to work than all of the competitors. They also got a better-dissolving glutamine inside.

It was all about flavor - if he could get them to try it once, then he'd get them hooked.

-

25:15 - Knowing everyone through online retail but trying to start a brand

Most people didn't know who Mike was, and many brands didn't even know that he was the one pushing so much volume through Europa with his online retailers. Over time, they began to realize his importance, especially when trying to get a product on their website.

Many knew Mike was making a brand, but he didn't want to be the front of it, since he wanted his own competitors to pick it up....

-

26:00 - Enter Marc Lobliner, Exit Marc Lobliner

Mike met Marc Lobliner through the Weider people, and he was super high-energy -- perfect for a startup. He became the face of the brand, allowing Mike to work the back-end and make sure that competing retailers would be okay with picking up his products.

In Episode #053 of the PricePlow Podcast, we hear from Marc Lobliner and talk about why he added Nutrition21's Velositol to his Outright Breakfast Bars. Marc spent much of the 2000s as the face of Scivation while Mike worked the backend.

Mike R digs a bit deeper, knowing that there was an Xtend reformulation that shook the customer base quite wildly, yet they were the first to make BCAAs taste great. He also skips forward to the sale of Scivation in 2017, when Doss mentioned "flavor" a few times on our phone interview. Lobliner eventually exited too, so we need more details on the order of events.

Mike makes it clear that Marc Lobliner will be working 80 hour weeks forever - he's truly a machine. However, a brand that's tied to a single individual, or has his name on it, will be insanely difficult to transact (sell) -- this creates too much liability. This drove a difference of opinion on where the brand needed to go, so Mike bought Marc out of the business.

-

27:30 - Chris Lockwood and the Reflavoringg / Reformulation

A bit before Marc Lobliner's exit, Chris Lockwood joined the team. He's currently with Nutrabolt and one of the smartest people Mike knows - if you want to feel dumb about science, just talk to Chris. Mike wanted to build it into a business that could be sold, and Chris cleaned up quality and compliance, but also wanted to do a reformulation and reflavoring.

Chris wanted to add electrolytes as well, and with the data, Mike agreed.

We made the very bold move of taking a category-leading product and changing the entire profile. I think a lot of our consumers would have been happier if I went to their homes and beat up their family members. Luckily at that time, social media isn't what it is today.

Why do this? Because Scivation had to make a transition to brick-and-mortar retail. That consumer wasn't as overloaded with artificial flavors like the hardcore guys. Back then nobody knew how to flavor, they'd just dump the artificial flavor on it. That wouldn't work with normal people.

-

30:00 - Beware of "Built to Sell"?

Mike R confirms that at some point, Mike decided to want to sell Scivation. But it wasn't always like this, and he urges that if you create a business with the plan of selling it, then you'll likely make some bad decisions along the way.

No matter what, you have to focus on doing right by the consumer, you can get to a transactable situation -- but the company will need to be prepped.

In retrospect, Mike R comments that Mike's decisions make sense. People may want to make a big fuss over drama with Marc Lobliner, but someone was going to have to get pulled out of this business. Marc loves to be out front, but that didn't jive with what Mike's path was for this brand. Mike wanted to soften it up, go more mainstream (for the growth opportunity), and a ton of things happen all at once.

-

33:30 - 2012: Nutrabolt's First Acquisition Offer

With all of that having just happened, Mike had one more thing to deal with -- an uncle who owned part of the business that wasn't putting work in. He had to be bought out.

And in 2012, Nutrabolt put in their first acquisition offer on Scivation. While that didn't end up happening (yet), it did put a valuation on the business. So with that valuation, Mike needed to raise enough money to buy his uncle out.

Mike's 2012 situation is what a lot of brands will face their first time going to market.

-

34:45 - CEO is a Very Overused Term - Getting a Real CEO

So Mike was running basically everything and the business wouldn't exist without him, but that doesn't make for a business that can be sold either.

"CEO is a very overused term in the sports nutrition space. I was always very clear that I was not a CEO. The easiest way to know that you're not a CEO is when you see a real CEO and you see the difference."

So, in order to buy his uncle out, Mike borrowed from a private equity group, and they told him he had a killer business, but it was not sellable. They said they'd give him the money, but he had to do what they said in terms of molding the company into something that could be sold.

-

37:00 - What changes did the private equity group force?

At first, the changes were painful. Scivation was already successful, and Mike, a shorts and T-shirt guy, wasn't thrilled with suits coming in. But in this group were some insanely successful individuals, such as John Replogle,[4] the CEO of Burt's Bees (which was sold to Clorox) and Seventh Generation (also sold). This is the kind of person you listen to.

Replogle said to call a VP at Target that was available and hire him as CEO (this was Mike Hockenberry) - so Mike M did just that after hanging out with him without asking a single business question.

"Welcome to the pirate ship!"

-

41:00 - "It's Just Widgets"

With this came other changes - Scivation had to build an executive team. Mike had to agree to move the offices to Raleigh, NC or Durhman, NC because nobody wanted to be in Burlington and they'd have to pay far more to get talent there.

Mike said OK, and that started the building of the team. When the CEO said he needed a pool of equity for other executives, Mike lost his mind, but agreed to it because "that's the cost of business".

But ultimately, "it's just widgets" - executives without sports nutrition experience can operate at a high level in this industry.

-

42:00 - Sidebar to Scivation Flexatril

It was obviously Scivation Xtend that was the product, but Mike R can't help but mention Flexatril, a phenomenal joint supplement we still talk about to this day (and refuse to take the blog post down for).

Flexatril is a joint supplement made for his best friend -- his Italian Mastiff named Dozer. Dozer had joint issues and Mike got big into microlactin, which was always way too underdosed. Mike put in a legit dose and everyone loved the product, giving it tons of positive reviews.

Mike told Nutrabolt, "I know you're going to kill this SKU, and it's going to kill me that you're going to kill this SKU, because this is a super legit SKU that's really helping people."

It was truly created out of passion. He used 4 grams when everyone else was using 500 milligrams.

-

43:45 - The team you start with is almost never the team you end with

Mike gets back to business and executive team building -- the issue is that the people you start with are often family and friends, and won't be the same as the people you end with. This is the hardest thing on an founder, because people with expertise need to make more money and will get placed over legacy employees/friends.

This usually starts happening at $15-25 million for supplement companies, and then $25-50 "all hell breaks looks" where logistics turns far different.

Scivation was due for that leveling-up at that time, and they did it all at once -- everyone was impacted.

Mike's message for those who get replaced by or put under new management is this: "If you will learn underneath this person coming in, there will probably be an opportunity for you either here or at another company to actually *be* that person at the next company."

-

46:00 - Gamechanger: Bringing competent staff to GNC

Mike talks about his first trip to GNC with his CEO (who, remember, was previously a VP at Target). While he's doing his same song-and-dance for the buyers, the real meeting was happening between the Scivation and GNC executives over in the corner.

By the time they left, Scivation had an entire floor plan going into place, a POP (Point-of-Purchase) display going up, and more. Mike Hockenberry's ability to talk real business with the GNC executive team got them much further in their process - they simply speak another language.

-

47:45 - Going Pro: Raising Xtend's Price and Doubling Sales

Mike explains what happened next -- he liked Xtend at a lower price point - $23.99 for 30 servings. It was always a great deal, which is why it was a PricePlow favorite from the beginning.

The plan was to go to $29.99, but the CEO said that wouldn't work at scale, and decided to go to $34.99, and Mike about had a heart attack! It was the only way the number dynamics worked if they were to double growth.

Amazingly, they raised the price that much, and their sales in unit volume doubled. A story as old as time. Mike never would have made that decision, but the CEO and CFO had it all laid out and it made sense and worked.

-

49:30 - Mike's real reason for Xtend's success

Mike says he'd love to take credit for Xtend's success, but he actually points to a different reason: Blender Bottle! Reason being, it was the first actually good shaker cup that actually enabled their drink to be sold. Remember, shaker cups back then were awful.

The earlier adopters of the quality shaker cups were the guys training like crazy in the gym. They drank Xtend during workouts, and when others saw them drinking colorful drinks in their shaker, it drew more customers.

Blender Bottle enabled it all. Scivation didn't change much marketing when this all happened, but sales went up. Aside from protein powders, they were in the best position to benefit from a great shaker bottle.

"People are spoiled these days, man -- the products taste great, they mix good, they got a bottle it goes in, I'm the old man walking in the snow both ways now."

-

55:00 - Winning in retail: Commentary on Vitamin Shoppe Episode #105

Mike listened to Episode #105 with Jack Gayton of The Vitamin Shoppe and wanted to add some commentary.

Mike gives Blender Bottle a huge credit for Xtend's success. Before this, there was literally no solid way to use the product!

Here's what Mike has to say, talking about the word vomit he hears from brands and other supplement industry folks. First, he's not exactly in agreement that "any change to the product" counts as innovation. But going further, he states that innovation hardly matters at all.

What really matters in retail is dollars and cents, and if you are taking up shelf space with low-margin goods, you're going to get replaced the moment you falter.

If Mike were to come to a retailer with a new product/brand, he'd tell them three things:

- I'm going to be in stock

- I'm going to be margin-accretive (I'm going to provide better margins than whoever I'm replacing on the shelf)

- Here's how I'm going to drive people to your retailer

- ...and by the way, I'm buying them out to take their shelf spot.

Then innovation works after that. But just because you're great in one channel doesn't mean you're great in another. They underestimate how much cash this is going to take. So it's all "word vomit" until you hit those points.

Mike says they bought tons of shelf space at Vitamin Shoppe to get more flavors of Xtend in.

-

59:30 - Driving Traffic to a Retailer: Can Mike still hang?

So how would Mike drive traffic into a retailer if he's been out of the game for a while? He answers below - but long story short, he wouldn't have a vague plan and wouldn't drive traffic where everyone else is:

"My strategy isn't dictated by doing what I think is right. My strategy is dictated by what my competition is doing that leaves me a void to go in and say 'Hey, retailer, all these brands you have here, these are their five hot spots where they crush it, and I'm not going over there because there's no reason for me to. I'm going to bring you consumers from over there that will come in.'

And now all the retailer cares about is that those people are new. If I tell them I'm just going to redirect the consumer that's already in there, to them, this is why it has to be margin accretive.

If I can go in and go, 'Not only am I going to drive people in, but if they buy my widget, my widget makes you five percent more margin dollars than that widget right there, if all things are equal and all I do is move the shopper that's a positive for the retailer.

So the theory is I'm going to bring more, but let's say I don't, and I'm just keeping the person in the box that they're in front of, but I bring them to a product that's a 5% greater margin, then obviously the retailer is happy.

So, my point is, the categories and where you're going to go are what dictate the strategy for how you bring people in...

...so my job is two things, I gotta go to a new place to bring in new consumers, and I have to steal the consumer from the other guy."

So why don't the GNC brands just dominate everything, if they have such better margins?

Mike's answer is funny - do you buy the store-brand laundry detergent? Not everyone buys it. They buy marketing.

Even though Beyond Raw is a fantastic brand, and GNC's Pro Performance has been around forever... why do you buy the national brands? There's just something built-in that humans just don't want to prefer the store brand.

-

1:05:30 - "Supplement Brands" Aren't Brands

"Overwhelmingly, 'supplement brands' aren't brands -- they never were, they never will be -- but they want to be out of stupidity.

Brands want to create too many SKUs, and this creates a problem in the transaction area.

When asked, "Scivation wasn't the brand, Xtend was the brand?" Mike quickly retorts,

"Well, is Scivation around anymore?"

-

1:06:00 - Why Nutrabolt Bought Scivation (Xtend really)

Mike explains that Nutrabolt went hard twice trying to take over the amino space -- at some point, it became easier to acquire than to build.

And this is the strategy any company of size should follow.

Further, this is why it's important to be focused on your brand rather than trying to be all things, if you want to be acquired.

For Nutrabolt, it was literally a bolt-on transaction.

-

1:07:00 - How the Scivation / Xtend sale happened

Mike gets into the details of how the sale occurred. Shortly after losing his mom, who he was incredibly close to, he still decided to fly out to the Olympia, since they had been working so hard at it.

Announced here on April 1, 2023, we wrote: This is not an April Fool's thing -- Scivation has been acquired by Nutrabolt, the parent company of Cellucor!

He had a drink with Mike DiMaggio, Nutrabolt's Chief Legal Officer & General Counsel (and now also a close friend and, per Mike, possibly the smartest person in this space), and said he was going to take a year and get the company sold.

A month later, DiMaggio calls and asks Mike how serious he was. He asks how much Mike wants for Scivation, and Mike comes up with a big number, but hadn't really thought about it. DiMaggio said Mike was crazy, but 45 days later they had a letter of intent.

The deal closed March 31, 2017. The number Mike wanted was what he got.

-

1:09:45 - What key things did Scivation do to become worth this much?

Mike answers by saying what most companies screw up. By this point, they were officially a company with board meetings, minutes, etc. Companies don't do enough prep, and don't look at their trailing 12-month period. You need a good 18 months to prepare a business to sell, but nobody is because they're usually looking forwards and not backwards.

Contracts need to be locked tight with employees, vendors, etc. The new CEO was very formal and took Mike's "wild west" and cleaned it all up.

Posted on this blog in 2017: Key members of the two teams pose for a picture after signing one of the biggest recent deals in the supplement industry!

Nutrabolt also didn't need a single person from Scivation - it was a perfect bolt-on. This means staff and overhead like office and warehousing could be completely removed from the number and increase their multiple, since Nutrabolt wouldn't need to absorb those expenses.

-

1:12:30 - Leaving something on the table for the next guy

A key point is that Scivation hadn't yet gone in to FDM (Food / Drug / Mass), so there was still huge room for growth. Mike didn't want to do this, but Nutrabolt easily could.

This is what so many companies miss - they don't go to the market at the right time. If they're already everywhere, then there's nowhere left to go!

From Mike's perspective, the right number is $20-50 million. This is where you can bring on private equity or get fully acquired.

Meanwhile, the buyers' jobs are to reduce the price, while the seller's job is to keep the price high. You better have your ducks in order, not make outrageous claims, and don't have a drop in sales!

"It's brutal."

-

1:16:00 - Don't "Over-SKU" - Brands doing too much can't get sold

Mike R reiterates what he just learned, realizing that a brand that's everywhere and doing everything has no room for growth, and thus, no reason to be bought!

Mike confirms, and talks about brand that "over-SKU" because it's exciting -- you get to "formulate". One differentiation, he makes, is Nutrabolt, who's king with C4 during this period. They can afford to test new SKUs in different markets.

"I will never understand somebody who's like 15th in everything or 15th with their best SKU and 75th with everything else and the next thing you hear, they're going to make a greens product or something -- it's so stupid."

Very few people have an entire cabinet of everything from one brand. Optimum Nutrition sold more protein than anyone, and couldn't sell a pre-workout if their lives depended on it!

The effort it takes to go from 15th best-selling pre-workout to 10th best-selling pre-workout isn't sexy or fun, but it's what actually moves the needle.

The only reason Mike ever made other SKUs was for the International market (required pre-pay) and personal projects (Flexatril).

-

1:20:15 - Mike sees the deals, tons of brands are crushing it

We don't see everything going on -- but Mike often does. If someone's trying to get sold, it either crosses his desk or Mike Hockenberry's. And there are a lot of brands who are crushing it, that you've possibly never heard of, because they stay in their lane.

These are capable of being sold, because they can be combined with other strategies.

At the same time, not every brand needs to be sold. You can try to run this for life and take profits and pay yourself handsomly. But if you're trying to get sold, there are things you have to do.

-

1:22:30 - The dumb rule of private equity

If getting private equity involved, whatever they invest, they're going to want somewhere around a 3X multiple of that within five years. You need to provide a plan on how you're going to do that.

-

1:24:00 - Mike's Post-Scivation Project: The McCandless Collection

After selling Scivation, Mike went and restored his dad's old race cars -- Herb McCandless was a legendary American Pro Stock drag racer. They have a car museum named the McCandless Collection in Burlington, NC. They have a blast going to shows and events and showing his old cars. Also see their McCandless Antique Auto YouTube Videos.

They run the Collection as a non-profit and help with a nearby community college.

After that, Mike started an auction company selling old advertising signs. He's the type that will always be working on something.

-

1:25:30 - What's Next for Mike?

Mike's also been part of a few other businesses that sold in the past few years, but is now free and clear of everything and has no non-competes in the industry. Typically those non-competes are going to be at least 2 years, they've also been out to 5 years. Some categories could be exempt (like Mike's keto companies were carved out).

However, he's "too old" for another startup. He'd rather consult owner-to-owner or founder-to-founder, helping good people get sold. Mike R argues that he still has one more big go at it - he's not that old!

After selling to Nutrabolt, who didn't need him to do much, Mike still went on a scheduled trip to China to talk to his vendors face-to-face and tell him the news. He highly believes in face-to-face. That transitions us to the next fun part...

-

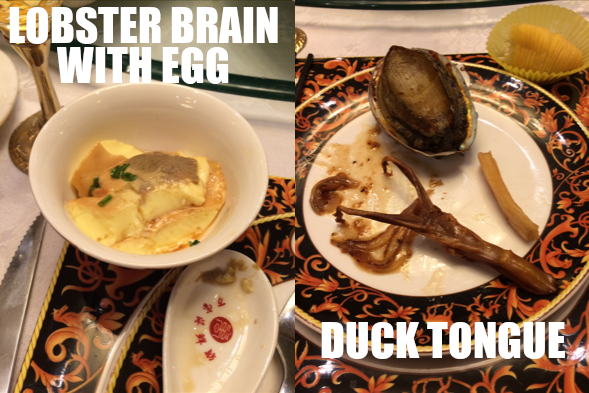

1:29:15 - Mike's China Stories, Mike and Ben's 2016 Forum Interaction

Mike R comments that Mike's posted some while stuff of the foods he was served in China.

But first, he goes into a drinking story with Matt Titlow of Compound Solutions, who joined him on a trip and saw Mike's drinking "superpowers", as he outsmarted a supplier who was attempting to get him drunk before negotiations.

The point is, it's a rite of passage, and Mike believes you follow their traditions in their country.

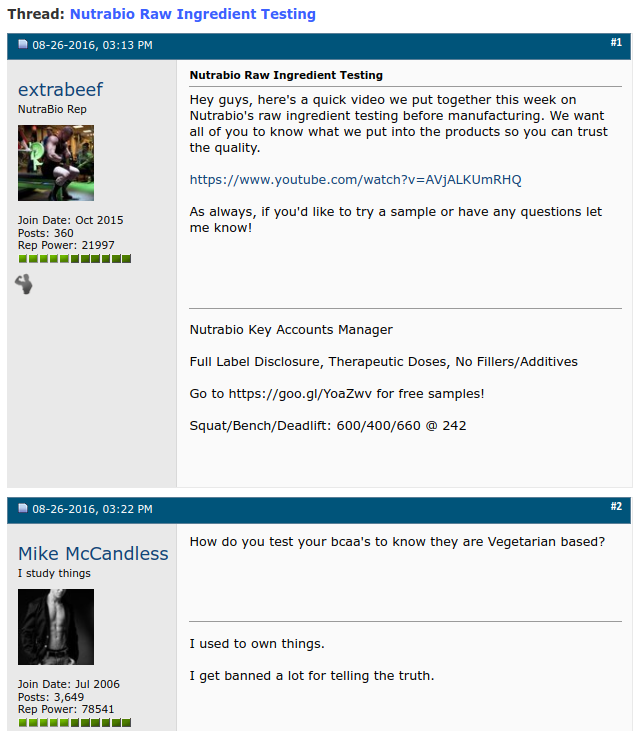

This then brings us to Ben's story with Mike from 2016, when he was working with NutraBio and claimed they had vegan BCAAs. Mike asked, "How do you test your BCAAs to know they are vegetarian based", knowing that there was no test for it![5]

Mike then explains these trips to China. You'd meet potential suppliers at SupplySide West, they'd show pictures of pristine facilities, and say they could supply Xtend. Mike knew that basically only two suppliers could really supply him, but he went on the trips anyway.

A pictures Mike took at a factory that failed inspection, to say the least. These trips to China were incredibly necessary when doing the amount of business he was.

He then tells a story of scammers who were renting out a manufacturing facility that wasn't even theirs, and a story about a factory that just had abysmal conditions. Point being, you need to vet this stuff out if you're serious about this.

Mike's secret was to check their water treatment -- this was generally the source of heavy metal contamination, so it'd be an important thing to test.

All in all, Mike would be fine if he never had to go back, but it was a great experience.

-

1:36:30 - Any lessons from the sales of the keto brands?

Mike R asks if there's anything to learn about the keto brand sales. Ketologic and FBomb were different because they were spending a ton of cash in order to grow, running at a high burn rate. In January 2020, they were ready to sell to a publicly-held company, not knowing what lay beyond in the coming weeks and months.

They had been spending money on national advertising, had Tim Tebow, demand was up, every major retailer wanted their products. He set a ton of products in inventory, because stores like CVS, Target, and Walgreens want you to always stay in stock, so you need to cover not just their stock, but also their backstock and more stock in your inventory (as well as have some on order).

With that much cash tied up in inventory, what's not ideal is to have the entire world shut down at that point. Especially when your product is shelf-dated.

"I'll do a bunch more deals in time and that that experience at the front line is invaluable -- you can't teach it in a book. I've never done a business class I don't really read the business books and all those types of things.

My belief is if I walk into a room of people who have gone to the right schools and done all that stuff, I know their playbook and they don't know mine. Because it's usually a bit of chaos. That's what I use to my advantage -- the unpredictability.

But you got to have competent unpredictability."

-

1:42:30 - Being out of Sports Nutrition: Mike's Soul Cleanse

After a hiatus when Ben asks a "private question", the guys return talking about Ghost Lifestyle, which is indeed a brand. Mike has funded a bunch of cancer studies, and the weight one takes on when someone has cancer is far beyond anything we deal with in sports nutrition.

Mike tells a funny story about returning the Olympia a year after he sold Scivation, and he just turned around and left after smelling the "ProTan and protein farts" and the ex-girlfriends in the industry. This leads us to a fun story about the Arnold.

-

1:44:30 - When Bulk Nutrition Dominated The 2006 Arnold

At the 2006 Arnold, Mike had a truck decked out with Bulk Nutrition, unloaded his stuff, and made tons of chicken for all of the bodybuilders. They could eat it, but they had to pose on stage for 30 seconds. He got tons of shots with bodybuilders with the Bulk Nutrition show.

Then he used to truck to unload everyone else's supplements they didn't want to bring home, and sold an extra $250k worth of gear on his site that he got basically for free, since nobody ended up charging him for the product since they just wanted to go home.

This shows the out-of-the-box, chaotic thinking that is Mike McCandless.

Yet, everyone fits in the system. You need someone who balances the chaos -- for McCandless, it was Mike Hockenberry. The innovator / operator duo.

-

1:46:45 - Is Mike REALLY Too Old? Does he have one more big go at it?

Mike closes by saying that it's not that hard to make money in this industry, but companies make it hard, to the point where it can't be fixed.

"Too old for that shit. I'm like 100 years old in this industry."

Mike R argues that Mike's still got one more big go at it if he wants. But Mike would never compromise his time with his dad. Anything Mike does is more in the consult / board / prep role, helping the right companies get paid.

But Mike can't go 50%.

-

1:49:00 - Mike's biggest mistake post-Scivation

While at Scivation, Mike was forced with "OR" decisions - do this OR that. He could never do both, but overcame the bad decisions through sheer force.

Now, with more financial capabilities, he can do "AND" decisions. And this led to some trouble, since he did too much after selling Scivation. You can't give 20% to a bunch of different things, even with assistance from others. You still only have so much time in the day.

"It took me a year to get involved in way too much, and it took me five years to unwind it.

I try to counsel people on how important the word no is."

-

1:51:45 - Giving back to the Scivation staff

Since Mike had so much equity (outside of the executive team and private equity), he says that he gave a ton of money back to the staff after they sold. He was left with 60-62% equity, and gave huge bonuses.

Mike gets back to a couple more stories on the Nutrabolt sale, where he had to be the crazy one and threaten to blow up the transaction because something wasn't going their way. Because he had so much equity, a million dollars in the deal meant a million dollars to him. He fought tooth and nail for literally everything. He repeats that it's brutal.

Mike then gives us with a suggestion to document the insanity that is a business transaction for someone.

-

1:58:30 - Tears shed. The moment it happens.

Mike closes with his reminiscing of the day the sale occurred -- he, Mike Hockenberry, and their CFO were in the conference room on the call, and it was all approved. It was done. They cried for 10 minutes, there was so much emotion over the past 4 months.

More detailed show notes are coming soon!

Where to Find Mike

Just in case, let's also let you sign up for Mike McCandless news alerts on PricePlow, so you get emailed next time he's mentioned (in a new venture or following podcast):

Subscribe to PricePlow's Newsletter and Mike McCandless Alerts

Thanks to Mike for bringing us your story, and for providing us some incredible tips behind the scenes too! We look forward to your next supplement startup ;)

Until next time, return to the PricePlow Podcast -- please subscribe on your favorite platform and leave a review!

Comments and Discussion (Powered by the PricePlow Forum)