Last week, we learned that GNC was closing 200 stores in 2018 per their Q1-2018 quarterly earnings report... and it looks like they're not the only "industry giant" getting crushed at the hands of the 'death star' and changing retail business climate:

Bodybuilding.com Drops 91MM to 66MM Revenue Year over Year

Liberty Expedia (formerly known as Liberty Media) reported in their Q1-2018 report that revenues at former industry powerhouse Bodybuilding.com have dropped $25 million, from 91MM to 66MM. This represents a 27.5% annual decline.

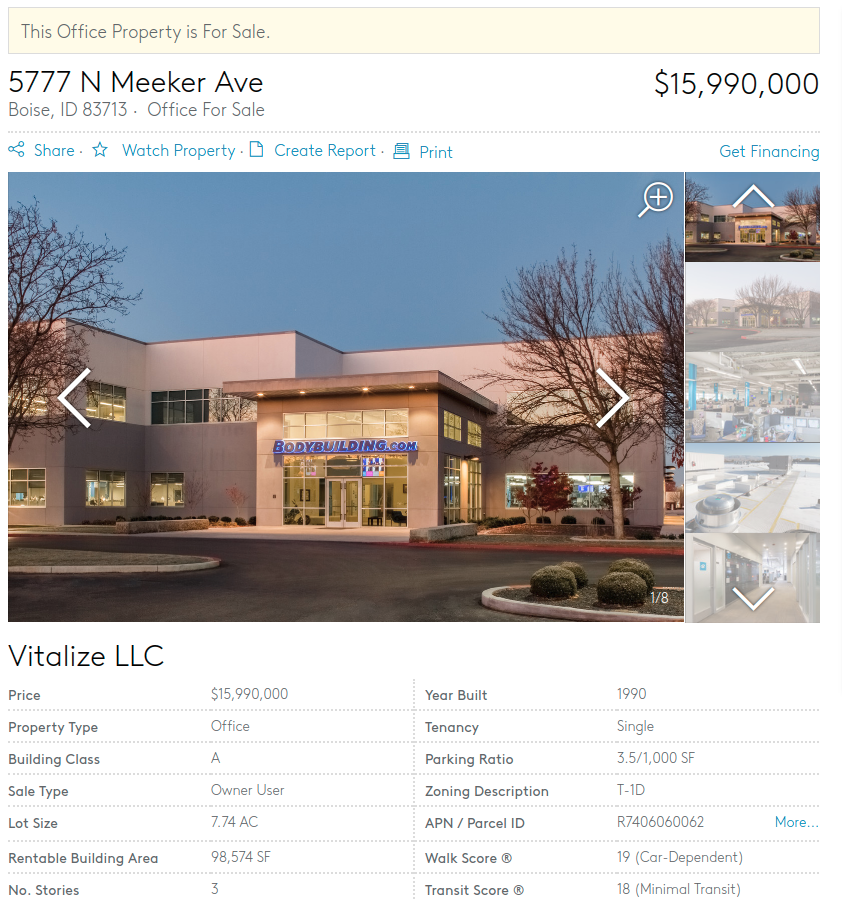

It gets worse than that: their office space is for sale!

Even sadder is this real estate listing, showing that their 98,574 square foot facility is now for sale for a whopping $15.99 million!

This marks an extraordinarily sad time, as it's clear the ongoing layoffs at Bodybuilding.com will likely continue.

The world is moving away from Bodybuilding.com

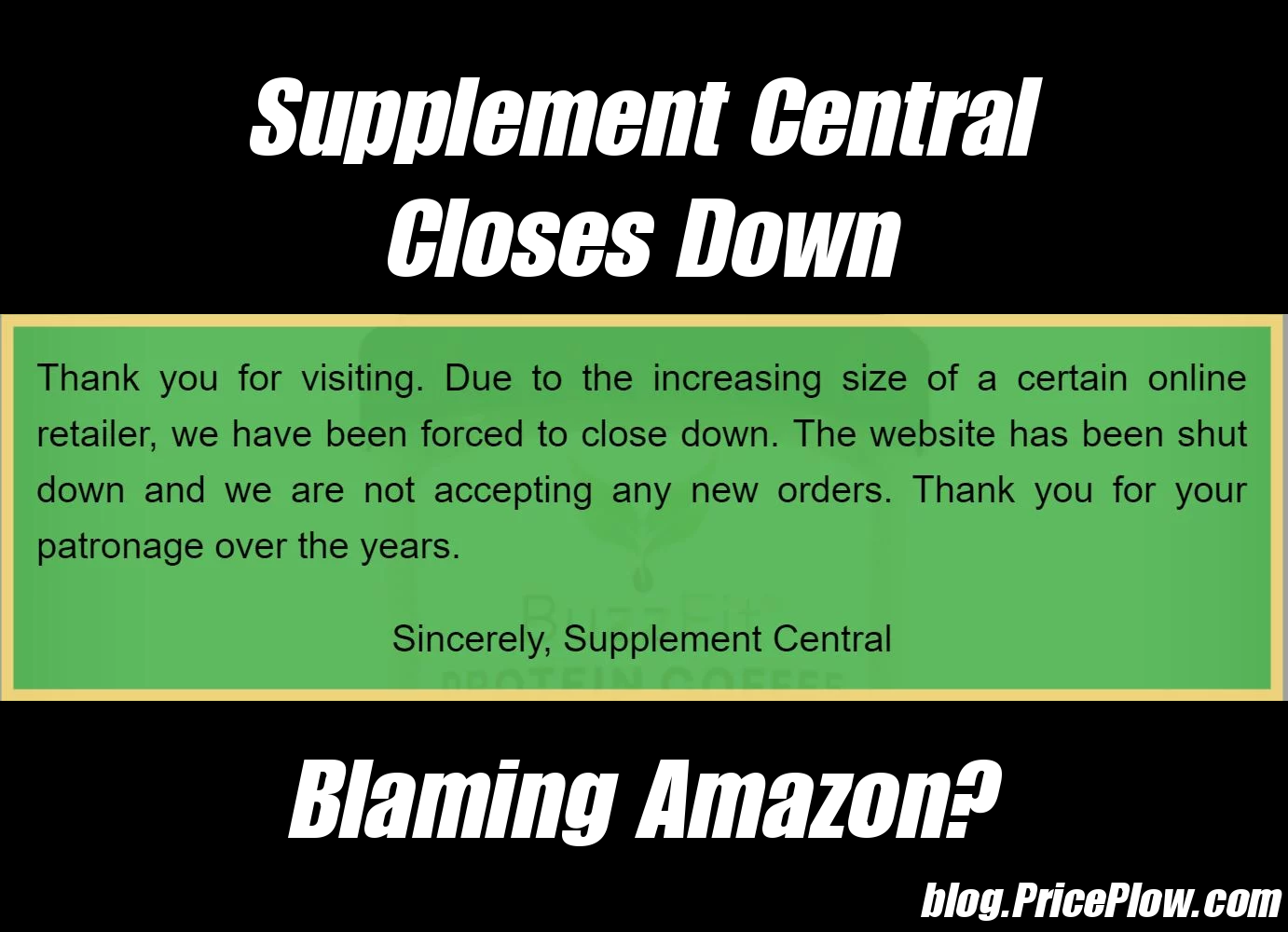

This follows the obvious trend towards the 1-2 punch of Amazon and Direct-to-Consumer business models, which have been leaving many specialty retailers out to dry, as discussed in the recent closing of Supplement Central (see the Facebook link in the comments for an incredible discussion on that).

Meanwhile, influencer marketing has changed everything, and while Bodybuilding.com was obviously all over that with JYM / Jim Stoppani, that fell apart and they weren't able to re-capitalize on the model again.

Their reliance on BOGOs between 2013-2016 absolutely crushed them, as people were buying the BOGOs then re-selling on Amazon for a discount once the price was back to normal on Bodybuilding. Customers were also "pantry loading", which made for less frequent purchases.

What BodySpace Could Have Been...

Supplement Central also recently closed, possibly blaming Amazon. See the comments for a link to an EPIC Facebook discussion.

Sadly, there's just been too many misses for the company, and there just doesn't seem like a recovery in sight. Bodybuilding.com missed a major opportunity to be a niche-based social media with BodySpace, instead laying down and letting fitness users move to social media over the last decade.

All in all, the lack of vision into the future (and perfectly-timed exit by Ryan Deluca) has left Liberty Expedia holding a bag that we don't expect them to hold on to much longer - and the real estate listing proves that.

Best wishes to those who have lost their jobs, we hope you find solid footing fast.

Comments and Discussion (Powered by the PricePlow Forum)