In October of 2019, Dan Lourenco, co-founder of Ghost Lifestyle, and Josh Schall of J. Schall consulting gave an interesting presentation at SupplySideWest in Las Vegas. It piggybacked off of a similar presentation they gave last year, but covered the latest news and shifts we've seen in the sports nutrition market.

Their presentation, titled "New Approaches to a Changing Sports Nutrition Market", can Be Seen on Josh Shall's YouTube channel below, with the presentation slides linked below that:

(Link to the presentation slides)

Below is a recap with a dash of added commentary:

Times they are a changin'

"Your Mom Drinks Ghost!" The market has broadened. So why are so many brands chasing the bodybuilder from the 90s?

As always, things have been changing - dramatically and quickly. In just the past year since their last presentation, there have been some monstrous acquisitions, such as the isomaltooligosaccharide pioneers over at Quest Nutrition selling for one billion dollars and OhYeah!'s ONE Brands going to Herschey.

Dan is quick to point out how much this industry has broadened, and it's far wider than we give it credit for. "Grandmas are now eating protein bars" and "Your Mom Drinks Ghost". Yet -- and Dan doesn't say this, but it's implied -- so many brands are chasing the same old meathead from 2004 that doesn't exist anymore!

The elephant is still the elephant -- but there are ways around it

Selling into these stodgy retailers is akin to your favorite song ending up on the radio. It’s no longer cool.

-- Dan Lourenço, Co-Founder of Ghost

You of course can't go two minutes in any consumer-centric conversation without discussing Amazon. There have been many responses, from brands going all-in on the platform (as well as Costco, Walmart, Sams, etc) to the different path Ghost has taken, which is discussed below.

Meanwhile, retailers are creating their own unique private label brands, while brands have rebelled by going direct-to-consumer with Shopify sites. And to top it off, Amazon themselves are launching several brands -- in several markets, not just nutrition.

Eroded trust brings opportunity

This entire situation erodes trust, but that presents an opportunity too. An opportunity to build it back... digitally through social media.

As Dan says in other presentations, a good label gets you a seat at the table, but nowadays, you still need to provide more. This is why Ghost formulates for the 1% who understand it (your typical PricePlow reader), but build the brand/story/messaging for the other 99%.

On that note, Dan is quick to note that GNC has done a great job formulating their pre workout and latest private label products, which is a testament that their new leadership gets it. More to come from them, we hope.

How Ghost takes on the elephant: no sales in Amazon!

It may surprise a casual consumer to see that Ghost doesn't sell on Amazon at all. Dan's slide asks, "are brands selling more or selling out"? This refers to those brands going big by selling at Costco, Walmart, Sams, etc.

From the retailer's perspective, this has a lost hook. What's going to bring a customer into your store if they can now buy the product from home bundled along with toilet paper? The question implied here is, "Why should you carry them at all?"

The Death Star has officially arrived. How far will they take this, and why should you participate if they'll advertise their own brands over yours?

And from the brand's perspective, what does this "Walmazonification" do to the consumer's perception of the brand? Selling into these stodgy retailers is akin to your favorite song ending up on the radio. It's no longer cool.

Dan gets asked when they'll go to Amazon - and it's not that he invented this idea. He responds, "When Nike starts selling their latest and greatest on those channels, maybe we'll consider it."

Control the distribution, control the experience

Instead, they control the channels, control the distribution, control the message, and ultimately, control the experience. And Ghost is willing to give up the customer who avoids their exclusive experience. This is the long-term play. Keeping it in the family.

This idea of controlled distribution versus "shotgun distribution" is still relatively new to the industry. You don't need to get your products everywhere - especially if it dilutes your message and value proposition.

Legacy brands under siege by new brands

Meanwhile, a challenge that many players face is that there are new brands popping up left and right with new launches literally every day. Legacy brands are not fully dealing with the speed of this. Contract manufacturers are even advertising on Facebook that you can start a supplement brand! How do you keep up with that?

The answer is through transparency, global reach, authenticity, high value, and conversation.

Use social media for the conversation, not just marketing/advertising

When internet retailer Supplement Central shut down, they implicitly blamed Amazon. This spurred a whole lot of "adapt or die" comments on social media.

First, brands need to think globally these days. The industry is no longer "USA USA USA". The USA may in fact lead with innovation (as we do in basically every technology on the planet), but as consumers, we are still a minority in this world. It makes sense for a globally-compliant label, if at all possible.

Meanwhile, authentic / nostalgic flavors are winning, but I add that this is still strongest in the US, while international still seems chocolate/vanilla. This will clearly change, as regionalized flavors done properly are finally going to take off. If you watch Ghost's Behind the Brand YouTube series, you know Dan and Ryan and the team are on top of this.

Grape is back, baby. There are two ways to deal with this 'legacy' flavor -- the nostalgia way like Ghost did here (as well as SteelFit in Steel Pump), or the modern way with blended flavor systems like NutraBio's Grape Berry Crush!

Dan's take on social media was one of the most interesting things stated. Searching Google is for the quality content, but social media is for the conversation and community. Yet too many brands use social media as an advertising platform and not a conversational platform. If you're not responding to DMs, you are LOSING.

Going for High Value, not always High Margin to win long-term

This has changed dramatically since 2007-2013, dubbed the glory days by Dan. Consider pre workouts -- while the prices are about the same, that 5-6g pre workout is now a 20-30g scoop!

Margins are no doubt lower. Competition is higher. To win in this game, you need to accept that you will profit less than the "glory days", and win with a long-term, high-value play.

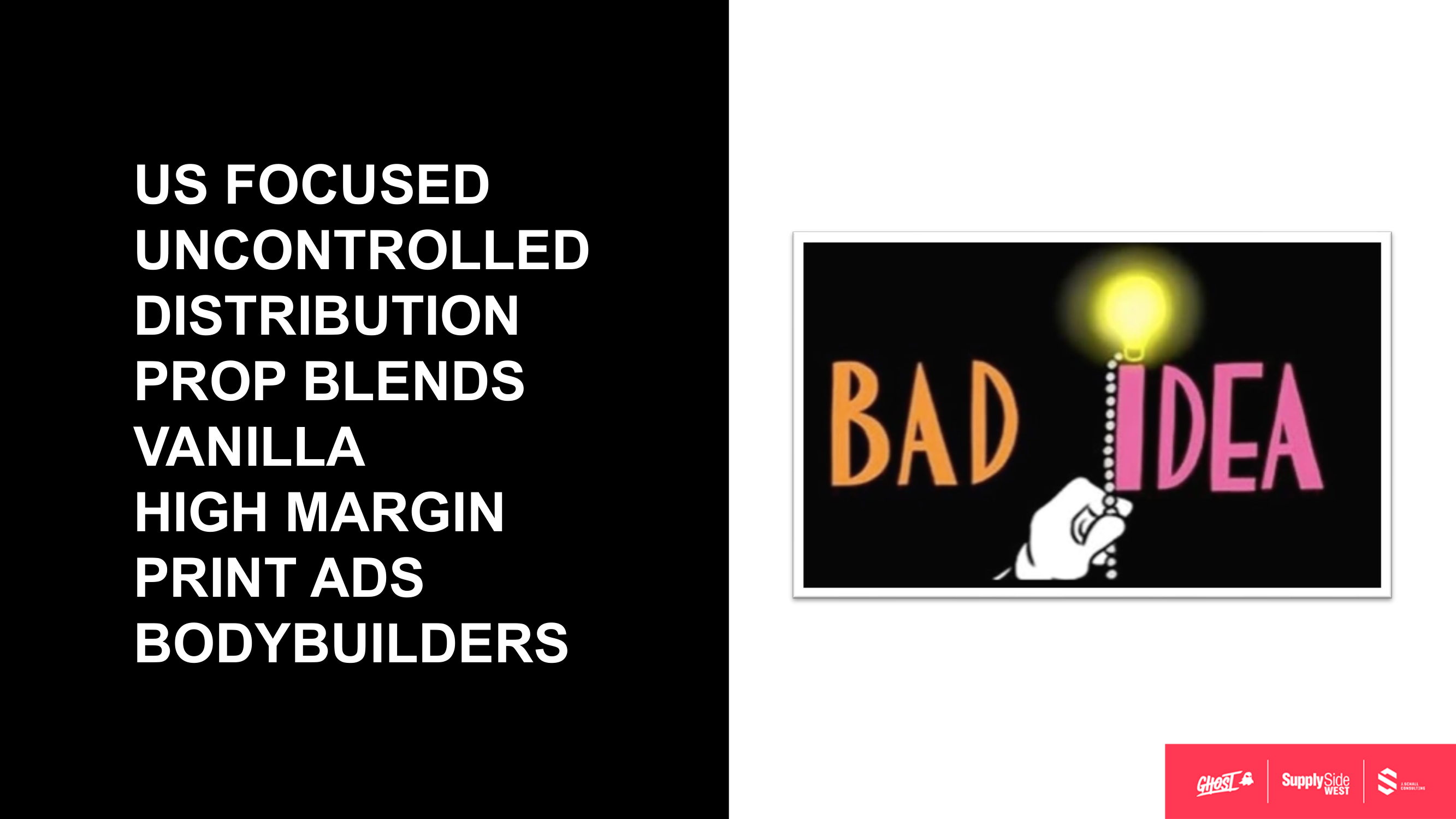

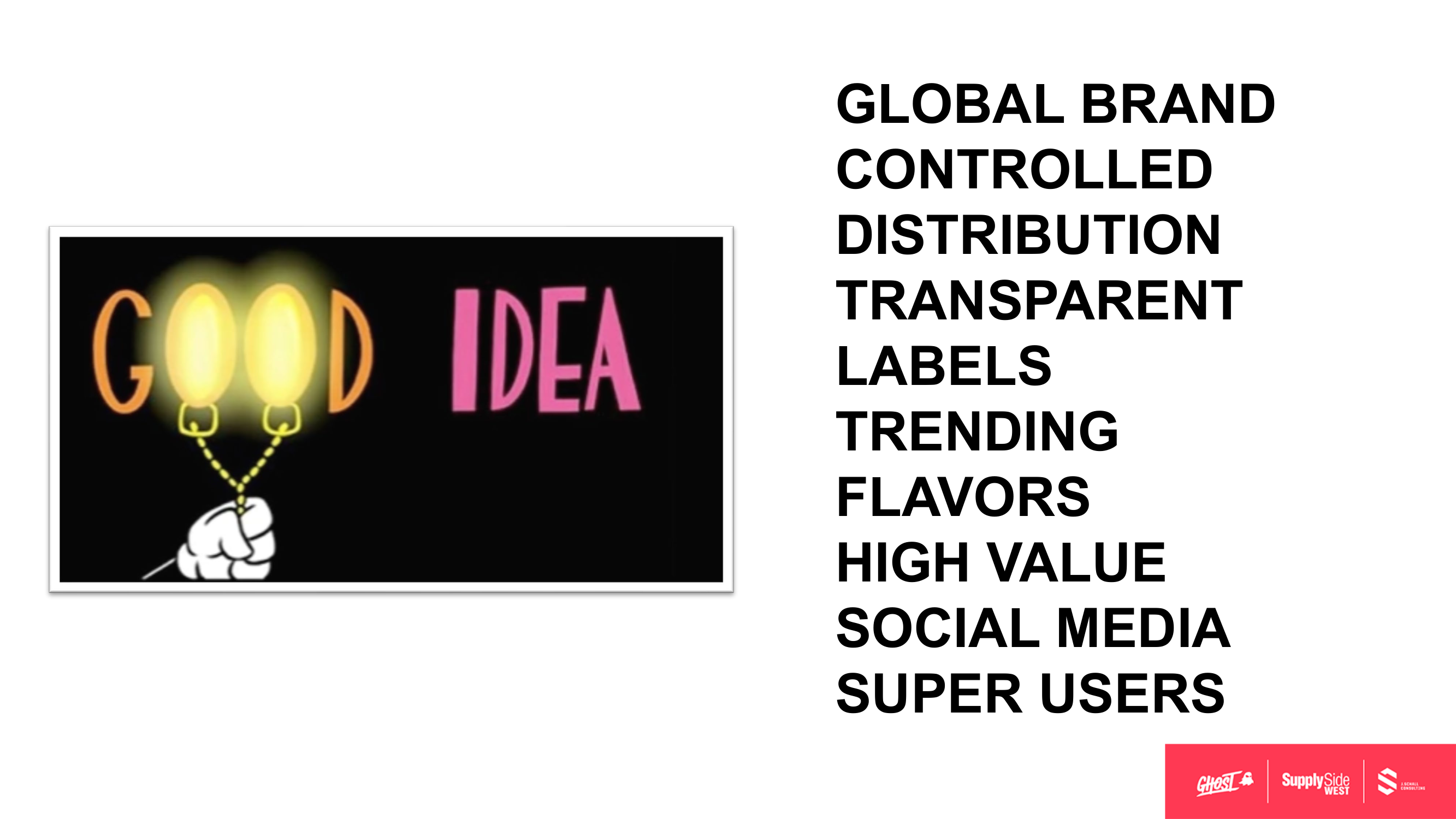

Good ideas and bad marketing ideas in 2019

All in all, the entire presentation can be summed up by the following two slides, titled "Good Ideas" and "Bad Ideas":

Good Ideas: |

Bad Ideas: |

|---|---|

| Global Brand | US Focused |

| Controlled Distribution | Uncontrolled Distribution |

| Transparent Labels | Prop Blends |

| Trending Flavors | Vanilla |

| High Value | High Margin |

| Social Media | Print Ads |

| Super Users | Bodybuilders |

Calling out the "Pink Tax"

Finally, it was nice to see Dan calling out the "Pink Tax", which is when brands give less but charge more for female-targeted products. Ghost will combat this a bit in 2020 with better unisex-targeted products.

Stay tuned to PricePlow....

For that endeavor, you'll have to stay tuned to our Ghost news alerts, or sign up below:

Ghost – Deals and Price Drop Alerts

Get Price Alerts

No spam, no scams.

Disclosure: PricePlow relies on pricing from stores with which we have a business relationship. We work hard to keep pricing current, but you may find a better offer.

Posts are sponsored in part by the retailers and/or brands listed on this page.

Comments and Discussion (Powered by the PricePlow Forum)