On Episode #172 of the PricePlow Podcast, recorded at the 2025 GNC Global Conference, Mike and Ben sit down with Eric Morato of Sports Nutrition Distributors (SND) and Jack Sehgal of Nutralabz to explore the complex world of Latin American supplement distribution. This conversation provides an insider's look at one of the most promising yet challenging international markets for supplement brands.

Eric Marato from SND (Sports Nutrition Distributors) and Jack Sehgal from Nutralabz discuss the complexities of Latin American supplement distribution, regulatory challenges, and how Basic Supplements successfully expanded into 17 countries on Episode #172 of the PricePlow Podcast.

Eric, with over 15 years of experience in Latin American distribution, shares the realities of expanding into a region comprising 32 different countries, each with unique regulatory requirements, cultural preferences, and market dynamics. From his Miami-based operation, SND has become the bridge between American supplement brands and Latin American consumers, representing major names like Glanbia, Iovate, Dymatize, and Premier Protein. The discussion reveals how Basic Supplements has successfully entered 17 Latin American countries through SND's expertise, demonstrating the power of strategic international partnerships.

This episode builds on our previous conversations with Jack, including Episode #156 with Marc Curcio on Basic Supplements' founding and Episode #160 with Chuck Zhang on Chinese markets, providing a comprehensive view of international supplement distribution strategies.

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

https://blog.priceplow.com/podcast/latin-america-supplements-snd-172

Video: Latin American Distribution Strategies with SND and Nutralabz

Podcast: Play in new window | Download (Duration: 34:03 — 33.3MB)

Detailed Show Notes: Breaking Into Latin American Markets

-

0:00 - Introductions: Meeting the Latin America Expert

Mike opens Episode #172 from the 2025 GNC Global Conference, introducing Eric Morato from Sports Nutrition Distributors (SND) and welcoming back Jack Sehgal from Nutralabz. This conversation serves as a natural follow-up to Episode #160, where we explored Chinese markets with Chuck Zhang, now shifting focus to Latin America's unique distribution challenges and opportunities.

Eric shares his impressive background, having started in the supplement industry at age 18 in 2010 and witnessing the evolution of international markets over 15 years. His Miami-based company, SND, has become a major player in Latin American distribution, representing established brands like Glanbia Nutritionals, Iovate, Dymatize, and Premier Protein. The geographical positioning in South Florida provides strategic advantages for serving the 32 countries that comprise the Latin American market.

Mike establishes the context by referencing our previous conversations with Jack, noting how Basic Supplements has rapidly expanded internationally through partnerships like the one with SND. This represents a significant shift from the brand's domestic focus we discussed in Episode #156 with Marc Curcio, demonstrating how strategic international partnerships can accelerate global growth.

-

2:15 - The Registration Challenge: Why Ingredients Matter First

Eric explains that the first step in Latin American expansion isn't marketing or pricing strategy—it's examining product labels and ingredients. This regulatory-first approach distinguishes successful international expansion from domestic launches, where brands can focus primarily on consumer appeal and competitive positioning.

The complexity stems from each country maintaining its own regulatory framework, similar to how the United States has the FDA. Many ingredients commonly used in American supplements haven't been approved in Latin American countries, creating immediate barriers to entry. Some compounds are completely banned, while others face strict dosage limitations that may render formulations ineffective or require complete reformulation.

This regulatory landscape explains why SND has built relationships with regulatory authorities across 32 countries over 15 years. The company maintains direct communication channels with government agencies responsible for supplement approval, understanding the specific requirements and timelines for each market. This infrastructure allows brands to navigate the registration process efficiently rather than attempting to build these relationships independently.

Ben adds context about the differences between countries, noting that what's legal in one Latin American country may be prohibited in another. This fragmented regulatory environment requires expertise that most American brands lack, making specialized distributors like SND essential for successful expansion.

-

4:15 - The SND Advantage: Established Relationships and Legal Compliance

Jack Sehgal & Ben Benedict discuss Nutralabz' brand house strategy, Basic Supplements & GR8 Lifestyle success in Episode #169 of the PricePlow Podcast

Eric emphasizes that SND exclusively operates through legal channels, avoiding the temptation to circumvent regulations through unofficial importation methods. This commitment to legal compliance has built trust with both regulatory authorities and retail partners, creating sustainable distribution channels that support long-term brand growth rather than short-term gains.

The company's approach involves working directly with each country's regulatory equivalent of the FDA, ensuring proper documentation and approval processes. This legal foundation enables brands to build legitimate market presence rather than operating in regulatory gray areas that could result in product seizures or legal complications.

Jack adds that this regulatory expertise was crucial in Basic Supplements' decision to partner with SND. Rather than attempting to navigate 32 different regulatory frameworks independently, the partnership allows Basic to leverage SND's established relationships and proven processes. This strategic approach enables faster market entry while maintaining full legal compliance.

The discussion reveals how regulatory compliance affects product development timelines. Registration processes can take up to two years in some countries, requiring brands to commit to markets and formulations well in advance of launch. This extended timeline emphasizes the importance of working with experienced distributors who understand the regulatory landscape and can guide strategic decisions.

-

6:15 - Manufacturing and Quality: The American Advantage

Basic Supplements has launched their first supplement, Basic Whey, and beyond some fun new flavors, they're doing things different by disclosing the Glanbia proteins used inside, where their products are manufactured (Nutrablend Foods in Buffalo, NY), and showing the total protein percentage by weight on the front of each tub!

The conversation shifts to manufacturing considerations, revealing that "Made in the USA" remains a significant competitive advantage in Latin American markets. Eric explains that consumers in these markets actively seek American-manufactured products, viewing them as higher quality and more trustworthy than local alternatives.

This preference for American manufacturing creates opportunities for brands like Basic Supplements, which can compete effectively with locally-manufactured products on price while maintaining quality advantages. Colombian distributors specifically cited Basic's American manufacturing as a key factor in their decision to carry the brand, enabling competition with local products while commanding premium positioning.

Jack notes that this quality perception isn't just marketing—American manufacturing standards genuinely differ from those in many Latin American countries. The combination of regulatory oversight, manufacturing processes, and quality control systems creates products that often exceed what's available through local production. This quality differential justifies premium pricing and builds consumer loyalty.

However, the manufacturing location also adds complexity to distribution. Shipping costs, import duties, and logistics challenges must be factored into pricing strategies. The key is finding the balance between American quality advantages and price sensitivity in markets where average monthly wages may be as low as $500.

-

8:00 - Price Sensitivity and Market Dynamics

Eric provides crucial context about Latin American consumer economics, noting that minimum wages in many countries average around $500 per month. This economic reality makes a $100 protein tub represent a significant portion of a family's monthly income, requiring creative approaches to product positioning and packaging.

GNC CEO Michael Costello shares his journey from volleyball-playing creatine customer in the 1990s to leading America's most iconic supplement retailer with a renewed consumer-first focus on Episode #170 of the PricePlow Podcast.

The solution involves developing products that serve different market segments within each country. SND works with brands to create individual stick packs and smaller serving sizes that make premium products accessible to broader consumer bases. This approach, inspired by successful consumer goods companies like Unilever that sell single-use sachets in developing markets, allows brands to serve both premium and mass-market segments.

Jack explains how this pricing sensitivity influenced Basic Supplements' international strategy. The brand's "daily driver" philosophy—providing high-quality, essential supplements at affordable prices—translates well to Latin American markets where value and accessibility are paramount. The simplified formulations and transparent pricing align with consumer needs for effective products that don't strain household budgets.

This economic reality also affects product mix strategies. While protein powders and pre-workouts remain popular, hydration products and single-serving formats often perform better due to lower price points and immediate consumption benefits. Understanding these economic dynamics is essential for brands developing Latin American market strategies.

-

10:00 - Brand Prestige and Consumer Psychology

Eric reveals an interesting dynamic in Latin American supplement consumption: consumers actively seek prestigious American brands, similar to how luxury goods operate in developed markets. This phenomenon creates opportunities for established American brands while requiring newer brands to invest in education and market development.

The prestige factor means that brands like Glanbia and Dymatize, which may have lost some prominence in American markets, maintain strong positions in Latin America. This brand recognition provides immediate market credibility and reduces the education required for consumer acceptance. However, it also means that newer brands must work harder to establish credibility and market presence.

Jack notes that this prestige dynamic influenced Basic Supplements' international branding strategy. Rather than developing separate international brands, the company maintained American branding and packaging while adapting to local regulatory requirements. This approach leverages the "Made in USA" advantage while maintaining brand consistency across markets.

The discussion reveals how brand building in Latin America requires patience and long-term investment. Unlike domestic markets where social media can rapidly build brand awareness, Latin American success requires sustained presence, relationship building, and consistent market investment. This timeline reinforces the importance of working with experienced distributors who can provide market continuity.

-

12:00 - The Loyalty Factor and Long-Term Partnerships

Eric emphasizes a crucial difference between Latin American and North American business cultures: the loyalty factor. In Latin America, business relationships are viewed as long-term partnerships requiring mutual investment and commitment. This cultural difference affects how brands should approach international expansion strategies.

GR8 Lifestyle Supplements launched May 8 exclusively at GNC! Each product contains exactly 8 carefully selected ingredients for cellular health, sustainable energy, and overall wellness.

The loyalty expectation means that brands cannot simply enter markets opportunistically, seeking quick returns without sustained commitment. Latin American partners expect brands to invest in market development, education, and relationship building over multiple years. This investment includes not just financial commitments but also time, attention, and genuine engagement with local market dynamics.

Jack adds that this partnership mentality has influenced Nutralabz' international strategy. Rather than treating distributors as transactional relationships, the company invests in partnership development, including travel to markets, face-to-face meetings, and collaborative product development. This approach builds stronger relationships and more sustainable market positions.

The conversation reveals how several American brands have damaged their reputation by entering Latin American markets without proper commitment, then withdrawing when immediate results didn't materialize. This pattern has created opportunities for brands like Basic that understand the importance of long-term partnership development and sustained market investment.

-

14:15 - WhatsApp Commerce and Digital Distribution

An fascinating aspect of Latin American commerce emerges as Eric explains how "online sales" in the region often means WhatsApp rather than traditional e-commerce websites. This represents a fundamentally different approach to digital commerce, requiring brands to understand communication-based selling rather than automated online transactions.

WhatsApp Business has become the primary platform for B2B communication and sales in Latin America, with distributors maintaining contact lists of hundreds of retailers and communicating promotions, inventory updates, and product information through the platform. This direct communication model enables rapid response times and personal relationships that traditional e-commerce cannot replicate.

The WhatsApp commerce model also extends to consumer sales, with many retailers using the platform to communicate with end customers. This creates a more personal shopping experience but requires different marketing approaches and customer service strategies. Brands must understand that success in Latin America often depends on relationship-building rather than automated sales processes.

Jack notes that this communication preference has influenced Basic Supplements' international marketing strategy. Rather than relying solely on traditional digital marketing, the brand invests in content and materials that can be easily shared through WhatsApp and other communication platforms. This approach leverages the personal communication preferences that drive Latin American commerce.

-

16:00 - Educational Investment and Market Development

Eric describes SND's educational approach, including the development of "Basic University" and "GR8 University" programs that provide comprehensive training for distributors and retailers. These educational initiatives demonstrate the level of investment required for successful Latin American market development.

The educational programs serve multiple purposes: they provide product knowledge for retail staff, build brand credibility through scientific backing, and create deeper relationships with distribution partners. When a distributor operates over 100 stores across a country, training their staff effectively requires systematic educational programs rather than ad-hoc communication.

These educational initiatives also address the knowledge gap that exists between American supplement innovation and Latin American market awareness. Many ingredients and formulation approaches that are well-known in American markets require explanation and education in Latin American contexts. This educational investment builds market foundation for long-term success.

Jack emphasizes that this educational commitment differentiates successful international partnerships from transactional relationships. Brands that invest in distributor education and consumer awareness building achieve better market penetration and more sustainable growth than those focused solely on immediate sales results.

-

17:30 - Flavor Adaptation and Cultural Preferences

Looking beyond basic collagen supplements? GR8 Lifestyle REJUVEN8 combines 10g premium collagen with creatine, CoQ10, and more for comprehensive cellular health support. Your skin, joints, and energy levels will thank you!

The conversation explores how flavor preferences vary significantly across Latin American countries, requiring localized product development strategies. Eric explains that chocolate, while popular globally, actually ranks behind vanilla in Colombia, and that Colombian consumers prefer less sweet vanilla flavors than American markets.

This localization extends to region-specific flavors like churros and tres leches, which resonate strongly in Mexican markets but may not translate to other Latin American countries. The challenge involves developing flavors that serve large enough markets to justify production costs while maintaining local appeal and cultural relevance.

Basic Supplements has embraced this localization challenge by working directly with distributors to develop and test region-specific flavors. This collaborative approach ensures that new flavors meet local taste preferences while maintaining the brand's quality standards. The process involves sending samples to distributors for consumer testing before committing to full production runs.

Jack notes that this flavor development process demonstrates the manufacturing flexibility that enables successful international expansion. The ability to develop custom flavors for specific markets while maintaining core formulation integrity provides competitive advantages that purely domestic brands cannot match.

-

19:00 - Partnership Execution and Market Support

Eric emphasizes that SND functions as an extension of the brands they represent, taking responsibility for market execution rather than simply facilitating transactions. This approach includes developing marketing materials, organizing educational seminars, creating promotional products, and managing all aspects of market development.

The partnership model allows American brands to focus on domestic growth while ensuring professional international market development. SND handles everything from regulatory compliance to retail relationships to consumer education, providing comprehensive market support that would be difficult for brands to develop independently.

This execution capability extends to practical marketing support, including developing locally-relevant marketing materials, organizing trade shows, and managing social media presence in Spanish. The goal is to maintain brand consistency while ensuring local market relevance and cultural appropriateness.

Jack adds that this comprehensive support model has been crucial for Basic Supplements' rapid international expansion. Rather than attempting to build international capabilities internally, the partnership allows the brand to leverage SND's established infrastructure and expertise while maintaining focus on core business development.

-

21:00 - Labeling and Brand Presentation

The discussion reveals interesting dynamics around product labeling and brand presentation in Latin American markets. While regulatory requirements may mandate local language information, consumers actually prefer to maintain English branding elements that emphasize the product's American origin.

Products like "Basic Whey Protein Isolate" maintain their English names because consumers associate these terms with quality and authenticity. The challenge involves balancing regulatory compliance with consumer preferences for American branding, often resulting in bilingual labeling that satisfies both requirements.

This labeling preference reflects the broader consumer psychology that values American supplement brands. Rather than localizing brands completely, successful products maintain clear American identity while providing necessary local language information for regulatory compliance and consumer understanding.

The conversation also touches on the importance of maintaining visual brand consistency across markets. Consumers in Latin America often research products online before purchasing, and consistent branding across American and international markets builds confidence and trust in product authenticity.

-

23:00 - International Market Visits and Relationship Building

Eric describes the importance of face-to-face relationship building in Latin American markets, noting that SND travels to partner countries once or twice per month. This travel commitment demonstrates the personal relationship requirements that distinguish Latin American business culture from more transactional American approaches.

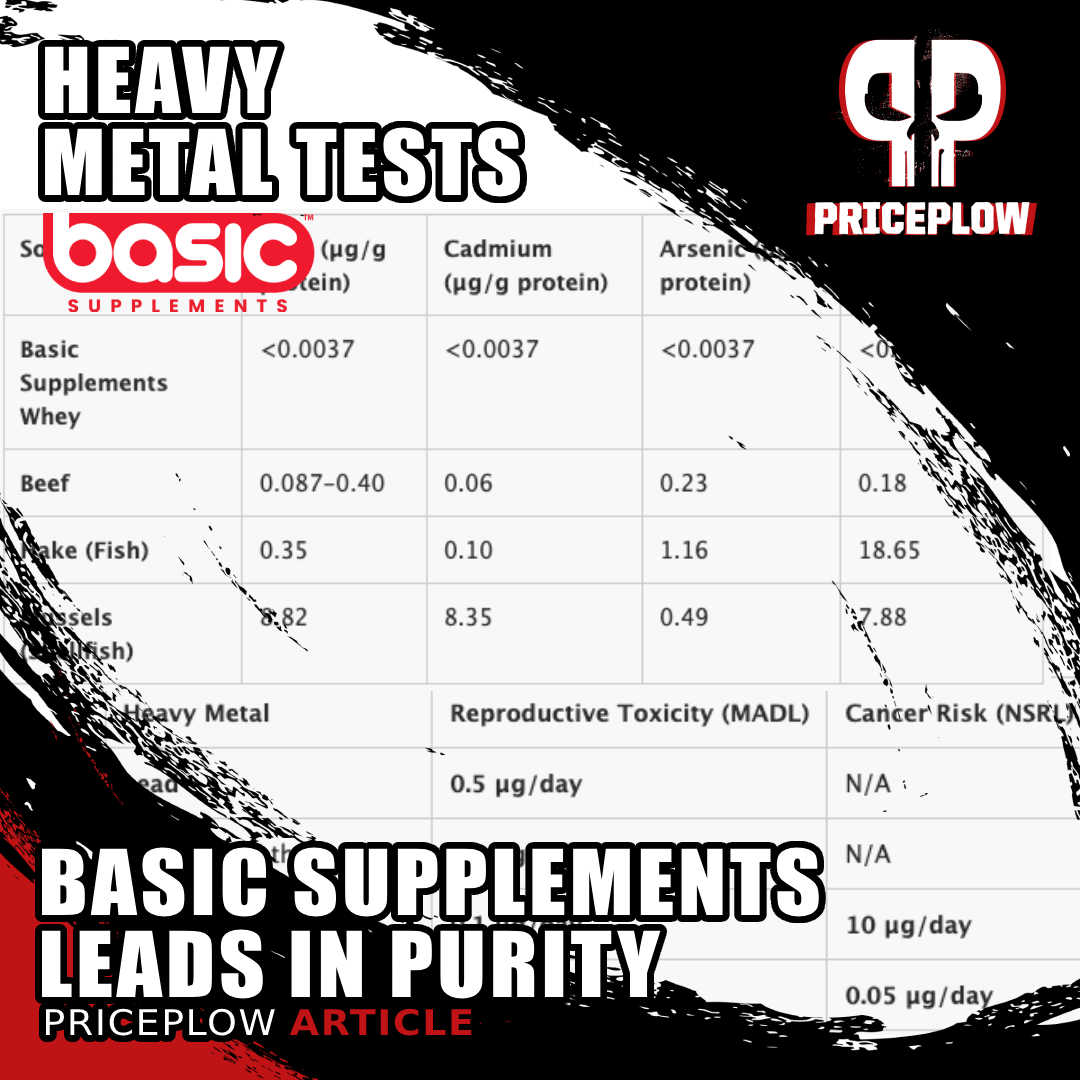

Basic Supplements shares heavy metals test results showing their whey protein has significantly lower levels than meat and fish. See the data on how their rigorous testing and quality control sets new standards for supplement safety.

When American brand representatives visit Latin American markets, it creates significant impact beyond what can be achieved through remote communication. These visits demonstrate commitment to the market and build personal relationships that translate into stronger business partnerships and market support.

Jack shares his experience visiting Colombian markets, noting how these trips provide insights into local consumer behavior, retail environments, and market dynamics that cannot be understood through remote communication. These insights inform product development, marketing strategies, and distribution approaches.

The travel investment also provides opportunities for direct feedback from consumers and retailers, enabling brands to adapt strategies based on real market conditions rather than assumptions. This direct market engagement builds stronger partnerships and more effective market strategies.

-

24:00 - Digital Commerce and Technology Adoption

The conversation explores how digital commerce operates differently in Latin American markets, where WhatsApp Business serves as the primary platform for B2B transactions. This represents a simpler but more relationship-focused approach to digital commerce than traditional e-commerce platforms.

Distributors maintain WhatsApp contact lists of hundreds of retailers, sending product promotions, inventory updates, and pricing information through the platform. This direct communication model enables rapid response times and personal service that automated e-commerce cannot provide.

The technology adoption patterns reflect broader market characteristics, where personal relationships and direct communication are valued over automated transactions. This preference affects how brands should approach digital marketing and customer service in Latin American markets.

While traditional e-commerce channels exist, they often serve different market segments than WhatsApp commerce. Understanding these different channels and their appropriate applications is crucial for developing effective Latin American market strategies.

-

25:00 - Wellness Trends and Market Evolution

Eric provides insights into current Latin American supplement trends, noting a shift from pure bodybuilding focus toward general wellness and health consciousness. This trend aligns with global supplement industry evolution but reflects specific Latin American cultural values around health and nutrition.

The wellness trend creates opportunities for products beyond traditional bodybuilding supplements, including hydration products, general health supplements, and lifestyle-focused formulations. This market evolution opens opportunities for brands like GR8 Lifestyle that focus on comprehensive wellness rather than specific performance goals.

Cultural factors also influence wellness trends, with many Latin American countries maintaining healthier traditional diets and more active lifestyles than American averages. This health consciousness creates receptive markets for quality supplements that support existing healthy lifestyle practices.

The discussion reveals how understanding these cultural health perspectives can inform product development and marketing strategies. Rather than trying to change consumer behaviors, successful brands align with existing health values and lifestyle practices.

-

27:00 - Regulatory Challenges and Caffeine Restrictions

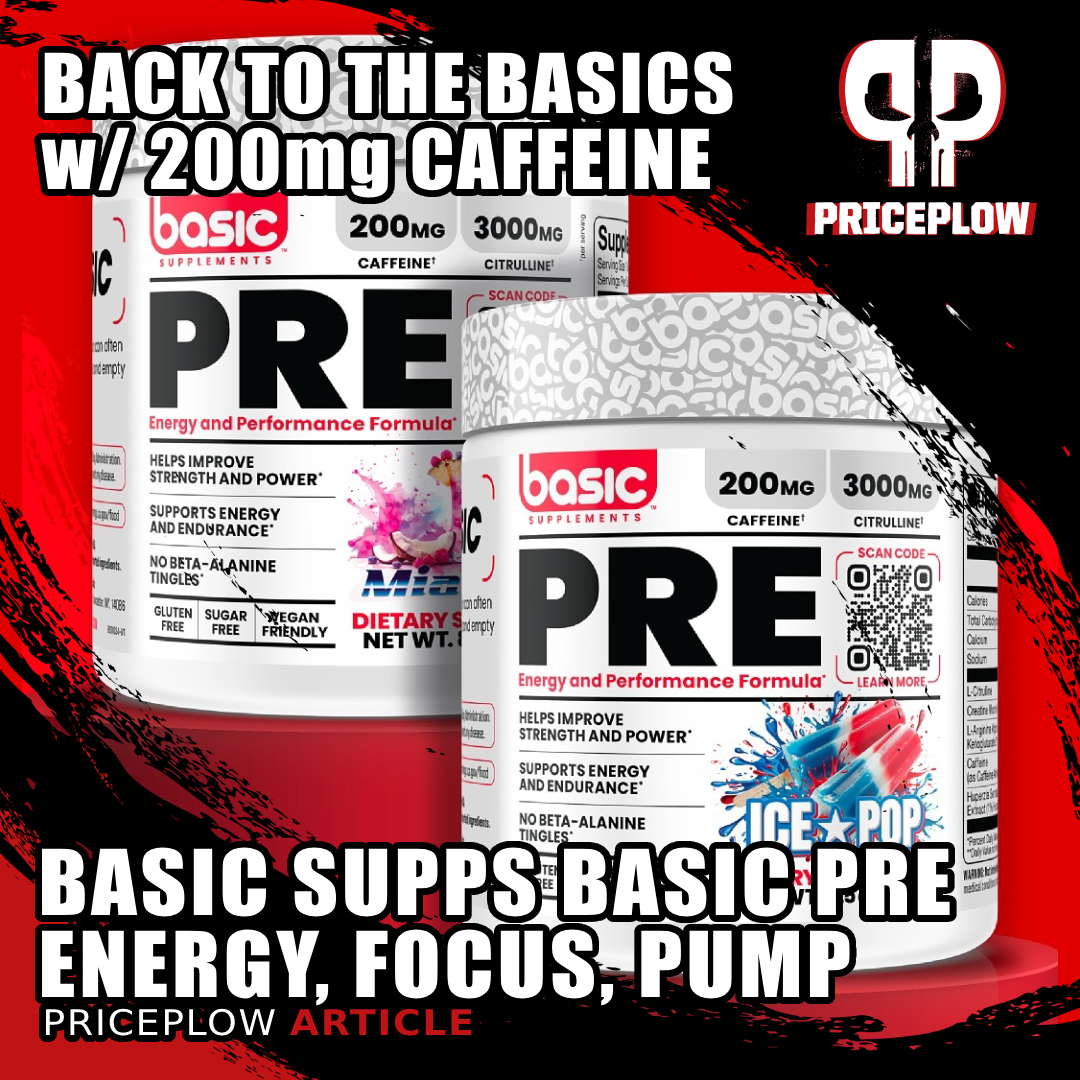

Basic Supplements Basic Pre brings just what's needed for focus, energy, and pumps, with 200mg caffeine and 3g citrulline per scoop -- and it's affordable with no tingles!

The conversation delves into specific regulatory challenges, particularly around caffeine content in pre-workout supplements. Chile, for example, restricts caffeine to 125mg per serving, significantly lower than typical American pre-workout formulations that often contain 300-400mg.

These regulatory restrictions require brands to develop region-specific formulations or accept that certain products cannot be sold in specific markets. The decision involves balancing market size against development costs and formulation complexity.

Eric notes that some countries have even more restrictive caffeine limits, creating challenges for brands that built their reputation on high-stimulant formulations. This regulatory environment favors brands like Basic Supplements that focus on moderate, effective dosing rather than extreme stimulation.

The regulatory landscape also affects product development timelines, as changes to formulations can require new registration processes that may take up to two years. This timeline requires brands to plan product strategies well in advance and commit to specific formulations for extended periods.

-

29:00 - Market Development Patience and Long-Term Strategy

Eric emphasizes the importance of patience in Latin American market development, noting that registration processes alone can take up to two years, followed by additional time for market development and consumer education. This timeline requires brands to maintain long-term commitment and investment perspectives.

The extended development timeline also affects cash flow and resource allocation, requiring brands to invest in markets before seeing returns. This financial commitment distinguishes successful international expansion from opportunistic market entry attempts.

Jack adds that this patience requirement has influenced Nutralabz' international strategy, focusing on fewer markets with deeper investment rather than attempting broad geographic expansion. This approach builds stronger market positions and more sustainable growth trajectories.

The conversation reveals how understanding these development timelines helps brands make informed decisions about international expansion priorities and resource allocation. Successful international growth requires strategic patience and sustained investment commitment.

-

30:45 - Innovation and Product Development Cycles

The discussion explores how product innovation cycles differ between American and Latin American markets, with trends often taking years to migrate from American innovation to Latin American regulatory approval and market acceptance.

This innovation lag creates both challenges and opportunities for American brands. While it may take years for new ingredients to gain regulatory approval in Latin American markets, it also provides time for brands to refine formulations and build market education before launch.

The regulatory approval timeline affects how brands should approach product development for international markets, often requiring separate product lines or modified formulations that comply with different regulatory frameworks while maintaining brand consistency.

Eric notes that this innovation cycle also affects competitive dynamics, as brands that invest in regulatory approval early can gain significant market advantages when new ingredients finally receive approval. This first-mover advantage can justify the investment in lengthy approval processes.

-

32:00 - Growth Trajectory and Market Expansion

Eric reflects on the significant growth SND has experienced, particularly with brands like Basic Supplements that have rapidly expanded into 17 Latin American countries since January. This growth demonstrates the market potential when brands align with experienced distributors and commit to proper market development.

The growth trajectory reflects both the quality of the partnership and the market demand for American supplement brands that provide value and accessibility. Basic Supplements' success demonstrates how the "daily driver" philosophy translates effectively to price-sensitive international markets.

Jack adds that this international success has influenced Nutralabz' overall strategy, demonstrating how international partnerships can accelerate growth beyond what domestic markets alone can provide. The success creates opportunities for additional brand development and market expansion.

The conversation concludes with both parties expressing enthusiasm for continued partnership development and market expansion. The success of Basic Supplements in Latin America provides a model for how American brands can achieve international growth through strategic partnerships and long-term market commitment.

Where to Follow SND and Learn More

- Sports Nutrition Distributors: Website

- SND Global: Facebook

- Contact: WhatsApp 305-748-3776

- Jack Sehgal: LinkedIn

- Related Episodes:

Thank you to Eric for sharing his extensive knowledge of Latin American supplement distribution and to Jack for providing the brand perspective on international expansion. This conversation provides valuable insights for any supplement brand considering international growth, demonstrating how strategic partnerships and long-term commitment can unlock significant market opportunities.

The success of Basic Supplements in Latin America through the SND partnership illustrates how American supplement brands can achieve international growth while maintaining quality standards and brand integrity. The key lies in working with experienced distributors who understand local markets, regulations, and consumer preferences.

Subscribe to the PricePlow Podcast for more conversations with industry leaders and international market experts!

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

Basic Supplements – Deals and Price Drop Alerts

Get Price Alerts

No spam, no scams.

Disclosure: PricePlow relies on pricing from stores with which we have a business relationship. We work hard to keep pricing current, but you may find a better offer.

Posts are sponsored in part by the retailers and/or brands listed on this page.