On Episode #187 of the PricePlow Podcast, we welcome Richard Foster (founder of Strom Sports UK) and Dean Harris (president of Strom Sports US) for an in-depth discussion filmed at PLT Health Solutions headquarters in Morristown, New Jersey. Joined by PLT's Steve Fink (who first joined us in Episode #146), this marks the podcast's first deep dive into the UK supplement market and the transatlantic differences in formulation philosophy, regulatory frameworks, and consumer expectations.

Richard Foster (Strom Sports UK founder) and Dean Harris (Strom Sports US president) join Steve Fink at PLT Health Solutions headquarters to discuss international supplement markets, branded ingredient innovation, and why UK health standards often exceed American requirements on Episode #187 of the PricePlow Podcast

Richard brings 19 years of industry experience building Strom from a UK supplement shop into a global brand focused on performance athletes, while Dean shares insights from bringing the brand to American consumers. The conversation explores why UK health products often exceed US standards despite America's more permissive approach to stimulants, how branded ingredients like ApresFlex and CellFlo6 deliver superior results compared to generic alternatives, and why the supplement industry is entering its "golden age" of science-backed innovation.

Whether you're interested in international market dynamics, ingredient science, or the future of supplement formulation, this episode delivers valuable insights from both sides of the Atlantic.

Subscribe to the PricePlow Podcast on your favorite platform:

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

https://blog.priceplow.com/podcast/strom-sports-plt-health-187

Video: Strom Sports UK/US at PLT Health Solutions - International Supplement Market Insights

Podcast: Play in new window | Download (Duration: 1:41:05 — 111.6MB)

Detailed Show Notes

-

0:00 - Welcome to PLT Health Solutions

The episode opens with introductions at PLT Health Solutions' New Jersey headquarters. Richard Foster introduces himself as owner and founder of Strom UK, sharing his journey from competitive bodybuilder and powerlifter to supplement entrepreneur. Starting 19 years ago as a supplement shop, Strom launched its own product line 11 years ago to fill a gap in the UK market for serious performance athletes. Dean Harris, who runs Strom US, brings a legal background and six months of experience building the American side of the brand.

The UK market looks to America for innovation and trends but maintains a refreshingly honest approach to the realities of enhanced athletics. UK consumers have earned a reputation for being hardcore, particularly in bodybuilding (a legacy still riding on Dorian Yates' success 30 years later). However, the UK lags behind the US in flavoring technology and marketing sophistication.

Steve Fink from PLT Health welcomes everyone and sets the stage for discussing innovation, ingredients, and industry trends from an international perspective.

-

2:15 - UK vs US: Quality Standards and Distribution Models

Dean addresses a common American misconception: that products must be made in the US to be high quality. UK health standards actually exceed American requirements in many areas. While the US allows more aggressive stimulant formulations, UK regulations demand higher quality control for health-supporting ingredients. This creates an interesting dynamic where US consumers want UK pre-workouts (for aggressive formulas), while international customers seek UK health products.

Distribution models differ significantly between markets. Strom UK operates 80% wholesale and 20% direct-to-consumer, carefully balancing online sales to avoid alienating retail partners. Beast Farm (Richard's brand partnership with strongman Eddie Hall) flips this ratio to 80% direct-to-consumer, which allows for higher-margin ingredients and substantial marketing spend but requires massive customer acquisition investment.

The UK market lacks America's direct-to-consumer dominance. Most sales still flow through distributors and retailers, though social media is gradually changing this landscape.

-

6:40 - Beast Farm: Eddie Hall's Supplement Brand

Richard clarifies his involvement with multiple brands, each targeting different market segments. Beyond Strom, he's a shareholder and formulator for Beast Farm, the supplement brand launched with Eddie Hall. Eddie had used Strom products throughout his career, and when his previous sponsorship deal appeared unfavorable, he approached Richard about creating a credible, properly-formulated celebrity brand.

Beast Farm represents how Richard would build Strom if starting today: slightly more mainstream with simplified formulations but maintaining the same quality standards. Richard also directs Combat Fuel, a straightforward brand aimed at military consumers. Each brand serves distinct audiences without cannibalizing each other's sales.

The Beast Farm partnership works because both parties committed to avoiding garbage celebrity brands. Every product must be credible, properly dosed, and effective.

-

8:30 - The Dinner That Started Everything

The PLT relationship began with what Richard calls a "genuine miscommunication" at Vitafoods Barcelona. Matt Nickerson from CellFlo6 had been promising Richard dinner for months. When Richard replied to an email about dinner plans, it landed in Steve Fink's inbox instead of Matt's. Steve graciously honored the commitment, booking a fancy restaurant for Richard, Eddie Hall's brother, Tariq, and Thomas from Strom New Zealand.

PLT Health Solutions has teamed up with CellFlo6, a patented green tea extract making waves in the supplement and beverage industries.

At no point had PLT actually offered dinner. Richard simply told them they were taking the group out. The evening proved fortuitous, leading to ongoing collaboration between Strom and PLT Health Solutions on branded ingredients like CellFlo6, ApresFlex, and others.

-

10:00 - ApresFlex: The Joint Health Game-Changer

Richard had been aware of ApresFlex for years but didn't have the right product for it. His Strom Support Max Joint formula sells globally and follows the "if it ain't broke, don't fix it" philosophy. Beast Farm Big Joint became the obvious home for ApresFlex.

Steve Fink explains what makes ApresFlex exceptional: at just 100 milligrams, it provides relief in as little as five days (remarkably fast-acting for a joint ingredient). The recent six-month study demonstrated something even more impressive: visual proof via MRI of actual cartilage regression. This level of clinical evidence is rare in the supplement industry, with very few ingredients showing measurable structural improvements rather than just symptomatic relief.

For general consumers, that immediate feedback matters tremendously. People feel results in 2-5 days and conclude "this is really working," which drives continued use and recommendations. Richard pairs ApresFlex with HydroCurc (water-soluble curcumin) for synergistic benefits, though the 1,000mg Hydro Curc dose in Strom Support Max Joint can cause digestive discomfort in some users.

This drives the reformulation for Beast Farm, which uses 600mg Hydro Curc (still clinically effective but tolerable for a broader demographic). Richard calls this the "parent test": can his mum take it without digestive issues? Not everyone can handle hardcore athlete formulations.

-

15:00 - The Evolution of Informed Consumers

Five to ten years ago, customers walked into stores like GNC and bought whatever the sales associate recommended (often overpriced, under-dosed products). Today's consumers research on ChatGPT, take photos of labels for instant analysis, and understand not just ingredient names but appropriate dosing.

The general wellness market (once ground zero for "absolute trash on trash" formulations) is rapidly improving. Consumers can now walk into Walmart, photograph a label, and know within 10 minutes whether they're wasting their money. This democratization of information is pushing out ineffective products and elevating ingredients like ApresFlex that can clearly explain their benefits.

6-month study shows AprèsFlex delivers MRI-verified cartilage regeneration at just 100mg daily. Not just pain relief -- actual structural improvement. STROM UK's Rick Foster explains why this sets it apart from typical joint supplements.

The hardcore supplement user now expects transparency, while the casual consumer is learning to demand it. More wellness customers are gravitating toward sports brands because sports nutrition generally features better dosing and clearer value propositions.

-

17:00 - UK Novel Food Regulations: The 1997 Rule

UK supplement regulation centers on the Novel Food Act, which establishes a simple principle: anything in the food chain before 1997 is acceptable; anything introduced after must be proven safe through expensive formal processes.

This creates bizarre situations. NMN is on the novel food consultation list and can't legally be sold in UK stores (though it's readily available on Amazon and eBay). When someone tried claiming uridine monophosphate was a novel food because it wasn't consumed before 1997, Richard countered that it's naturally present in brewer's yeast, which definitely existed before 1997. The argument prevailed.

Brexit complicated matters further. The UK's banned substances list still references 2020 EU guidelines, but the approved ingredients list isn't updating in parallel with EU approvals. There's no single authoritative source for what is and isn't legal in the UK.

The approval process costs over £100,000 and benefits everyone once completed. This removes any incentive for individual companies to fund approvals unless they anticipate millions in sales. The situation stifles innovation compared to the US GRAS system, which allows companies to conduct internal safety studies and self-certify.

-

19:30 - The Ashwagandha Controversy

Richard shares the ongoing ashwagandha consultation saga. A Danish study showed negative effects when rats received the equivalent of humans consuming two full bottles of KSM-66 daily for their entire lives. Unsurprisingly, this proved harmful, but there's no human data supporting safety concerns at normal dosing.

In 2022, UK brands were told to immediately stop selling all ashwagandha products based on this rat study. The situation originated in Denmark, spread to Holland, and created panic across the EU. The novel food consultation focused on liver health and thyroid function concerns about upregulation at very large doses in rat models.

MegaNatural-BP grape seed extract backed by 9 clinical trials for blood pressure and metabolic health. California-grown ingredient supports both cardiovascular and insulin pathways at 150-300mg daily.

Richard expects ashwagandha will receive GRAS status, largely because the companies behind KSM-66 have invested heavily in fighting the restrictions. However, this illustrates the precarious position of supplement brands operating under EU/UK regulations. Years of sales can be threatened overnight based on poorly-designed animal studies.

The deeper issue is Western culture's relationship with mood-altering supplements. Taking something every time you feel sad or anxious to make those feelings disappear trains you to view normal human emotions as problems requiring pharmaceutical intervention. This applies to ashwagandha and any adaptogen or mood-supporting compound used chronically to avoid processing emotions.

-

28:00 - Anti-Inflammatories and Clinical Dosing

The discussion shifts to inflammation management and common misconceptions. Inflammation is an important signaling process for recovery that needs to happen to a point, though chronic inflammation is harmful. Taking anti-inflammatories every day because you don't like feeling sore is counterproductive, but targeted use 12 hours post-workout or for specific injuries makes sense. Social media arguments get "turned to 12" for engagement. The reality is that training and nutrition account for 98% of results.

ApresFlex represents something different from acute anti-inflammatories. It's suitable for chronic daily use, especially for anyone over 30, addressing structural issues rather than just masking pain signals.

Richard also pushes back against rigid "clinical dosing" requirements for pump ingredients. Clinical studies dose ingredients in isolation. When you combine five ingredients all designed to enhance endothelial function and improve nitric oxide production, you likely don't need full clinical doses of all five. They're achieving similar effects through complementary mechanisms. This synergy argument wouldn't apply to ingredients with completely different mechanisms, but for pump formulas with multiple NO-boosting compounds, reviewers can be too quick to criticize products for not being "clinically dosed" in every ingredient.

-

31:30 - CellFlo6: From Acquisition to Integration

Richard explains Strom's history with CellFlo6, which they'd been using for three to four years before realizing it came through PLT. They purchased it from a UK distributor, unaware of the connection.

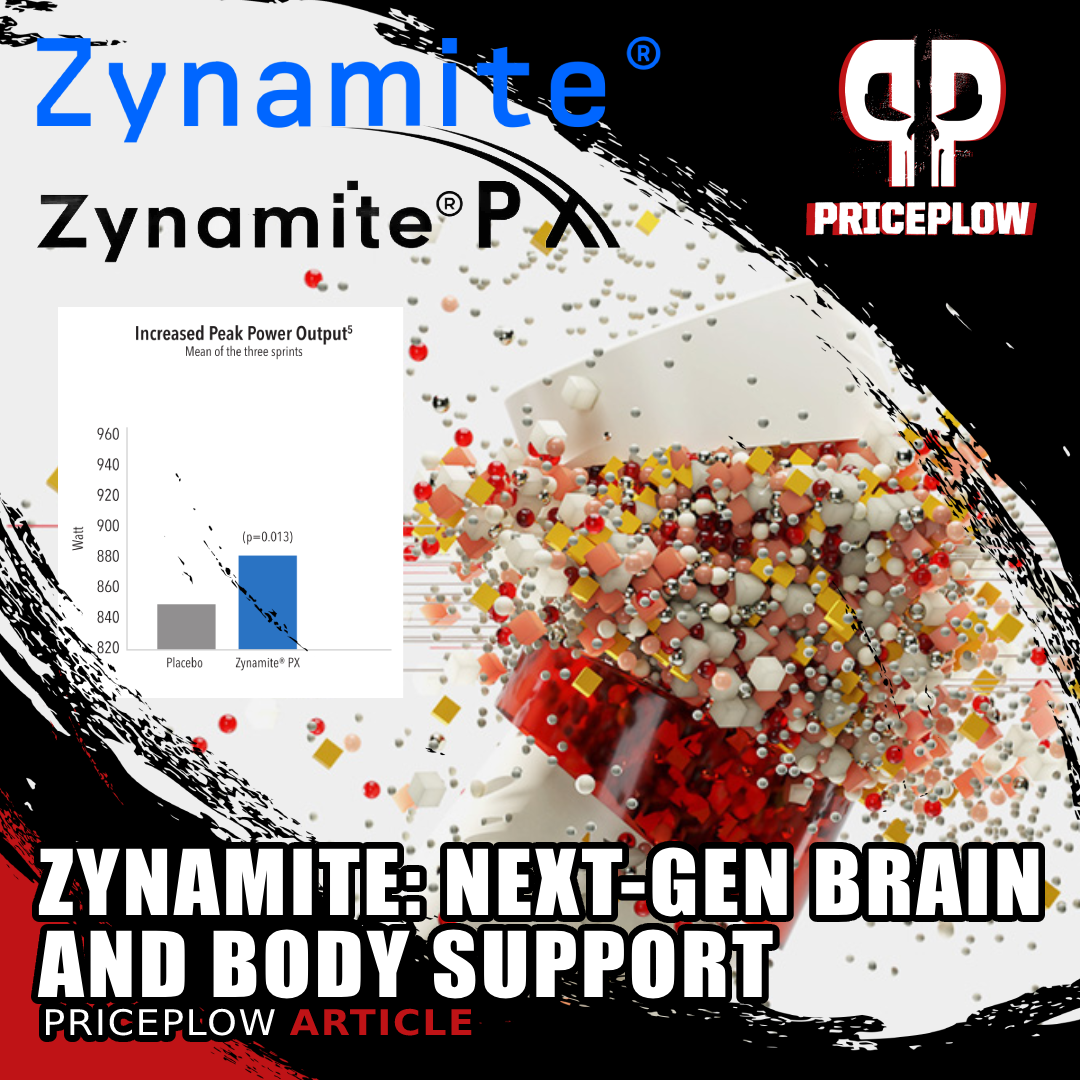

Zynamite is PLT Health's Next-Gen Brain and Body Support Ingredient, harnessing the power of ≥60% mangiferin from mango leaf extract

Steve Fink clarifies that PLT has partners throughout the world and offices in Europe, so regional distribution makes sense. The company doesn't just sell ingredients. They provide comprehensive support from initial concept through clinical design, regulatory navigation, and commercialization strategy.

This "white glove" approach differentiates PLT from ingredient suppliers who simply hand over material and move on. Some ingredient companies make it remarkably difficult to get straightforward answers about dosing, flavoring, mixing characteristics, and ideal applications. PLT's responsiveness (often providing detailed data within 24 hours of a request) makes them invaluable partners.

-

33:45 - Differentiation in a Sea of Branded Ingredients

Richard makes a crucial distinction between legitimate branded ingredients and what he calls "generic ingredients with a label on." He could theoretically buy citrulline, trademark it as "Stromalline," and sell it to brands as something unique. But the ingredient itself offers nothing special beyond branding.

PLT's portfolio stands apart because every ingredient has genuine points of differentiation: unique extraction processes, specific standardizations, extensive clinical validation, or novel applications. Rhodiolife, for instance, sources from specific geographic regions and maintains a phytochemical fingerprint impossible to replicate with cultivation in other areas.

The challenge for consumers is that product labels often can't communicate these differences. Two products might show "1% salidrosides, 3% rosavins" for rhodiola, appearing identical. But the underlying quality, bioactivity, and consistency differ dramatically between a premium branded ingredient and cheap generic material.

PLT's transparency (providing detailed specifications, credible scientific data, and consistent product quality) builds trust with brands and consumers.

-

38:00 - CreaPure and the Branded Ingredient Spectrum

Richard acknowledges that not every ingredient needs to be branded, and he'll happily use generics where appropriate. Someone trying to sell "trademarked citrulline" gets his standard response: "It's just citrulline." His sourcing and secondary testing protocols are robust enough for commodity ingredients.

Mirko Holzmüller and Stefan Schweyer from Creapure reveal the manufacturing secrets behind Germany's 99.99% pure creatine monohydrate and explore creatine's expanding applications beyond sports performance on Episode #173 of the PricePlow Podcast.

However, when a branded ingredient offers proven differentiation, it's worth the investment. CreaPure exemplifies this: they actually conduct secondary purification processing at Alzchem's facility to achieve consistent 99.98% purity (see Episode #173). This isn't just branding. It's a genuine quality specification backed by manufacturing differences.

Dean adds that many American consumers don't understand the value proposition of branded ingredients. Getting them to recognize that science-backed, clinically-validated materials justify premium pricing requires education and transparency, which PLT provides through extensive dossiers and support.

-

40:00 - The Rise of the Informed Consumer

Dean observes a fundamental shift in consumer behavior. Previously, people walked into GNC, got sold whatever the employee recommended, and bought overpriced, under-dosed garbage. Now they're realizing they don't need pharmaceuticals for every issue. Supplements can work, but they want to be informed.

Having actual science and clinical studies makes a tremendous difference. The informed customer base is growing, asking: "Where are your studies? Where's your blood work? Where's your proof?" Companies without substantiation are losing ground.

Richard's experience with Thrombomax (Strom's polycythemia/thick blood formula) illustrates this evolution. He used to use Pycnogenol, but when he couldn't get specifications beyond what generic French maritime pine bark offered, he switched to the generic. If a branded ingredient can't prove its differentiation, why pay the premium?

Conversely, when PLT provides comprehensive data within 24 hours of a request, the value becomes immediately clear.

-

43:45 - Third-Party Testing and the Informed Sport Trap

The conversation addresses growing demand for third-party testing, which Richard views as both positive and sometimes misunderstood. Consumers don't necessarily grasp what different types of testing reveal. Informed Sport certification verifies products don't contain banned substances (crucial for professional athletes). But it doesn't verify efficacy, optimal dosing, or ingredient quality.

Andy Holmes, Business Development Manager for LGC Science's Informed certification programs, comes onto the PricePlow Podcast Episode #162 and discusses the rigorous testing protocols and quality assurance measures that make Informed Sport, Informed Choice, and Informed Protein the global gold standards in supplement certification.

You could create Informed Sport-tested creatine gummies, and the testing would confirm there are no drugs present. But it wouldn't verify there's actually creatine in them. The certification addresses one concern (banned substances) without touching on whether the product works as claimed.

For comprehensive analysis, mass spectrometry testing of finished products becomes expensive and complex. If ingredients have certificates of analysis and manufacturing follows ISO 9001 protocols, there's a point where additional testing is just "double handling data" (verifying that everything that went into the bucket is still in the bucket).

-

46:15 - Beverage Formulation Challenges

Richard shares interest in creating a ready-to-drink creatine beverage for the middle-aged, busy consumer who leaves home in a rush. A Reaction Energy or similar drink with 5 grams of creatine (or even 2.5g to split dosing) would be convenient. The problem? CreaBev (water-stable creatine) degrades by 50% at six months, giving maybe three months of viable shelf life (see Episode #174).

To maintain potency, you'd need to add massive overage, which creates suspension problems and a grainy appearance that turns customers away. Richard challenges Steve Fink to solve this problem, and Steve hints that solutions exist if you think "outside the box."

-

47:50 - CellFlo6 in Peak Max: Bodybuilding Applications

Richard explains why CellFlo6 appears in Peak Max, Strom's pre-show diuretic for bodybuilders. He wanted it in their pump product Stim-Max but followed the "if it ain't broke, don't fix it" philosophy for an established bestseller.

Bodybuilding's central challenge is getting flat after depletion and struggling to achieve fullness and vascularity for stage presentation. CellFlo6 delivers exceptional results when loaded over 2-4 days (though no longer than seven). The mechanism lasts significantly longer than acute pump ingredients. If you load 1-2 grams on Saturday, you'll maintain vascularity through Sunday.

The endothelial function improvements help with nutrient delivery and uptake, supporting the carb-loading process.

There's only one patented, standardized, and clinically-studied kanna extract on the market: Zembrin from PLT Health Solutions.

Dean adds crucial context: "pre-show diuretic" sounds like bodybuilding, but Peak Max has found popularity in powerlifting for water cuts, jiu-jitsu for weight classes, and even casual use for photoshoots. The broad applicability demonstrates how ingredients developed for hardcore applications often benefit general populations.

The formulation provides four capsules per serving (300mg each), with dosing increasing to four servings the day before shows. Men's physique competitors might load for just a day and a half; heavyweight bodybuilders might load for three to four days.

-

52:15 - CellFlo6 for Libido and Cardiovascular Health

Beyond athletic performance, Richard plans to add CellFlo6 to Big Love, Beast Farm's libido support formula (currently being reformulated due to EU regulation changes around Tongkat Ali). He's careful not to market anything as a "test booster" because that's rarely what these products actually do.

If testosterone is actually low, that's a medical problem requiring medical solutions. If testosterone is normal, no supplement will meaningfully increase it. What people actually want from "test boosters" is feeling more masculine, having better libido, and improved sexual function (outcomes that don't require elevated testosterone). CellFlo6's vascular benefits directly address these goals through improved blood flow and endothelial function, making it far more relevant than ingredients marketed on the false promise of testosterone elevation.

-

55:00 - Mega Natural and the Sustainability Question

The conversation shifts to MegaNatural-BP (PLT's grape seed extract ingredient sourced from E.J. Gallo Winery in California). Richard ended up using Envita for Beast Farm's grape seed extract needs due to uncertainty about Mega Natural's EU importation at the time.

He appreciates grape seed extract's impressive long-term cardiovascular data (subtle but sustainable blood pressure effects in ingredients suitable for chronic use). Steve describes recent content filming at Gallo Winery, highlighting their sustainability story: E.J. Gallo and subsidiary Polyphenolics have "ratcheted and bolted on" comprehensive sustainability practices alongside nine clinical studies backing Mega Natural.

When asked if sustainability influences purchasing decisions, Richard delivers a characteristically blunt response: "I couldn't give a single fuck." While some companies build entire brand ethos around sustainability, his customer base cares about product effectiveness first, value for money second, and sustainability a distant third. If all three align, great. But never at the expense of the first two.

MegaNatural-BP is a grape seed extract with 9 clinical studies showing it improves blood flow and athletic performance. California-made and clinically effective at 300mg, it's the perfect pre-workout ingredient for better endurance and cardiovascular health.

Dean observes that sustainability matters more for certain customer segments and that some brands have built successful identities around environmental consciousness. For hardcore sports nutrition consumers, however, efficacy trumps all other considerations.

-

57:15 - Flavor: The Hardcore vs Mainstream Divide

Richard believes flavor importance correlates directly with how hardcore the consumer is. He doesn't care about taste except for intra-workout products. But the further you move toward mainstream consumers, the more absolutely they care about flavor.

He shares the story of Engineered Muscle (owner Riz), who markets products as "hardcore not for the general public, by bodybuilders for bodybuilders." Their pre-workout is called Dog Piss Flavor and their pump product Cat Piss Flavor. Within the hardcore UK market, this deliberately offensive branding has become incredibly popular. People want to be identified as hardcore enough to handle these products. They've since introduced Catalyst, a mildly-dosed electrolyte product with grapefruit extract that serves as an optional flavoring system for "pussies" who can't handle the unflavored versions.

The worst place to be commercially is "moderately efficacious and moderately okay tasting." Neither the hardcore market (wants maximum efficacy regardless of taste) nor the casual market (wants candy-like flavor regardless of efficacy) wants these products.

Despite hardcore products' success, with modern flavoring systems available, there's really no excuse for products tasting bad anymore. The key is following what ingredients naturally taste like. Ketone products need to be very sour, so the lemonade profile works perfectly. Similarly, mango bark extracts should lean into tea-like profiles rather than fighting their natural flavor characteristics.

-

1:03:45 - Nostalgia for the Wild West Era and Current Glory Days

The group discusses legendary pre-workouts like Ultimate Orange (which contained D-Ball, ephedrine, and Tang, mixed in a bathtub) and Jack3D with DMAA. Richard's all-time favorite remains Angel Dust V2 from Blackstone Labs, which featured an angel sprinkling what was clearly meant to represent illicit drugs.

However, Richard's hot take: none of these old pre-workouts were actually that great, and people are "just being really nostalgic." The old products offered drugs but poor ergogenic support. Modern pre-workouts provide better actual performance enhancement through properly-dosed effective ingredients. We're currently in the "glory days" of supplements with unprecedented data, novel ingredients, and clinical backing.

-

1:08:30 - The Collagen Controversy

PLT Health Solutions introduces TestFACTOR, a testosterone-boosting ingredient featuring Mangifera indica and Sphaeranthus indicus. Backed by clinical studies, it enhances testosterone, vitality, and sexual health in middle-aged men, with benefits like improved energy, strength, and quality of life.

When discussing mainstream consumers who would benefit from basic supplementation, Ben mentions millions going to gyms for leisurely exercise. This leads to collagen discussion, and Richard can't resist: "Name a scenario where someone will gain more from having a can of collagen versus a can of whey."

He doesn't have fundamental hatred for collagen but believes people should "just take glycine" if they want to address inadequate connective tissue intake. Glycine has better research backing, it's cheaper, and it's more targeted. Richard cites research showing that hyper-supplementing with collagen post-injury can cause problematic collagen cross-linking and excessive scar tissue. For post-workout recovery in athletes, "you could just have a glass of water and it would do the same."

However, Richard concedes the "mum test": his mum might benefit from collagen. Not every supplement recommendation needs to optimize for competitive athletes.

-

1:11:15 - The EU Caffeine Regulation Dilemma

Richard explains why EU products often use confusing "1 serving/2 serving" labeling: caffeine regulations require 32mg per 100ml of fluid. A 320mg caffeine pre-workout must therefore state that consumers should mix it in a full liter of water. To avoid this, brands label the full dose as "two servings" with each serving under the regulatory threshold.

This isn't because formulators don't understand dosing or are trying to rip people off. It's regulatory compliance. HR Labs' Liam, a smart formulator, labels this way because EU regulations mandate it. American consumers see two-serving pre-workouts and assume companies are being deceptive, not realizing the regulatory constraints.

Richard shares the Bucked Up collaboration where he formulated everything for one scoop, but they made it one-scoop/two-scoop with the single scoop under a certain caffeine threshold specifically to distribute in the UK.

-

1:14:45 - Extended Release Caffeine and zümXR

Steve Fink asks how important it is to deliver energy without the heart rate increase, blood pressure spike, and crash associated with high-dose caffeine. Richard gives "the real answer": just take modafinil and have coffee. For him personally? Not important at all (he'll just take more caffeine).

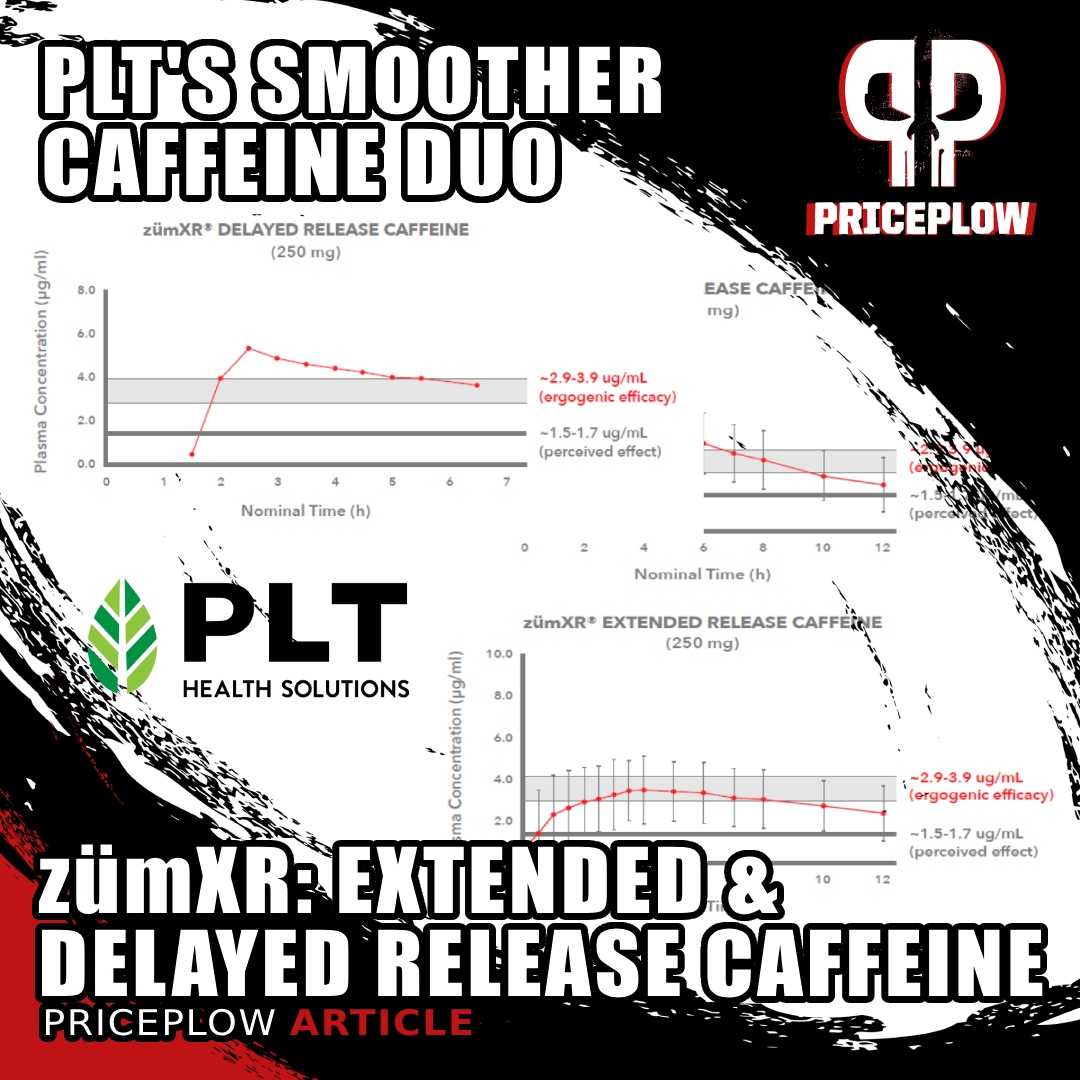

zümXR is pushing the boundaries of caffeine innovation. This advanced system allows for precise customization of the energy curve using their Extended Release (XR) and Delayed Release (DR) forms of caffeine.

But for general public consumers, particularly those sitting at desk jobs for 8-10 hours, this matters tremendously. A sustained energy delivery beats having a cup of coffee every 45 minutes, especially for people whose jobs involve anxiety triggers.

PLT's zümXR offers both extended release and delayed release options. Extended release is familiar (gradual caffeine delivery over time). Delayed release acts like "afterburners," providing a secondary boost hours after the initial dose.

Richard notes that most general public consumers don't even know extended or delayed-release caffeine exists. Their caffeine knowledge extends to coffee, maybe energy drinks, maybe pre-workouts. Education about caffeine delivery mechanisms represents as much opportunity as the technology itself.

-

1:20:00 - zümXR Caffeine and PLT's Nootropics

Richard discusses marketing strategies surrounding zümXR and PLT's nootropic ingredients, considering Zynamite, Zembrin, and Nutricog.

He singles out Nutricog as "one of the best things that you do that no one talks about." Despite being complicated and not experientially obvious (it works over time rather than acutely), Nutricog delivers remarkable results. Good measurable improvements begin at 15 days, but users really start noticing benefits around a month in.

The cognitive battery of improvements is extensive (11x better focus at the studied dose, with benefits across all tested metrics). Richard also commented on the flavor: "It's earthy, it's good."

-

1:23:30 - The Cognitive Health Revolution in the UK

Richard observes a massive shift in UK consumer priorities. People are becoming less interested in supplements that provide drug-like experiences or party enhancement. The wellness and longevity movements dominate, with mitochondrial optimization and biohacking replacing recreational supplementation.

MegaNatural-BP gets third-party sustainability validation. California grape seed extract from GALLO's 90-year stewardship program combines clinical benefits with verified environmental practices.

Men in their 30s aren't going out partying. They're trying to biohack longevity so they can keep doing sports into their 50s and beyond. At Strom's facility, they offer hyperbaric chambers, cryo chambers, ice baths, red light therapy, near infrared, shockwave therapy, and saunas. Surprisingly, the primary users are guys in their 20s and 30s, not the 50s-60s demographic Richard expected.

He finds it "almost disappointing that the next generation are not interested in going out and getting drunk" and engaging in the experiences previous generations embraced. They're interested in long-term health, brain function, and success (a real cultural shift reflecting different values).

Younger generations are experiencing less in general: less sex, fewer kids, less drug use, less alcohol consumption. They're "numbing out" rather than engaging with life experiences, spending more time on phones and in virtual spaces than in actual experiences.

-

1:36:15 - The Death of Present-Moment Experience

The conversation takes a philosophical turn discussing how cell phones have fundamentally changed human experience. Richard's daughter attended her first concert and sent him a video showing a sea of phones rather than people actually watching the performance. "Not a single person was in the room."

They reminisce about concerts where you couldn't share in real time. You had to experience it, then tell people about it later, creating motivation for others to attend future shows. Now everyone films everything, creating a strange dynamic where experiences are documented but not actually lived.

Richard attended Giants Live when Thor pulled the 510kg deadlift and deliberately didn't film it "because everybody filmed it." With thousands of cameras recording, his phone wasn't needed. The shared experience of being present mattered more than capturing personal footage he'd never watch.

No one ever watches their fireworks videos, photos of the Grand Canyon don't capture the actual experience, and dinners now feature four people at a table all on their phones instead of conversing.

For supplement industry professionals, the irony is clear: Richard's eleven-hour daily screen time sounds alarming, but five or ten years ago he probably had three hours of phone screen time and eight hours of laptop screen time. The device changed, not the total.

-

1:38:45 - Where to Find Strom Sports

Richard directs UK customers to stromsports.com and the brand's Instagram, where messages reach him directly. For more personal consultation, customers can book time with him on the website to discuss biohacking, wellness, and optimization (though he admits he "mostly end up just telling people to probably eat real food and don't worry about it too much").

Strom operates in New Zealand (Strom Down Under), Australia (now separate), and Ireland, with each region having specific distribution and regulatory considerations. Australia's capsule regulations make supplements prohibitively expensive without TSA registration, forcing powder-only formulations for that market.

For US customers, Dean handles Strom US at stromsportsus.com, with Instagram at @stromsportsnutritionus. The differentiation between regions reflects both regulatory requirements and market preferences, with each territory having specific product needs.

Richard emphasizes his love for America and hopes to retire there someday. It was important that Strom US be run by an American and generate money in America rather than being a UK export operation.

Where to Follow Strom Sports and PLT Health Solutions

PLT Health Solutions: Growth Through Innovation

- Strom Sports UK: stromsports.com

- Strom Sports US: stromsportsus.com

- Strom Sports US Instagram: @stromsportsnutritionus

- Richard Foster on LinkedIn: Richard Foster

- PLT Health Solutions: plthealth.com

- PLT Health Solutions on LinkedIn: @plthealth

- PLT Health Solutions news on PricePlow: https://www.priceplow.com/plt-health#news

Thanks to Richard, Dean, and Steve for this fascinating international perspective on supplement formulation, ingredient innovation, and market dynamics! Read our recent coverage: Beyond Pain Relief: Why This UK Supplement Brand Chose ApresFlex.

Subscribe to the PricePlow Podcast on any platform, sign up for PLT Health Solutions news alerts on PricePlow, and leave us a great review on iTunes and Spotify!

Comments and Discussion (Powered by the PricePlow Forum)