https://blog.priceplow.com/podcast/sportlife-distribution-michael-rossman-102

On the heels of an incredibly informative Supplement Manufacturing 101 episode on the PricePlow Podcast, we graduate to Distribution 102 with Michael Rossman, CEO of SportLife Distribution.

In Episode #102 of the PricePlow Podcast, Michael Rossman of SportLife Distribution joined to explain better supplement distribution

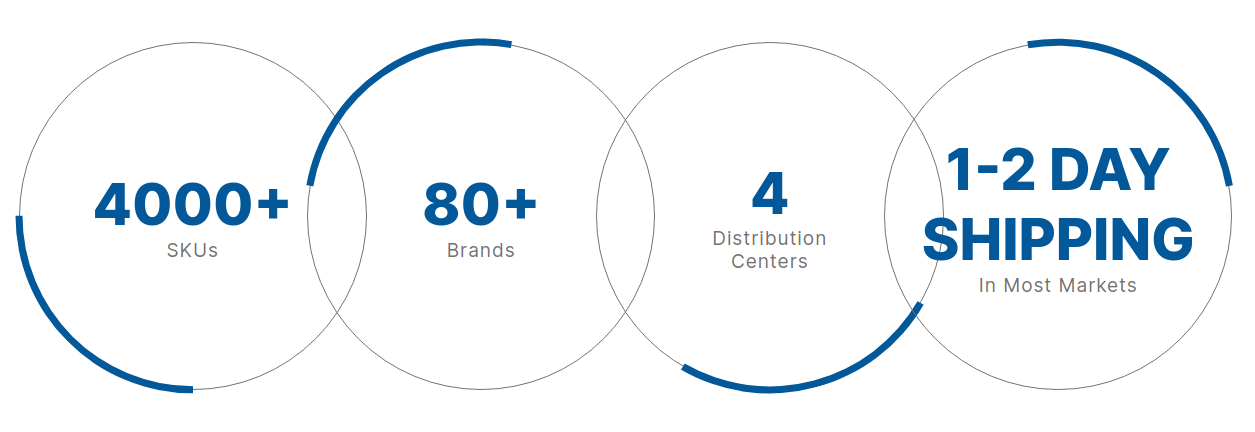

SportLife Distribution has been around for a bit less than a decade, but they've plugged quite a few gaps in the industry's supply chain, servicing brick and mortar stores with a selection of over 80 brands. This enables stores to place smaller orders from multiple brands, and get them quickly thanks to SportLife's well-placed distribution centers around the country.

Supplement Distribution, Trends, and Jobs with SportLife

In this episode, Michael gives us his backstory, teaches us about distribution, and explains SportLife's business model and where it fits into the industry. We also talk about how 2020 forced major changes to the industry, and how SportLife was well-positioned to succeed at a tough time.

The guys then get into trending products and brands, of course discussing energy drinks and functional foods. We leave off wanting a second episode with SportLife, but next time, we'll talk about the hot products in various parts of the country with SportLife's sales team.

Finally, SportsLife is hiring -- if you're looking for supplement industry jobs, this is a great place to start and get your foot in the door!

Podcast: Play in new window | Download (Duration: 1:01:12 — 64.6MB)

Subscribe to the PricePlow Podcast on Your Favorite Service (RSS)

Detailed Show Notes with Michael Rossman of SportLife Distribution

-

0:00 - Introduction to today's episode

In this episode of the Price Law Podcast, Ben and Mike are joined by Michael Rossman from SportLife Distribution. The conversation focuses on changes in distribution and retail, especially in the sports supplements landscape. The trio discuss the mechanics of distribution in sports supplements, trends in the industry, and why brands might opt for different distribution routes.

Michael, an industry veteran, shares his career journey. He started in the late 90s with Castillo's distribution, the precursor to Optimum Nutrition. There, he learned about sports nutrition and witnessed the company's transformation into a premium brand. In 2004, he joined Dymatize, a then-small company in Dallas, Texas, where he built the domestic sales team and experienced another massive brand growth.

In 2014, after Post (the cereal company) acquired Dymatize, Rossman decided to establish his own company, SportLife Distribution, in 2015. He speaks fondly of the distribution sector's dynamism, emphasizing its advantage of not being tied to a single brand's success or failure. Today, he remains satisfied with his decision to start SportLife Distribution and is excited about what lies ahead.

-

3:30 - How did Michael get started?

Michael explains that SportLife Distribution initially launched with any product they could acquire, starting with boutique brands created by store owners lacking connections to larger entities. These were niche brands not readily found in big-name retailers like Costco or Walmart. This strategy filled the gap created by Amazon's growing dominance, uniting retailers and consumers with these specialized brands.

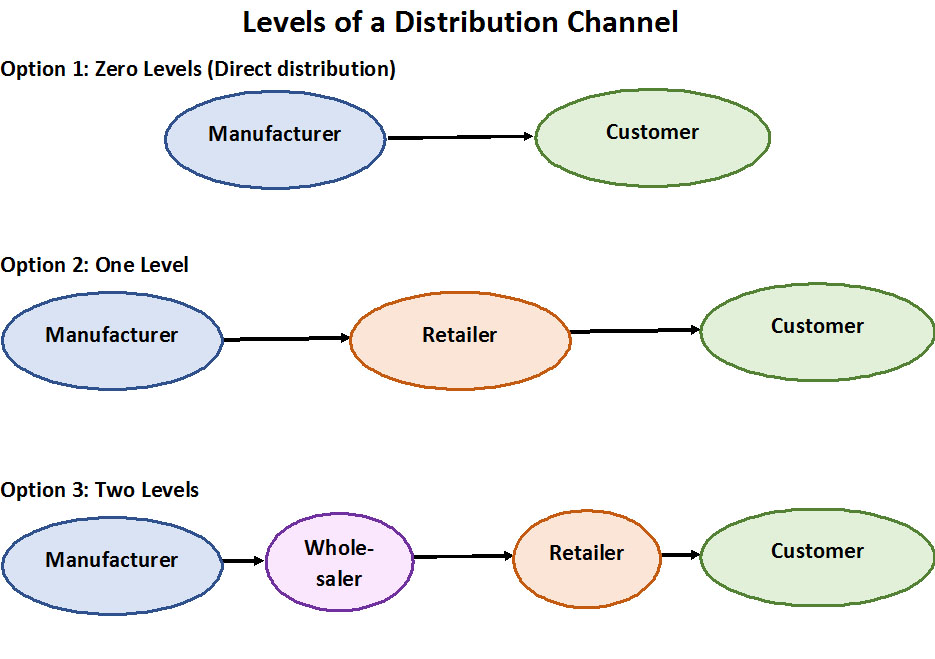

Addressing a common question, Rossman explains why stores don't buy directly from the brands. He outlines that as industries mature, distribution becomes a necessity due to the growing number of consumers and outlets. It becomes impractical for stores to buy directly from the manufacturers, given the breadth and diversity of brands available. For example, in the US alone, there are about 6-7,000 retailers and at least 200-300 brands in sports nutrition.

SportLife Distribution serves as a business-to-business 'Amazon model,' providing a one-stop-shop for all retailers. The company simplifies the business process for retailers, ensuring they can get a wide range of products efficiently and promptly, making them stand out in the competitive distribution space.

-

7:00 - Distribution: The benefit to the retailer and the brand.

Michael addresses the role of distribution and how sales teams fill potential voids in retailers' product offerings. The shift to influencer and social media marketing has significantly impacted the industry, creating a new platform to reach consumers. This strategy has proven beneficial for brands like Alpha Lion, RYSE, and Bucked Up, who have successfully used social media to increase their presence and demand.

Protein Bars and other functional foods is a massively growing business. Pictured: Arms Race Nutrition Foundation Bar

However, the changing landscape isn't just limited to marketing strategies; it has also brought about shifts in product categories distributed. Rossman notes that functional foods are currently the fastest-growing category. While pre-workouts and proteins remain relevant, there's been a significant surge in demand for brands providing healthy snacks and foods.

The energy drink market is also booming, yet Rossman expresses some caution. The influx of new energy drink brands presents challenges due to limited space both in-store coolers and warehouses. Despite the interest in this category, they're nearing their capacity for supporting new energy drink brands.

-

13:00 - How to get into the energy drink space?

In response to questions about how stores choose their energy drink stock, Michael highlights the influence of consumer demand. He shares an experience where, despite a product's excellent taste, great packaging, and excellent pricing, it failed to sell because it lacked brand recognition. In categories like energy drinks and functional foods, customers typically grab what they recognize, limiting the opportunity for retailers to promote new offerings.

All three of these distribution methods work in the supplement industry, but not all work for all brands. Smaller shops that want to place smaller orders are best going through distributors for many products. Image courtesy Wikimedia

The conversation turns to the financial and logistical challenges of breaking into the beverage market. The high costs of manufacturing, inventory management, and shipping can put a significant strain on a brand, potentially leading to financial difficulties. Rossman warns brands considering entering the energy drink sector to be aware of these risks.

Adding to the discussion, Ben points out the high costs of shipping heavy cans, an expense that makes direct-to-consumer sales less popular but contributes to the importance of distributors who can provide a range of options to retailers. Rossman agrees, mentioning that shipping costs are the second highest expense for their distribution business. Nonetheless, their ability to supply retailers with a variety of beverages in smaller quantities is a key advantage.

-

17:15 - How to work with a distributor?

In response to the question about why brands should consider working with SportLife, Michael points out two main factors: Amazon control and their specialized sales team.

Rossman recognizes Amazon as a "500 pound elephant" in the room that can compromise a brand's price integrity if not properly managed. To combat this, SportLife takes a strong stance on their market focus – the independent brick-and-mortar operators who aren't large chains like GNC or Vitamin Shoppe. They do not sell to anyone without a physical store, helping to prevent the products from ending up on Amazon, eBay, or other third-party platforms.

Furthermore, the SportLife sales team, composed of experienced industry veterans, knows the importance of customer service. They strive to make business easy for their customers, offering flexible purchase quantities and providing the products the stores need.

Rossman also mentions the difficulties of going direct for the store, which includes high minimum order requirements and credit card fees. He suggests that for a brand to be in a store like Mike's hypothetical Oklahoma supplement shop, working with SportLife would be a wise choice.

-

20:45 - Navigating Market Changes

Addressing the market changes of recent years, Rossman explains that the industry has seen distribution move into specific channels. While SportLife dominates the independent operator space, other distributors focus on different sectors, such as military bases or food, drug, and mass market stores.

COVID-19 played a significant role in reshaping the distribution landscape. When fitness chains like 24 Hour Fitness and Gold's Gym declared bankruptcy due to forced closures,[1,2] distributors who were heavily dependent on such corporate accounts faced significant financial strain. SportLife, however, managed to push ahead, as they were not as leveraged with large corporate accounts. They even expanded their team by hiring personnel from struggling distributors.

-

23:15 - Working with retailers

Michael makes it clear that he believes brick-and-mortar retailers are more likely to support distributors that do not also supply the FDM (Food, Drug, Mass) market. He explains that by selling too much of a certain brand that is widely available in bigger chains, smaller retailers might drive their customer base away due to the cheaper and more convenient options available elsewhere.

Rossman further warns about the potential risks when a brand grows so large that it changes its products to meet the demands of big retailers like Walmart, Costco, or Sam's Club, possibly compromising the needs of the consumer. This, he argues, is why specialty stores will continue to thrive – they offer expertise and tailored advice that larger retailers cannot.

Using the example of wine shopping, Rossman notes that consumers interested in expensive, hard-to-find wines are more likely to visit boutique wine shops where they can get expert advice, just as in sports nutrition.

He acknowledges that SportLife does carry some brands that are in mass channels, mainly because stores need to stock those brands to maintain customer traffic. The goal, according to Rossman, is to make business as convenient as possible for their stores and to support the brands that support specialty brick-and-mortar retailers.

-

26:15 - Cycles of growth and distribution.

Michael takes an opposing stance to the idea that brands must move on to larger distribution channels as they grow, citing examples of well-known brands that have not seen massive success in mass-market channels. He mentions Dymatize, which moved into Costco but is now rebuilding itself in the specialty space, and Optimum, which he argues is no longer dominating sports nutrition.

An example Flash Friday Sale posted to @SportLifeDistribution. As you can see they work some many of the brands we've educated on, like MuscleTech's iQ Series

Rossman also talks about EAS, a former sports nutrition giant, which was bought by Abbott Laboratories, who inexplicably let it go. Hi-Tech picked up the trademark, but the brand hasn't held its former glory for well over a decade now.

According to Rossman, not all brands will find success in larger, mass-market channels, and it may not be a desirable move for specialty boutique supplement companies. He also asserts that seasoned retailers are aware of this trend and have stopped complaining about brands moving into mass-market channels, instead preparing for it as part of the cycle.

Rossman also notes that it's important for brands and retailers alike to be responsive to market trends, implying that SportLife is more reactive to the trends of retailers rather than proactive in anticipating changes in advance. His comments shed light on the challenges of navigating the cycles of the market, suggesting that success can be found in different channels depending on the specific nature and goals of each brand.

-

29:00 - Direct to consumer has replaced mass distribution.

Michael outlines what he views as the ideal distribution strategy for a brand: a strong direct-to-consumer network, a presence in specialty stores, an international business, and a partnership with Amazon, which he views as a part of the direct-to-consumer strategy. This method allows brands to effectively reach consumers without necessarily needing to venture into big box stores, which may not be the right fit for every brand.

Rossman suggests that distributors such as SportLife are able to fill the wholesale division role for brands, providing a service that would otherwise be time-consuming and complex for brands to manage on their own. He believes that the brands are excellent at marketing and product creation, but often struggle with shipping, an area where distributors excel.

Rossman also touches on a historic tension in the industry between brands and distributors, explaining that distributors sometimes took advantage of brands, leading to an unsustainable "direct to retail" approach. He believes that the industry has matured, with established channels and a more nuanced understanding of the role of distribution, leading to a healthier dynamic between distributors, brands, and retailers.

-

34:00 - Distribution is a valuable asset

Customers in San Diego don't need to wait 5+ days for orders to arrive from east coast brands anymore - they use SportLife instead!

Michael emphasizes the benefits of running a lean, nationwide distribution business that is adaptable to changing market conditions. SportLife relies on major delivery services like FedEx and UPS, rather than operating its own fleet of trucks. This model allows for flexibility and efficiency, as they don't need to be concerned with managing drivers or maintaining vehicles.

Rossman highlights that they have multiple warehouses located throughout the US to ensure that they can quickly and efficiently reach retailers in any part of the country. The focus is not on flashy infrastructure, but on the practicalities of storage and distribution. This low-overhead strategy means more resources are available for their staff and for providing better margins to their retail partners.

He further emphasizes that the role of a distributor like SportLife is not to build its own brand with consumers, but to ensure the products that consumers want are in the stores they frequent. This is accomplished without much fanfare, with even the top brass stepping in to pack boxes if necessary. For SportLife, simplicity and reliability are key.

-

39:15 - Distribution centers and the nuts and bolts behind the scenes

Michael goes into detail about how SportLife Distribution makes an effort to reuse every box that comes their way to save on costs and limit waste. This not only includes boxes they receive in shipments but they'll even reuse boxes from personal deliveries. Although this might not seem like a significant saving, when it's multiplied by the thousands of boxes shipped daily, the costs saved can add up significantly.

He further explains the hidden costs that are often not considered by the brands. Branded boxes are great, but the costs add into the hundreds of thousands of dollars per year when you start customizing things like that. Everything from packing tape, packing paper, to manpower all add to the overhead of running a distribution company. However, for SportLife Distribution, their goal isn't just to make money but also to make life easier for the retailers.

When asked about the challenges of distributing temperature-sensitive products such as protein bars or chocolates, Michael notes that it is indeed a challenge, especially with warehouses in warm climates like Las Vegas, Dallas, and South Florida. To tackle this, they have climate-controlled spaces in their warehouses and offer cold pack options for their customers. This includes using special wrapping and zip-lock bags to avoid condensation. He emphasizes that the key to delivering these products in good condition is next-day shipping, which can be guaranteed due to their nationwide network of warehouses.

-

43:00 - Payment terms for specialty gyms

Michael talks about the financial realities of running a distribution business, emphasizing the need for financial health. He explains that the business traditionally operates on very low margins - around one to two percent. This means that even small disruptions, like those caused in 2020, can have major implications for the business.

For smaller, individual retailers like Mike's hypothetical Oklahoma shop, the payment terms are pretty straightforward. A credit card is kept on file, and as soon as an order is shipped, the card is charged.

However, when dealing with larger entities, such as gym chains like Gold's Gym, the situation becomes more complex. These organizations have multiple locations with central receiving spots, and managing their inventory requires time and logistics. As such, SportLife Distribution is open to extending payment terms for these larger entities, but not without due diligence. They assess the creditworthiness of these entities, checking references and financial health to ensure that they're a viable risk.

However, Michael also acknowledges the risks of overextending credit terms. The company maintains a careful balance between risk and benefit, and is not averse to walking away from business if the risks outweigh the potential benefits. This cautious approach ensures that the company maintains its financial health and sustainability.

-

46:00 - Cool trends in the industry

Michael shares his observations on regional trends and the role of logistics in shaping these trends. He mentions that brands like Axe & Sledge and Bucked Up, which had originally focused on direct-to-consumer and direct-to-retail sales in their home regions (Pittsburgh area for Axe & Sledge and Utah for Bucked Up), saw their footprints grow significantly when they partnered with SportLife Distribution. He suggests this is not so much about changing consumer demand, but about providing logistical solutions to help these brands expand their reach.

Posted to @SportLifeDistribution on Instagram, updating customers on the latest flavor of Bum Energy Drink that's available

He mentions a relatively new brand, Anabar, that has seen rapid growth. Originally based in the Houston market, their presence expanded dramatically upon partnering with SportLife Distribution. Anabar produces a protein bar that Michael and others on the call rave about, emphasizing its delicious taste.

In terms of his personal energy drink preferences, Michael highlights Bum Energy for its tasty flavors and modest caffeine content (around 100mg). He also mentions liking RAZE Energy, JST WRK from Axe & Sledge, and the new Vibe line from Celsius. He indicates a preference for 12-ounce cans over the more traditional 16-ounce size for energy drinks, largely for their ease of distribution and the fact that consumers seem to prefer the smaller size.

Overall, the trends highlighted in the conversation emphasize the role of distribution in broadening a brand's reach and the importance of offering products that meet consumer tastes and preferences.

-

52:00 - Leveraging distribution to increase sales

Michael explains the complex and ever-changing distribution rights in the sports nutrition industry. Using the example of Celsius, a popular energy drink brand recently acquired by Pepsi, he discusses the difficulties faced by specialty retailers in sourcing products. Because big corporations like Pepsi primarily focus on mass markets such as convenience stores and supermarkets, they often overlook sports nutrition channels, creating a demand-supply gap that SportLife Distribution tries to fill.

He also talks about brands that are challenging to work with, due to various factors such as pricing terms, delivery delays, or mis-shipments. While some brands may be in high demand, the operational difficulties they present can sometimes lead distributors to seek alternatives.

-

54:45 - Economic outlook for sports nutrition

Michael expresses a positive outlook for SportLife Distribution and the sports nutrition industry at large. He believes there's still room for growth and expansion into new markets. In spite of the challenges posed by inflation and potential economic recessions, he is optimistic about the resilience of the sector.

Rossman also highlights the potential job opportunities at SportLife Distribution. The company is in constant need of warehouse staff, sales representatives, administrative personnel, and HR professionals. Ideal candidates are individuals with a passion for sports nutrition, product knowledge, retail experience, or those who simply want to be part of the industry.

The company plans to roll out an online ordering portal to facilitate more seamless interactions with their retailers.

Ben and Mike propose a future episode featuring a panel of sales representatives from SportLife Distribution, to discuss trends and their experiences in different regions of the country.

This was an incredibly educational podcast episode - we'd like to thank Michael for his time.

Important Links

- Website: SportLifeDistribution.com

- SportLife Jobs: SportLife Distribution Jobs

- LinkedIn: SportLife Distribution

- Instagram: @SportLifeDistribution

Thanks again Michael! Return to the PricePlow Podcast and please subscribe and leave a review on the platform of your choice.

Comments and Discussion (Powered by the PricePlow Forum)